The latest high-profile crypto platform the bad guys are targeting is crypto-roundup-metawin-hack-major-token-unlocks-and-industry-developments/” target=”_blank” rel=”noopener nofollow”>metawin. Hackers reportedly broke into the crypto site's withdrawal system and stole over $4 million in digital assets.

Metawin's CEO confirmed the security breach as the casino immediately stopped all its payment requests.

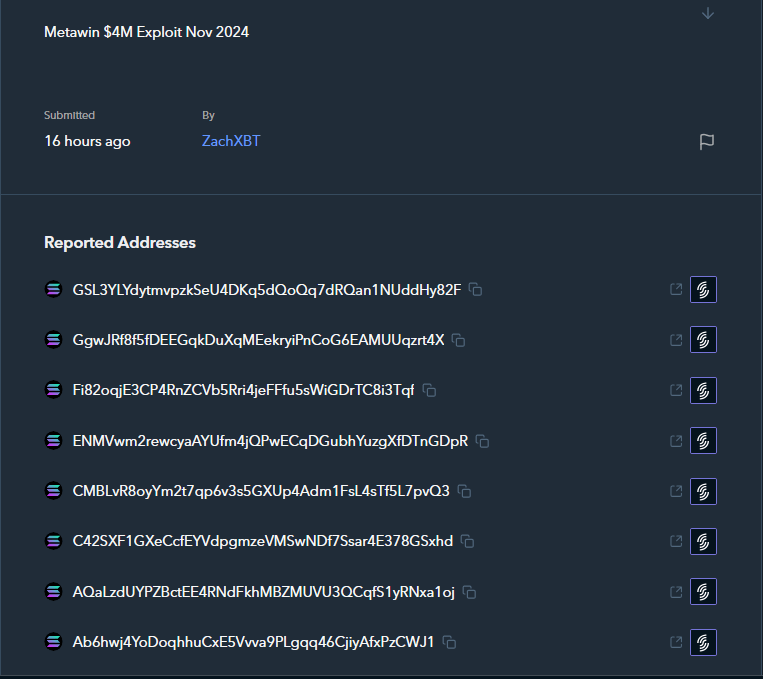

A crypto user reported that the hacker transferred funds to the HitBTC nested service and KuCoin. The user also discovered that there are approximately 115 crypto addresses related to the hacking incident.

Withdrawals are back online after the latest statement from the casino regarding the hacking incident, where currently 95% of its users access this service.

A series of expensive cryptocurrency hacks this October

The incident was reported on Telegram by a network investigator. ZachXBTwho wrote: “It appears that the Metawin cryptocurrency casino was mined for over $4 million in Ether and SOL today.”

<blockquote class="twitter-tweet”>

MetaWin Casino Loses $4 Million in Hack as crypto Scams Rise

online casino twitter.com/metawincom?ref_src=twsrc%5Etfw” rel=”nofollow noopener” target=”_blank”>@metawincom lost around $4 million in a hack on November 3, targeting its hot wallets through a flaw in its withdrawal system, according to CEO Skel.

Withdrawals were stopped but have since been restored… pic.twitter.com/KT28cS3UCs

— PROTOCOL OF TRUTH (@veritas_web3) twitter.com/veritas_web3/status/1853206849174331858?ref_src=twsrc%5Etfw” rel=”nofollow noopener” target=”_blank”>November 3, 2024

The Metawin hack is the latest in high-profile online hacks and thefts targeting the DeFI sector. October is one of the costliest months for cryptocurrency security breaches. There were 20 hacks in the month, costing crypto companies around $88 million. These hacking incidents highlight the current security weaknesses of crypto sites, particularly those in DeFI.

A screenshot of eight of the 115+ theft addresses linked to the hacker. Source: ZachXBT

According to industry tracking, Radiant Capital was the hardest hit crypto company in October.

On October 17, hackers exploited weak points in the platform's smart contracts and successfully stole $53 million.

The hackers used cross-chain protocols to transfer the digital assets to ethereum, making it difficult to track the assets. Then, we have a US government wallet compromised for $20 million. Interestingly, the hacker returned most of the funds, but $700,000 is still missing.

Another interesting hacking case targeted EigenLayer and The Tapioca Foundation. On October 4, EigenLayer lost $5.7 million in theft and the Tapioca Foundation also lost $4.7 million.

x/8uUD6UkM/” width=”2475″ height=”1163″/>

As of Nov. 4, 2024, the market cap of cryptocurrencies stood at $2.25 trillion. Chart: TradingView

Losses pile up as more crypto sites come under attack

Many are concerned about hacking and security breaches in DeFi. So far this year, hacker activity has caused $1.7 billion in losses. This includes 179 incidents. While there have already been some violations this year, the numbers are much more significant than what occurred last year. In other words, the stakes are much higher for blockchain developers as fees continue to rise.

Analysts say hacking incidents in the third quarter cost companies about $750 million. Each hack averaged $5.93 million in digital assets. These hacking losses suggest a growing crypto problem that the industry must address.

Featured image of Dall-E, TradingView chart

<script async src="//platform.twitter.com/widgets.js” charset=”utf-8″>

NEWSLETTER

NEWSLETTER