An anonymous Ethereum investor has lost more than $2 million trading Ether (ETH) since September 9, 2022, on-chain data shows.

Buy Ethereum expensive, sell cheap

Stained According to on-chain monitoring resource Lookonchain, the “stupid money” trader spent $12.5 million worth of stablecoins to buy 7,135 ETH after it rose 10% to $1,790 in September 2022. But a subsequent correction forced the trader to sell the entire stash for $10.51 million.

As a result, the trader lost almost $1.75 million. Interestingly, waiting and selling at today’s price would have resulted in a smaller loss of $1.14 million.

1/ Please don’t blindly follow the buying trend $ETH after the price goes up for a period of time, and don’t panic selling after the price goes down.

Stupid money that loses more than 2M $USDC in half a year he will tell you how dangerous this behavior is.

— Lookonchain (@lookonchain) February 22, 2023

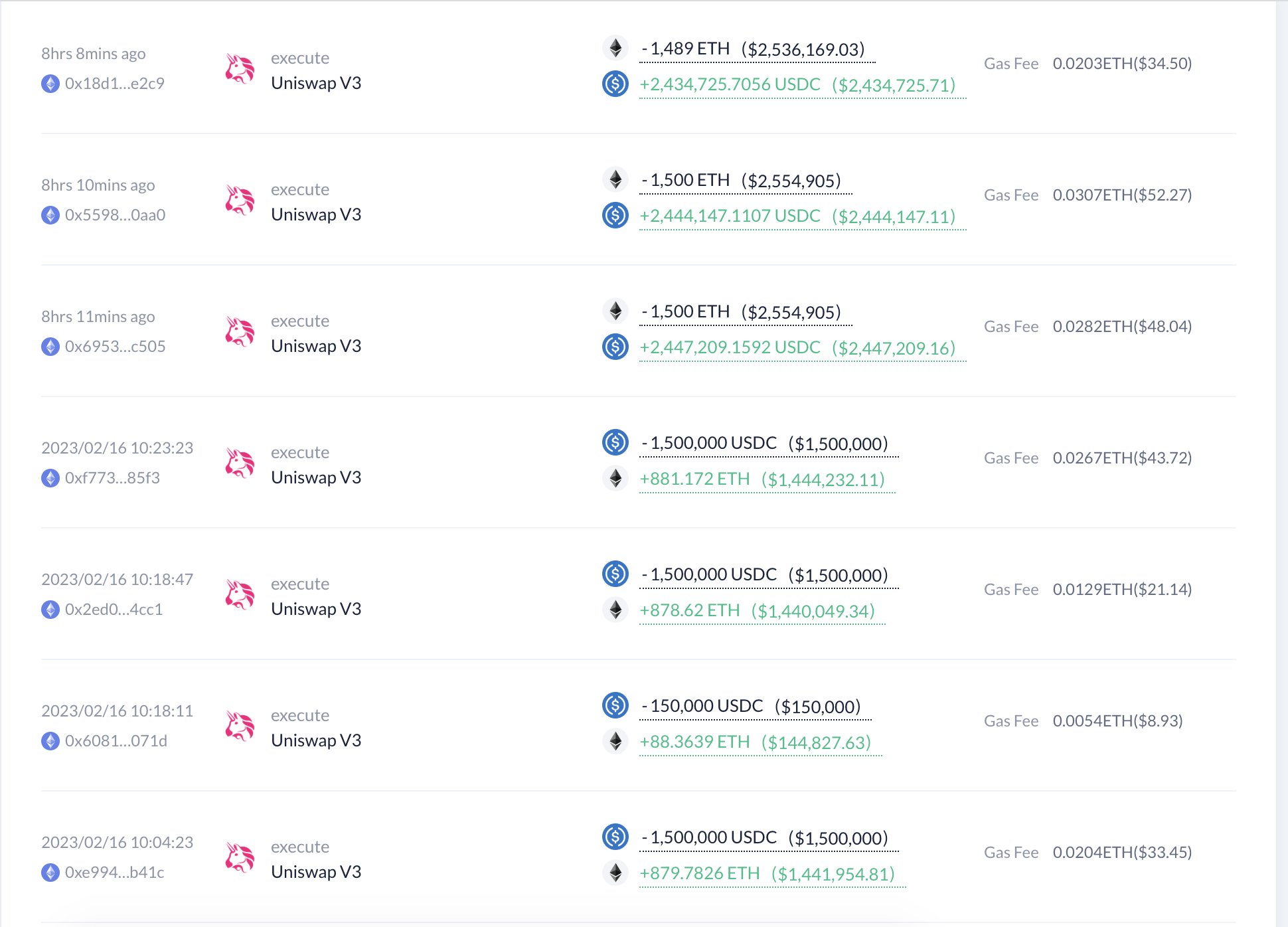

Investor trading resurfaced in February as the ETH price had increased by roughly 10%. The data shows that $7.65 million worth of ETH was purchased on February 16, only to be sold eight hours later when the ETH price fell, resulting in a loss of another $324,000.

3 Ethereum Investment Lessons to Learn

Traders can use such examples to learn from the mistakes of others and reduce their investment risks with proven strategies. Let’s take a look at some of the most basic tools that can help reduce losses.

Do not rely on a single foundation

The investor traded stablecoins for ETH for the first time on September 12, just three days before the long-awaited transition from proof-of-work (PoW) to proof-of-stake (PoS) via the Merge update.

The Fusion, however, turned out to be a “selling the news” event. Therefore, going extremely bullish on Ether based on strong fundamentals was a bad call.

Furthermore, going all-in while relying on an indicator, particularly a widely anticipated news event, is often a losing strategy, so traders must consider multiple factors before making a decision.

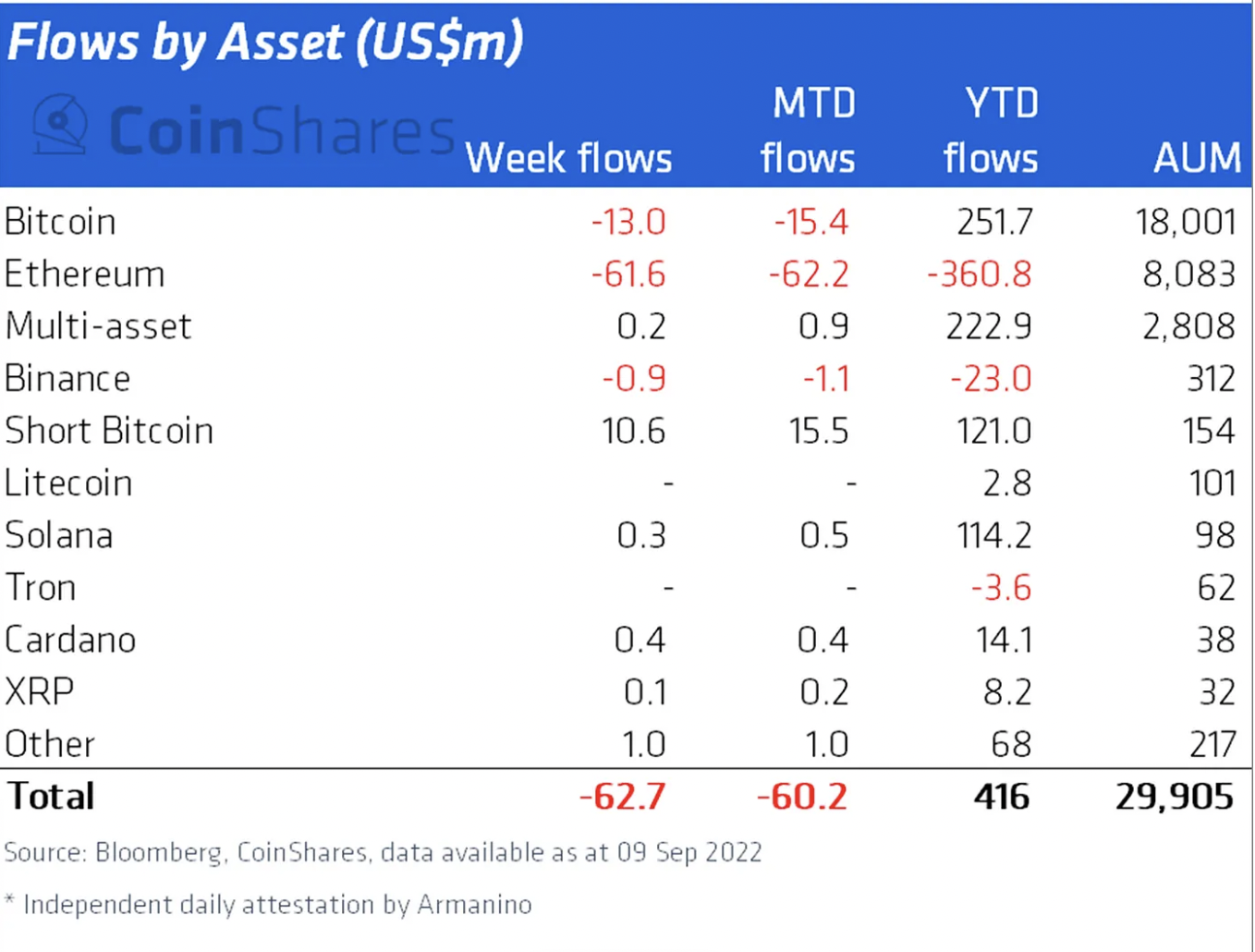

For example, one of those metrics was institutional flows. ether investment funds suffered $61.6 million worth of outflows a week before the merger, according to CoinShares’ weekly report, suggesting that “smart money” was trending lower.

Hedging with put options

Option hedging in Ether trading allows investors to buy option contracts against their current open positions. Therefore, investors could mitigate risk by opening a put option contract against its bullish point.

A put option gives the holder the right, but not the obligation, to sell ETH at a predetermined price on or before a certain date. So, if the spot price of Ether falls, the investor could sell the asset at a pre-agreed price, thus protecting himself from losses in the value of ETH.

Don’t go all-in; check boost

Don’t put all your eggs in one basket no matter how much capital you can spend.

Instead, entering positions in increments could be a safer strategy while keeping some funds on the sidelines. Therefore, traders can buy ETH during a short or long-term bull run, but can save some capital to buy during potential dips, while relying on multiple technical indicators for signals.

For example, momentum oscillators like the Relative Strength Index (RSI) reveal whether Ether is oversold or overbought in specific time periods. So a strategy of going long when the RSI reading is near or above 70 and forming a lower high has a high probability of failing.

Related: A Beginner’s Guide to Cryptocurrency Trading Strategies

The Ethereum daily chart below shows the two cases where the aforementioned investor bought ETH along with the RSI forming a lower high.

Ultimately, traders’ mistakes can serve as opportunities to learn what works for an investor and what doesn’t. The main takeaway is that investors should enter a market with a defined plan based on their own analysis and risk appetite.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

NEWSLETTER

NEWSLETTER