ethereum, the linchpin of the decentralized application ecosystem, is navigating a precarious path this week. The value of the cryptocurrency, having broken through the fundamental support level of $2,250, is now teetering on the brink of a decisive crossroads, caught between the prospect of a resurgence and the looming threat of a steeper slowdown.

Analysis of the technical picture reveals a cautious narrative, as ominous bearish trend lines emerge on the hourly charts of the Kraken exchange, while a resilient resistance at $2,240 presents a formidable obstacle.

ethereum: Uphill battle and key levels to watch

The journey to regain lost ground requires a Herculean effort on the part of ethereum” target=”_blank” rel=”nofollow”>ethereal, which requires overcoming the initial hurdle at $2,240 and then engaging in a formidable battle against the resistance at $2,280. The fate of the digital asset is at stake, and the outcome is likely to shape its trajectory in the coming days.

eth price action in the last week. Source: Coingecko

However, if ethereum stumbles on this uphill climb, a safety net awaits at $2,200, providing a temporary buffer against a further drop to $2,000.

But in the midst of the technical confusion, a ray of sunshine breaks through the clouds. Market sentiment around ethereum remains surprisingly bullish. Despite the price decline, the volume of net profits locked in by eth investors has reached a multi-year high, suggesting a shift in focus from short-term gains to long-term holdings.

ethereum High-Wire Law: Key Metrics

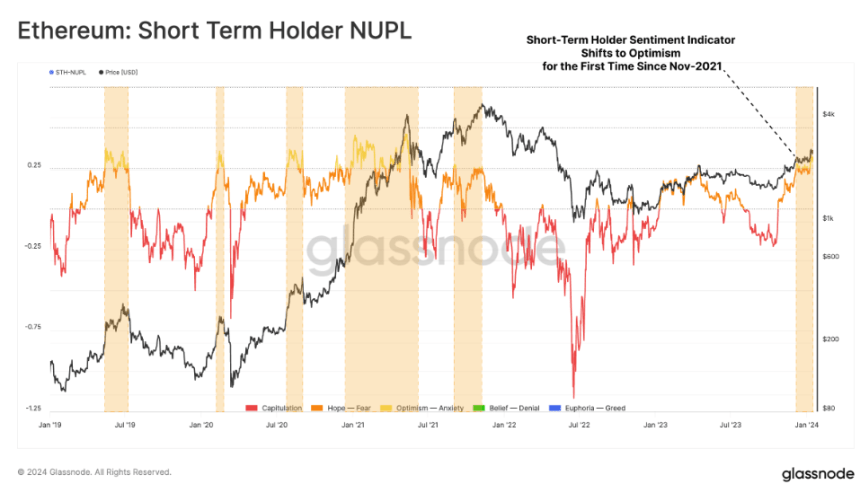

This newfound patience is further corroborated by the rising net unrealized gains/losses (NUPL) metric for short-term token holders. This figure, which reflects the potential profitability of investors based on their purchase price, has exceeded 0.25 for the first time since the all-time high in November 2021, signifying an increase in confidence among those who recently acquired eth .

ethereum currently trading at $2,220 on the daily chart: TradingView.com

The current scenario resembles a tightrope act, except the stakes are considerably higher. Technical charts show warning signs, but market sentiment whispers sweet words of optimism. It remains to be seen if ethereum finds its footing and rises, or takes a misstep and plummets.

Take a look

- ethereum faces near-term technical challenges with resistance points at $2,240 and $2,280.

- Support lies at $2,200 and $2,165, with a chance of a break below $2,000.

- Despite the price drop, market sentiment around ethereum remains positive.

- Record net profits set and rising NUPL for short-term holders suggest long-term optimism.

While ethereum's path forward remains shrouded in uncertainty, the technical picture paints a potentially bleak picture. With resistance levels looming and little support on the ground, a drop towards the psychologically significant $2,000 mark cannot be ruled out. However, resilient optimism among investors, evidenced by flat earnings and rising NUPL, suggests hidden strength that could fuel an unexpected recovery.

Featured image from Pixabay, TradingView chart

Disclaimer: The article is provided for educational purposes only. It does not represent NewsBTC's views on whether to buy, sell or hold investments, and investing naturally carries risks. It is recommended that you conduct your own research before making any investment decisions. Use the information provided on this website at your own risk.

NEWSLETTER

NEWSLETTER