Ethereum’s Ether (ETH) token price has pulled back from its rally trend against Bitcoin (BTC) as it hits a series of lower highs in April.

ETH price risks further losses against Bitcoin

As of April 24, the ETH/BTC pair is down 5.5% from its local high of 0.0709 BTC six days ago. In the same period, Ether fell almost 15% and Bitcoin fell 11.25% in US dollar terms.

For now, ETH remains above its 50-day exponential moving average (50-day EMA; the red wave) near 0.0672 BTC. But if the March 2023 fractal is any indication, Ethereum price could drop sharply below the wave of support.

The ETH/BTC pair saw a reversal trend in March after testing the 200 day EMA (the blue wave), breaking below its 50 day EMA in the process.

If the fractal plays out similarly in April, the downside target is 0.0627 BTC by the end of the month, roughly 7% lower than current levels and a level that served as major support in March and April.

This target also coincides with Ether’s long-term rising trendline support, the “buy zone” on the chart below, which has been limiting its bearish attempts since June 2022.

Ethereum Weekly Institutional Flows Outperform BTC

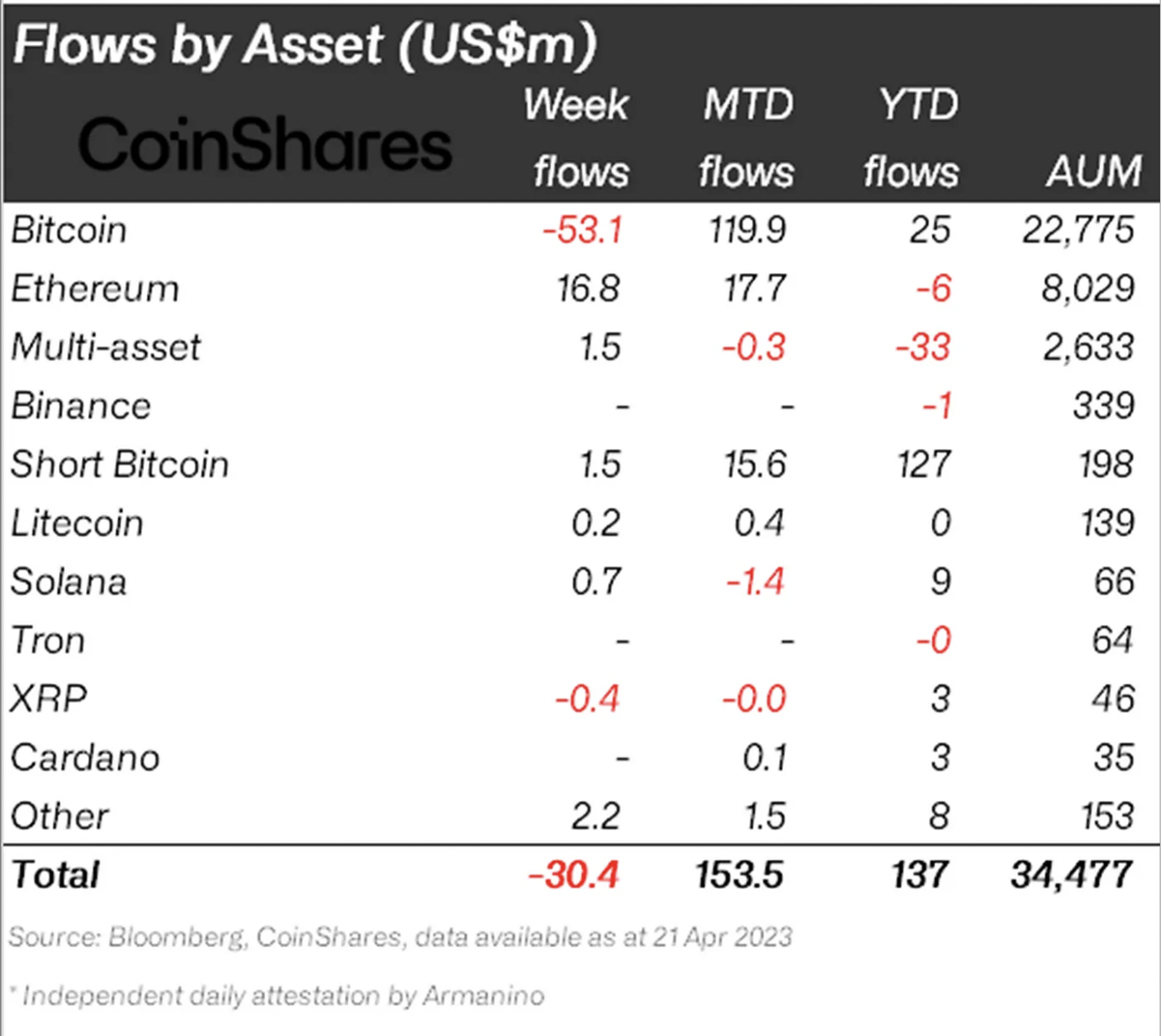

Interestingly, Ethereum’s underperformance against Bitcoin was contrary to last week’s institutional flows.

Ethereum funds drew $17 million into its coffers in the week ending April 21 versus Bitcoin’s $53.1 million outflow, according to the latest CoinShares report.

“These entries suggest that there is increasing confidence among investors following the successful implementation of the Shapella update,” noted James Butterfill, CoinShares head of research, adding that “they were solely from Europe.”

Related: Ethereum Up 20% In April While Markets Pro Sees 379% Rise In One Day

As for Bitcoin, the breakout began around April 14 when the coin reached $30,000, a psychological resistance level. Butterfill said that BTC’s drop below $27,500 was due to profit-taking in the absence of macroeconomic triggers.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.