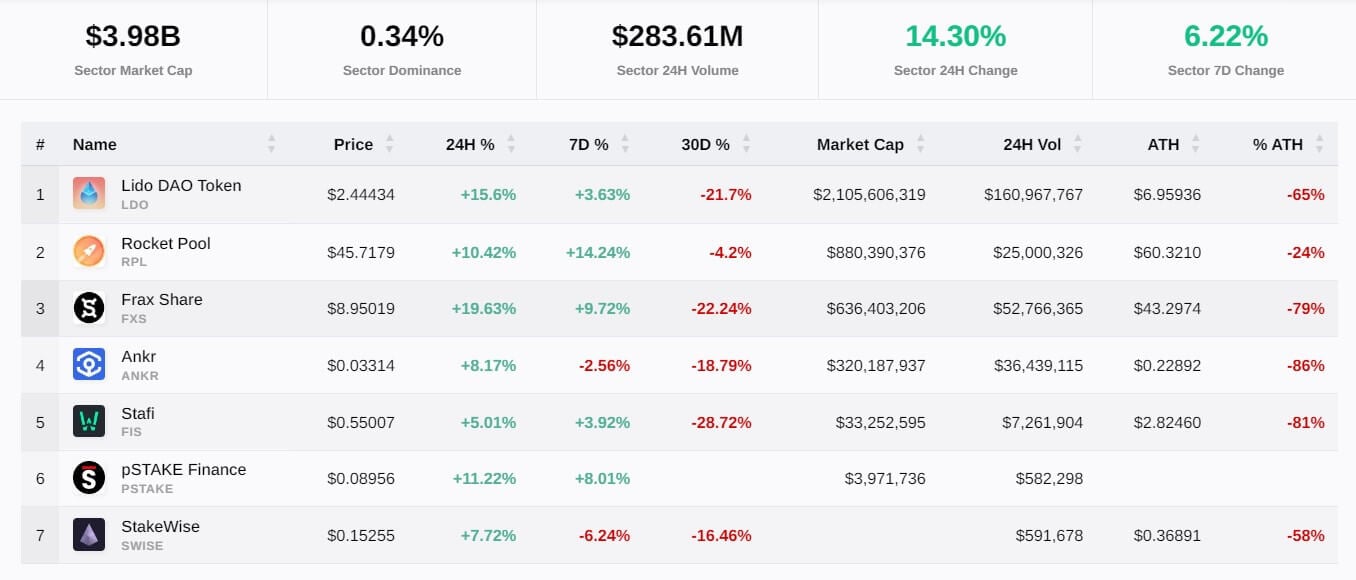

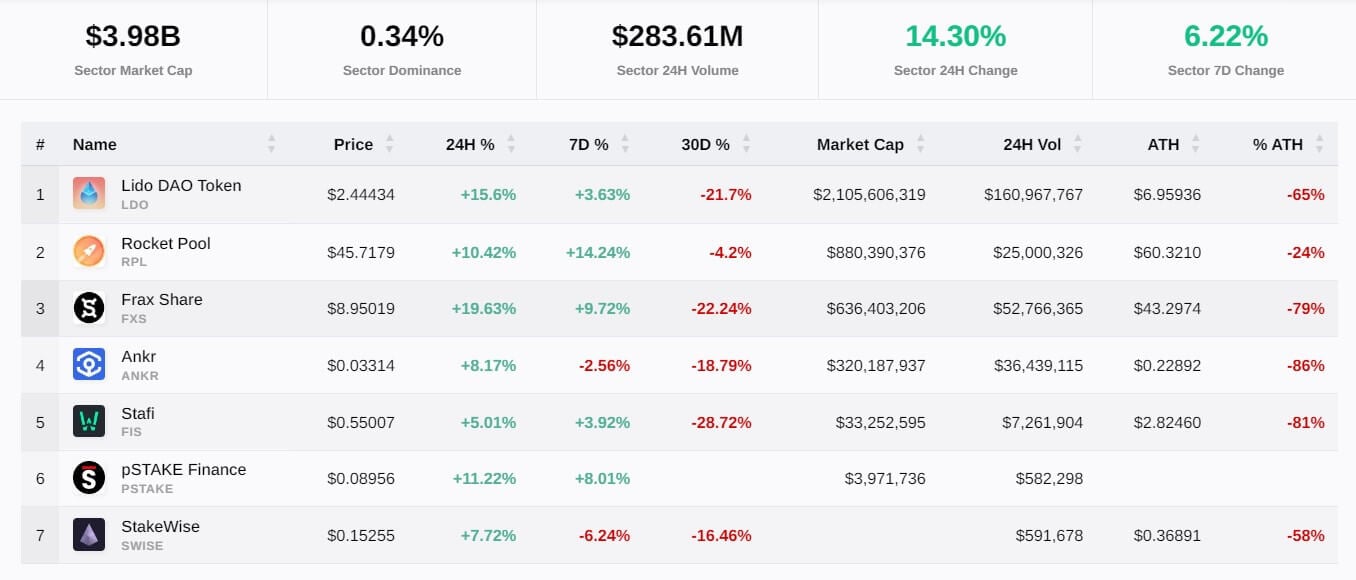

Liquid staking is the best-performing crypto sector in the last 24 hours after a rally of more than 15%, according to CryptoSlate data.

According to the data, all seven projects in the space soared by more than 5%, with two of them, Lido (LDO) and Frax Share (FXS), among the top five gainers on March 29.

Liquid staking derivatives (LSD) platforms have enjoyed renewed interest following news that the much-anticipated upgrade to the Shapella network, enabling staked Ethereum withdrawals, will go live on April 12 in epoch. 194048, according to an Ethereum Foundation statement.

Frax Share leads its peers

According CryptoSlate Data, Frax Share FXS is the best performing liquid staking derivatives token during the reporting period, up 19.63%.

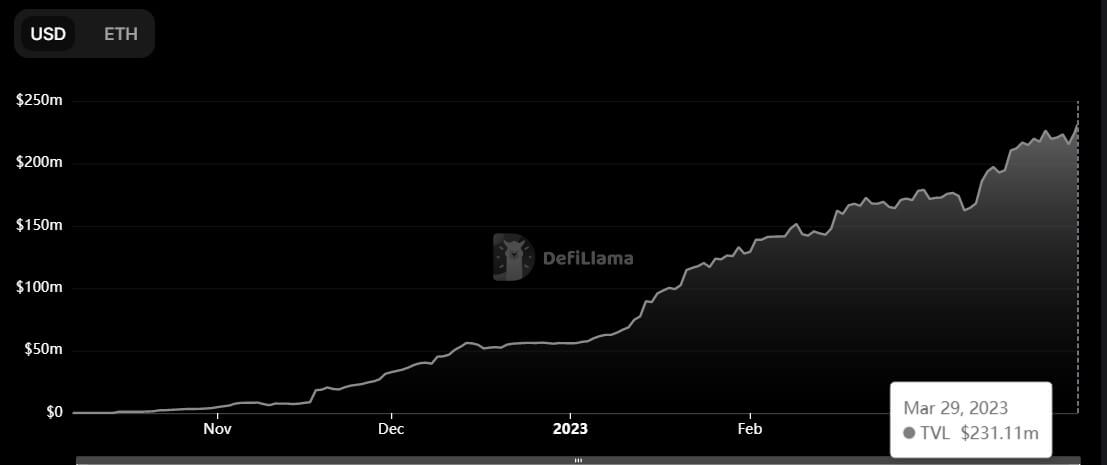

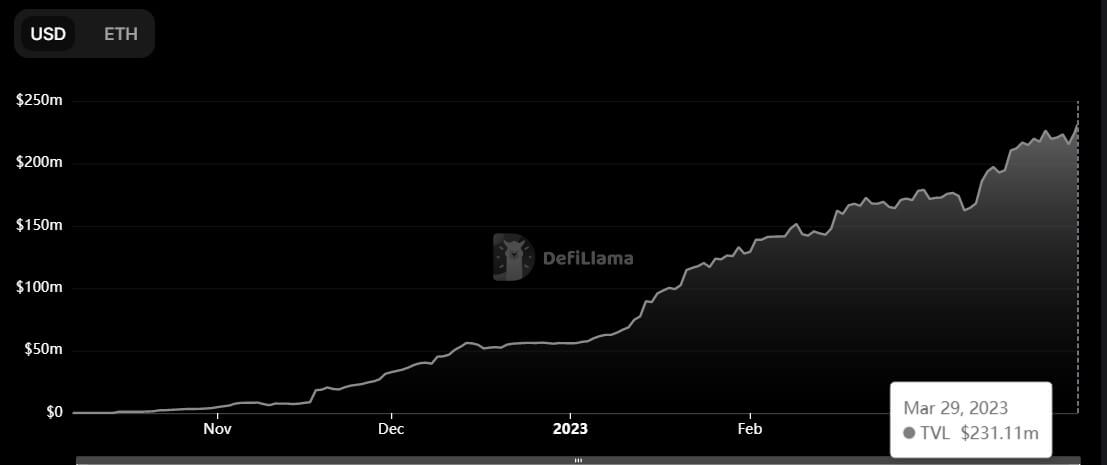

FXS is the governance token of the Frax Protocol and its price has risen significantly after launching a liquidity staking program late last year.

Total Value of Assets Locked (TVL) in Frax Ethereum (frxETH) increased by 31.49% over the past 30 days to an all-time high of $231 million, equal to 131,970 ETH tokens, according to DeFillama data .

In February, Blockchain analytics firm Nansen reported that the supply of frxETH grew by 70,000 ETH in three months.

Lido continues to dominate LSD

Meanwhile, Lido remains the dominant participation platform in the cryptocurrency industry. Its LDO token increased 15.57% in the last 24 hours to $2.43 as of this writing.

Despite the Lido developer’s decision to cancel its staking services for Polkadot and Kusama, the protocol’s TVL rose 6.51% to $10.89 billion.

According to Dune Analytics datathe protocol accounts for about 32% of all ETH staked, which translates to around 5.8 million tokens.

On top of that, it is also the most dominant decentralized finance protocol, with a 21.8% market dominance, according to DeFillama. data.

Meanwhile, other staking protocols such as Rocket Pool (RPL), StakeWise (SWISE), ANKR, and Stafi (FIS) posted positive gains in the past 24 hours. Overall, the market capitalization of crypto tokens in this sector sits at $3.98 billion at press time.

In the last 24 hours, DeFillama data shows that the top 10 liquid stake protocols, except for Marinade Finance, saw their TVL increase by an average of 5%.

NEWSLETTER

NEWSLETTER