Reason to trust

Strict editorial policy that focuses on precision, relevance and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reports and publications

Strict editorial policy that focuses on precision, relevance and impartiality

Leon football price and some soft players. Each Arcu Lorem, Ultrices any child or ullamcorper football hate.

This article is also available in Spanish.

According to an x post of the cryptogo analyst, ethereum (eth) can be reaching the end of a bears trap. The analyst predicts that cryptocurrency could exceed its recent range of $ 4,000, potentially looking at a new historical (ATH) of $ 10,000.

ethereum leaving the bear trap?

ethereum seems to be ready to free himself from a possible bears trap, since the second largest cryptocurrency for market capitalization continues to operate in the low range of $ 2,000 after supporting a strong sale of a sale in December 2024.

Related reading

For the uninitiated, a trap for bears refers to a false signal that seems that the price of an asset continues to fall, tempting merchants to shorten it, only so that the sudden price reverse and increase, which makes these short positions liquidate.

In a recent x post, Cryptagos emphasized that eth can be close to the end of such a trap. The analyst shared a weekly eth table that illustrates how cryptocurrency could be in the edge of a trend reversal after months of important settlements.

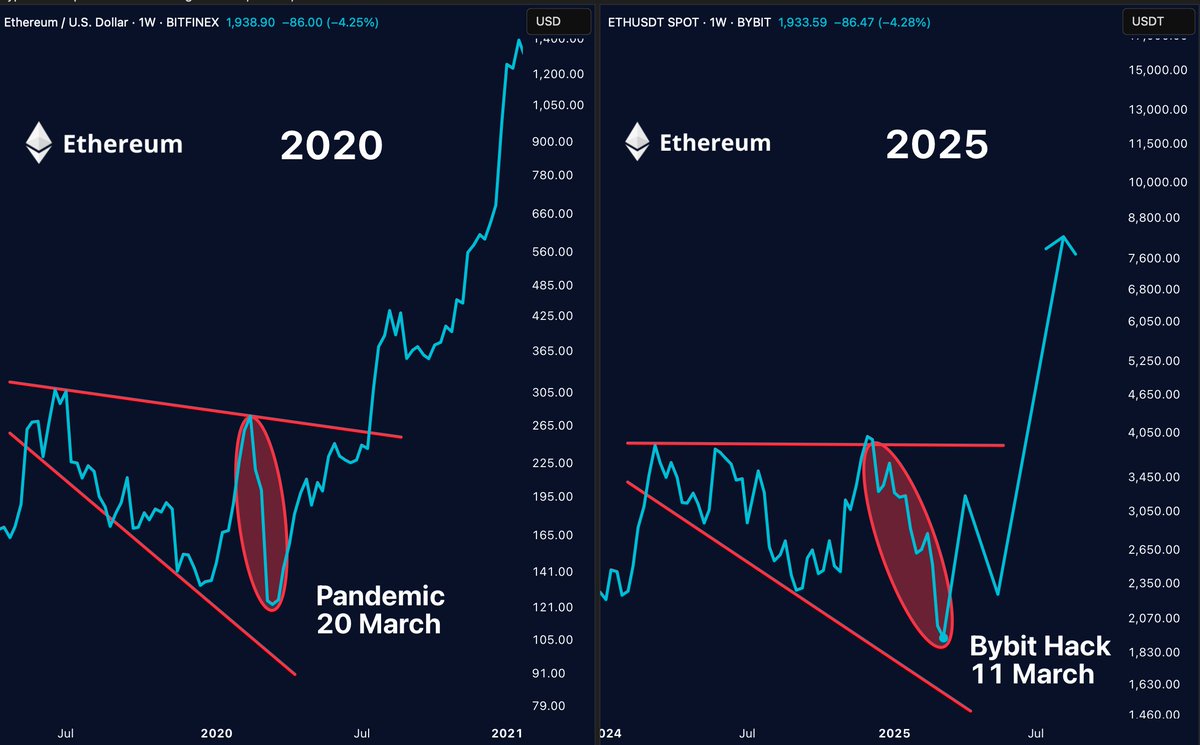

Merlijn cryptographic analyst, the merchant, echoed the feeling of Cryptagos, highlighting the similarities between the action and the current pricing patterns of eth in 2020. He pointed out that the last time this configuration arose, “Panic became a historical rally.”

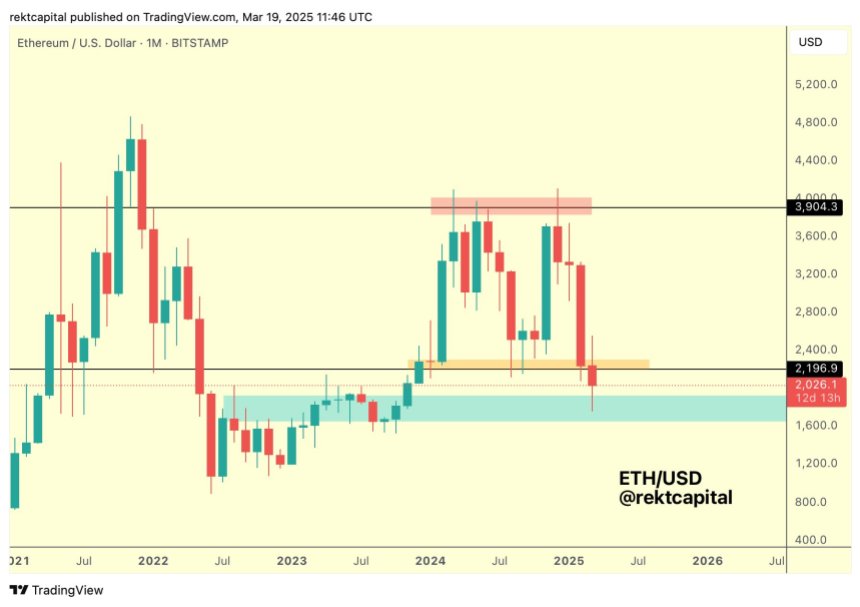

The Rekt Capital cryptographic investor also intervened, noting that ethereum is quoting within a “area of historical demand.” The investor declared:

If the price can generate a reaction strong enough here, then #eth You can claim the macro range of $ 2196- $ 3900 (black). If eth does this before the monthly closure of March, then all this inconvenience of less than $ 2200 would end as a downward wick.

eth about to leave the accumulation phase

The experienced crypto commentator Ted shared a graph that indicates that eth has left its short -term accumulation phase. He explained that the digital asset has been in accumulation from its fall from $ 3,000 to $ 1,800. Ted added that a sustained price share above $ 2,000 could light a significant price rally.

The remarkable analyst Daan crypto Trades revealed that he recently converted some of his bitcoin (btc) in the long term eth for “first time in years.” He cited the current eth/btc trade pair as presenting an attractive risk/reward settings.

Related reading

Beyond the action of the bullish price, several technical indicators are pointing out a possible eth rally in the short term. In particular, the weekly relative force index of eth (RSI) recently hit A minimum of several years, a sign that a reversal of trends could be imminent.

However, growing eth reserves in encryption exchanges remain a precautionary point, since they could suppress the bullish impulse if investors choose to sell. At the time of publication, eth is traded at $ 2,029, 7.8% more in the last 24 hours.

Unspash's prominent image, x and TrainingView.com graphics

(Tagstotranslate) Altcoin

NEWSLETTER

NEWSLETTER