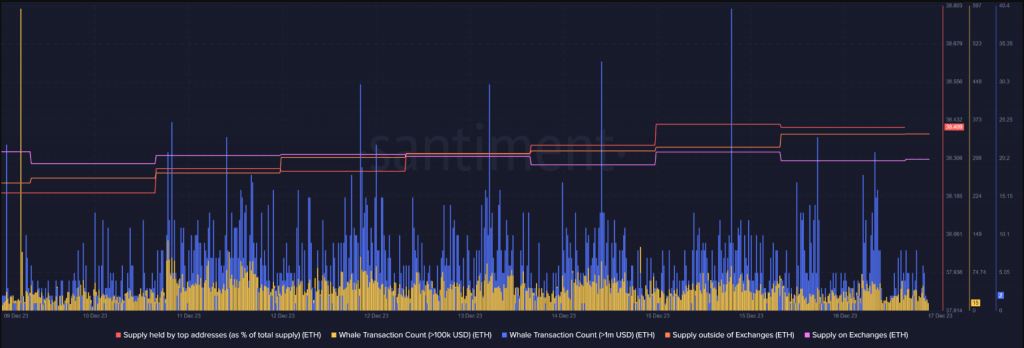

In the past week, some of ethereum's largest whales, those with holdings ranging from 1 million to 10 million eth, have accumulated an impressive 100,000 eth, valued at a staggering $230 million.

This active buying stance by influential investors highlights their unwavering belief in the long-term potential of ethereal, even in the face of recent price corrections.

Despite the recent downward price trend, indications from recent whale activities on ethereum suggest persistent confidence in a continuation of the bull market.

Rich Traders Hoard Millions in ethereum

Following the promising start of the first days of December 2023, several cryptocurrency assets, in particular ethereum, showed solid performance.

crypto whales have reportedly gobbled up hundreds of millions of dollars worth of Ether, the leading altcoin, over the past seven days, according to a highly respected expert.

Some of the largest ethereum?src=hash&ref_src=twsrc%5Etfw” target=”_blank” rel=”nofollow”>#ethereum The whales have been on a shopping spree, picking up more than 100,000 $eth Just last week: that's a whopping $230 million! pic.twitter.com/jWHY6MXDgs

—Ali (@ali_charts) December 16, 2023

On social network

Price rallies are usually the result of strong buying demand from wealthy investors, and the recent whale accumulation indicates that is the case.

On December 7, Santiment Feed connected a whale accumulation pattern to the rise of eth, culminating in a 19-month high above the price of $2,350.

As a general rule, whale activity affects the prices of cryptocurrency assets. Recent activity among eth whales indicates that a price rally may be approaching.

ethereum currently trading at $2,235 on the daily chart: TradingView.com

Although there is a lot of buying pressure in the market at the moment, caution is advised because the bottom has not yet been reached.

RSI and neutral stochastic, ethereum uncertainty

The Relative Strength Index (RSI) and Stochastic are currently in neutral territory, according to data from eth/summary” target=”_blank” rel=”nofollow”>CryptoQyant. Despite the buying activity, there is still uncertainty about the true bottom of the market.

We analyze the liquidation heatmap to try to estimate possible ethereum support levels. According to the analysis, there was an increase in settlements in the range of $2,140 to $2,170.

This implies that before ethereum price starts its next bullish bounce, it is likely to fall below these levels. But in the event of a rally, ethereum would have to overcome a significant resistance level near $2,380.

Source: Santiment

ethereum's short-term price changes are difficult to forecast due to the complex interplay of market indicators and settlement data.

Meanwhile, the price of $2,148 appears to be the asset's short-term support, based on an analysis of eth's daily price chart. To increase the probability of a new rise before the end of 2023, the bulls will hope for this level to hold.

If there is a break below, it may indicate the construction of a more complex bullish continuation chart pattern, similar to a bull flag. On shorter time frames, this pattern may resemble a descending channel and undermine expectations of another significant rise in 2023.

The values of ether and other cryptocurrencies are sensitive to a number of external variables, including broad macroeconomic sentiment. ethereum is already up 81% so far this year at its current price.

Featured image from Shutterstock

Disclaimer: The article is provided for educational purposes only. It does not represent NewsBTC's views on whether to buy, sell or hold investments, and investing naturally carries risks. It is recommended that you conduct your own research before making any investment decisions. Use the information provided on this website at your own risk.