The share of Ethereum (ETH) held by so-called whale addresses has declined since Ethereum’s Shapella update in mid-April, suggesting that large investors may lean lower in the near term.

ETH whale population shrinks after Shapella

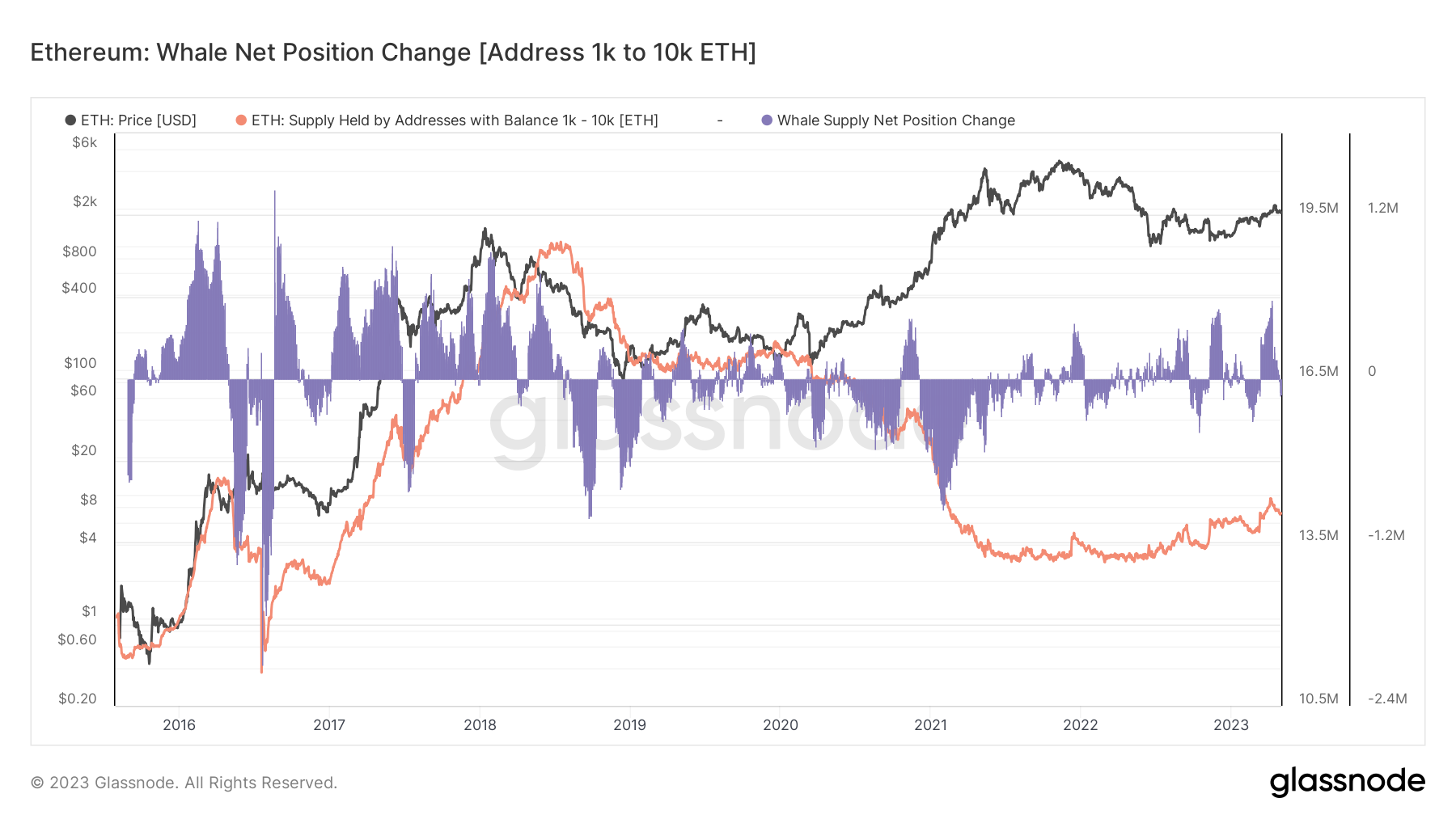

The amount of Ether held by addresses with 1,000-10,000 ETH, or “whales,” was over 14.033 million ETH on May 1, according to data from Glassnode. By comparison, the count was 14.167 million ETH on April 12, when Shapella went live on Ethereum.

Interestingly, a week before the Shapella update, the Ethereum whale cohort had 14.303 million ETH, the highest amount in 2023.

The “shrimps” are the only ones buying ETH from Shapella

The Ether price is down more than 3.5% since the Shapella update, suggesting that several whales may have “sold the news.”

Interestingly, other address cohorts also showed a decline, including sharks (100-1000 ETH), fish (10-100 ETH), crabs (1-10 ETH), and even megawhales (10,000+ ETH).

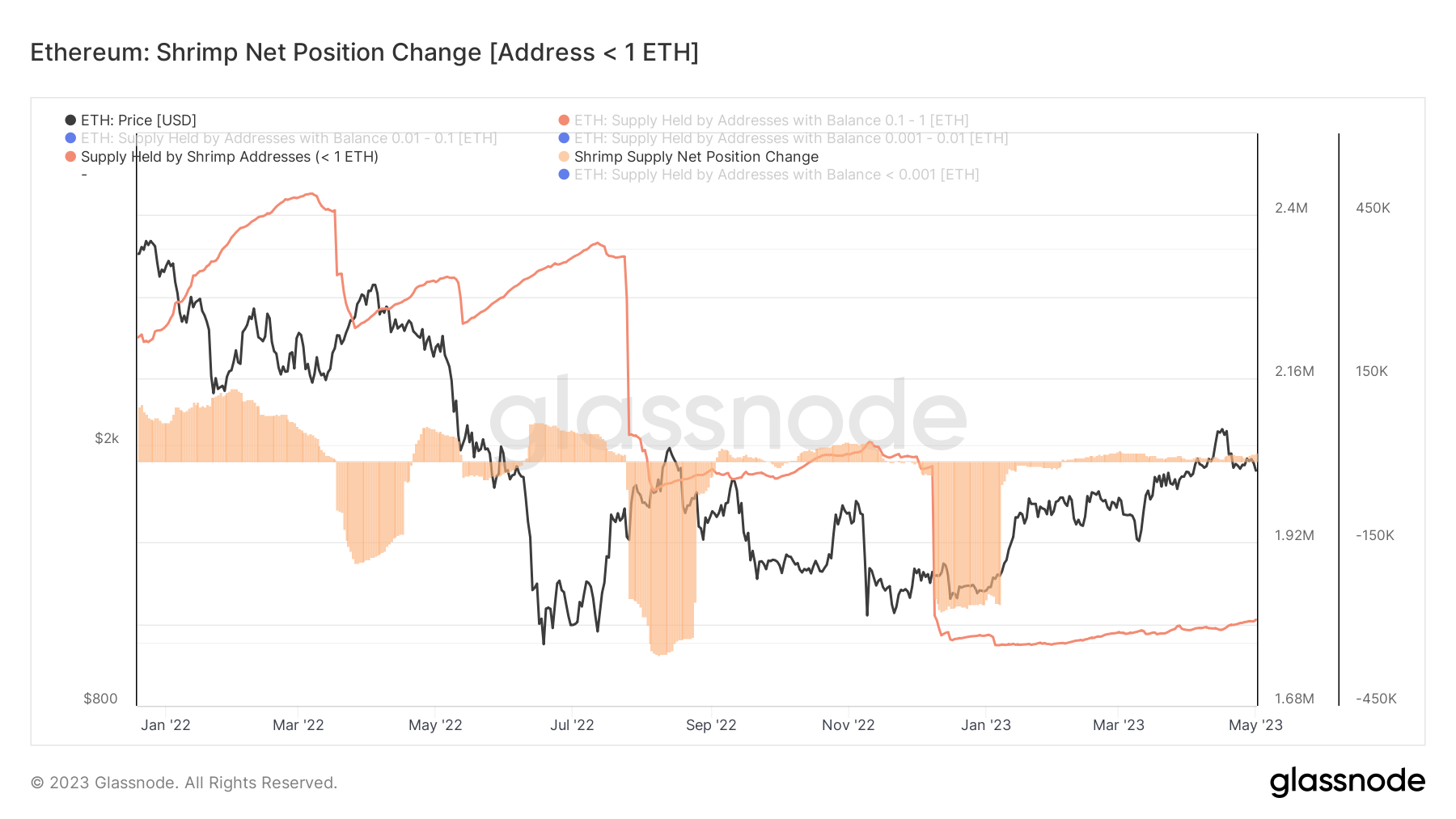

Shrimp only (

Shapella allowed investors to withdraw the staking-locked ETH, which some say would increase selling pressure.

Since the Shapella update, investors have withdrawn more than 1.97 million ETH worth around $3.6 billion, according to Beaconcha.in. However, to date no major changes have been seen in the ETH balances of cryptocurrency exchanges.

Ethereum Whales vs Shrimp

Historically, fewer Ethereum whales generally mean more downside risk for the ETH price.

Whale activity normally acts as a leading indicator of the market. Therefore, the accumulation of wealthy investors usually precedes a price increase, and vice versa.

The positive price-whale correlation existed until March 2020, as shown in the chart below. Subsequently, retail mania took over along with the Fed’s quantitative easing and the correlation broke.

Notably, the ETH price surged from $110 in March 2020 to over $4,950 in November 2021 despite declining whales. The inverse correlation continued throughout the downward price trend to around $850 in June 2022.

But since then, whale holdings have increased by almost 1 million ETH. Meanwhile, the ETH price has more than doubled to around $1850, suggesting a possible return of the price-whale correlation, which would be a bullish sign for Ethereum.

Where can the price of ETH go next?

The $2,000 level is a major psychological resistance level for ETH/USD that the bulls have failed to break in multiple attempts in 2023.

Related: Ethereum Price Outlook Weakens, But ETH Derivatives Suggest Hitting $1.6K Is Unlikely

On the daily chart, ETH/USD remains above the short-term support provided by its 50-day exponential moving average (50-day EMA; the red wave), near $1,840. A successful bounce from here opens $2,000-$2,125 as the next bullish range target in Q2.

Conversely, a break below the 50-day EMA risks sending ETH towards its 200-day EMA (the blue wave) near $1,670, roughly 10% below current price levels.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

NEWSLETTER

NEWSLETTER