Ethereum’s recent implementation of the Shapella update on April 12 was pivotal, as it triggered changes for validators, allowing them to withdraw their staked ETH from the network.

At first, the development caused a backlog of withdrawal requests as investors looked to cash in on their assets at stake. This raised concerns that massive withdrawals would cause the price of ETH to drop. However, the past week has been cause for positivity as assets in play have started to return to pre-Shapella levels.

The trust of the validators was restored in the last few days

This trend began on April 17, when there were more deposits than withdrawals for the first time since the Shapella update. At the end of the day, there were about 68,000 ETH staked on the Ethereum network.

This continued on Tuesday, April 18, when there was a positive balance of 26,680 ETH, with 91,500 ETH deposited vs. 64,830 ETH withdrawn. Unsurprisingly, this trend has continued throughout the week, with ETH staked more than the amount withdrawn, according to the chain’s data.

Related reading: Gemini to Launch a Crypto Derivatives Platform Outside of the US

This trend suggests increased confidence among validators in the Shapella post-update staking process. It also supports the belief that enabling withdrawals has not resulted in a mass exodus of validators.

However, the balance is still negative if the data from the last week are considered. Overall, around 1.4 million ETH has left the network versus 700,000 that have been deposited. In addition, there are more than 650,000 ETH that have not been withdrawn.

As seen in the chart above, not all validators withdrew their 32 ETH stake. Some validators have partially removed the interest generated from your original deposit.

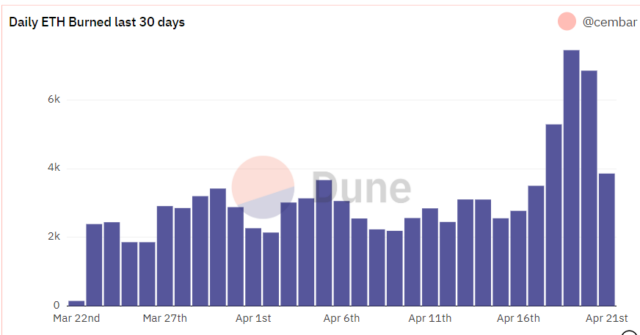

Ethereum Witnesses Rise in Token Burning

The release of the Shapella update also resulted in a significant increase in ETH burns. This is one of the consequences of the update, and in the last week there has been a steady increase in daily burns.

Related reading: Ukraine prepares to follow in the footsteps of the EU and adopt MiCA regulations

In the past three days, a total of 17,000 ETH has been burned from circulation, sparking debate within the Ethereum community. This latest increase in consumption rates could be related to the recent increases in the Pepe (PEPE) and Chad (CHAD) meme tokens that have taken the crypto community by storm.

There has been an increase in the use of MEV (maximum extractable value) bots to earn rewards in meme tokens by rearranging block transactions on the Ethereum network.

The recording mechanism was implemented in August 2021 on the Ethereum network as part of the EIP-1550 proposals. This development was made to transition ETH into a deflationary asset in the future, decreasing its supply and increasing its value.

At the time of writing, Ethereum is valued at $1,850, down 11% from last week as the crypto market turned red. Whether this is a slight market correction or the end of the uptrend remains to be seen.

Featured image from Istock.com Charts from Tokenunlocks, Dune Analytics and TradingView

NEWSLETTER

NEWSLETTER