Data shows that more than 70% of the total Ethereum supply staked comes from staking services, with Lido accounting for the largest amount.

Ethereum staking service providers have secured a total of 11.4 million ETH

Last year, ETH successfully completed a transition to a Proof-of-Stake (PoS) consensus mechanism, which meant that miners no longer had a role to play in the network, as chain validators called “stakers” they fulfilled their function.

Like miners, participants earn rewards for acting as network nodes and handling transactions, but to become a participant, all an investor needs to do is secure 32 ETH collateral in the Ethereum staking contract and then Unlike what mining needs, the validator here does not require any significant computing power to carry out the task.

But as the 32 ETH requirement is too high for the average investor (at current exchange rates, a 32 ETH stack would be worth around $52,400), some companies have started providing staking pool services, where holders can usually Deposit any number of tokens and earn staking rewards on them. These services usually work by pooling the coins locked by the different users, so that the combined amount exceeds at least 32 ETH.

According to the data of the on-chain analysis company glass node, the total value locked in the Ethereum staking contract is now around 16.1 million ETH in the general network (ie including all platforms as well as investors with self-custody wallets). This is approximately 13.4% of the total circulating supply of the cryptocurrency.

Here is a graph showing how much of this ETH is coming from the different market share services:

Looks like Lido is the largest player in the market right now | Source: Glassnode on Twitter

As shown in the graph above, the total amount of Ethereum staking by all these services adds up to 11.4 million ETH, which is just under 71% of the total staking supply. Lido alone contributes 4.7 million ETH, which is more than 29% of the total coming from these platforms.

Lido is a decentralized liquid staking pool, which is a type of platform that adds ETH from investors to the staking pool and gives them another token in exchange that is backed 1:1 with their original position. This token provides users with liquidity on their locked ETH, which means they can sell it whenever they want or use it in other services (such as derivative positions).

Coinbase, Kraken and Binance, the next three largest providers in the sector, combined have locked around 4.3 million ETH. Their individual domains are 12.8% for Coinbase, 7.6% for Kraken, and 6.3% for Binance. Clearly, even their combined dominance of 26.6% is still less than Lido alone.

ETH price

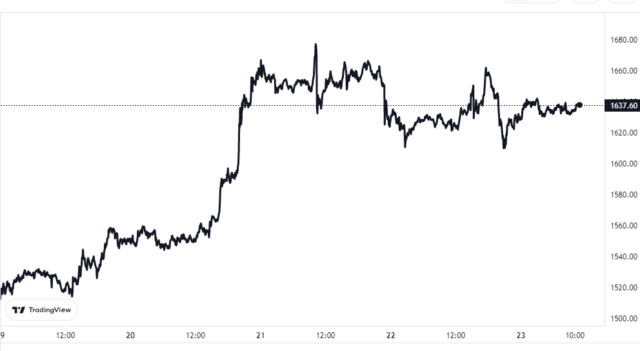

As of this writing, Ethereum is trading around $1,600, up 6% in the past week.

The value of the crypto seems to have been moving sideways since the surge a few days ago | Source: ETHUSD on TradingView

Featured Image by Zoltan Tasi on Unsplash.com, Charts from TradingView.com, Glassnode.com