Four days after the Ethereum (ETH) Shapella upgrade, more than 1 million ETH has been withdrawn, according to beaconcha.in data.

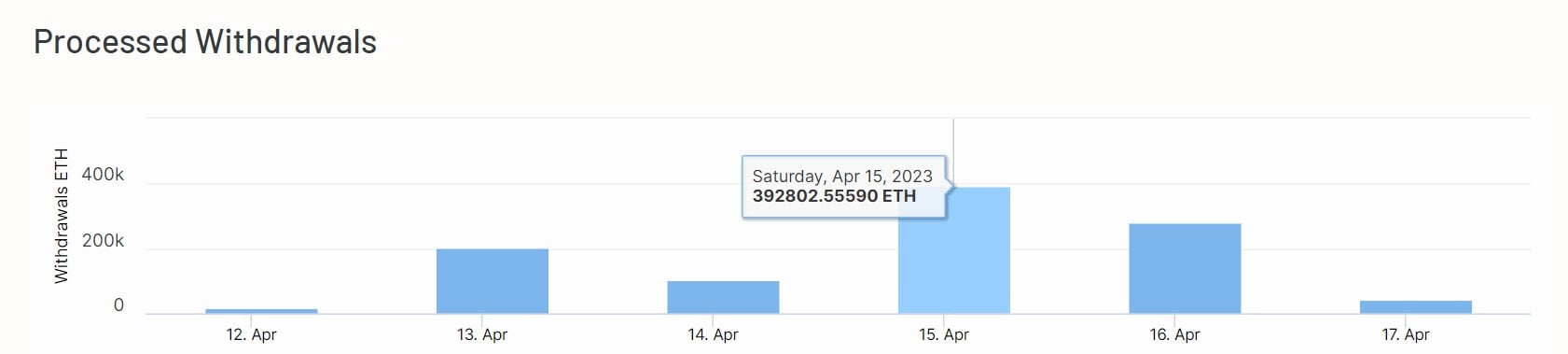

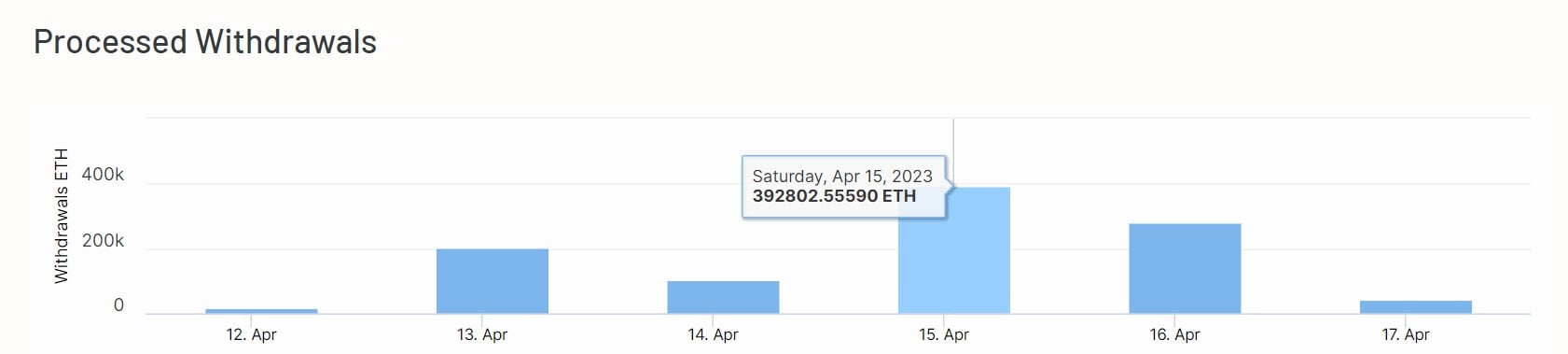

According to the data, 1.04 million ETH have been withdrawn out of the 491,037 withdrawals processed. The highest withdrawal was processed on April 15 when validators removed 392.8012 ETH from the Beacon Chain.

On other days, more than 150,000 ETH were withdrawn, respectively.

In the meantime, more ETH will be withdrawn in the coming days. According unlock tokens, 866,850 ETH valued at $1.81 billion are waiting to be withdrawn from 471,370 validators.

Lido tops withdrawals

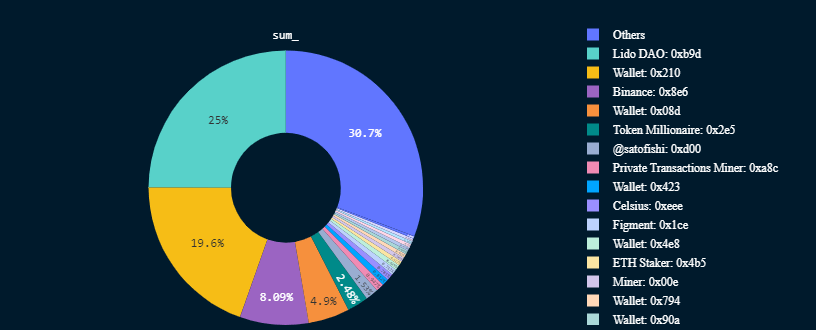

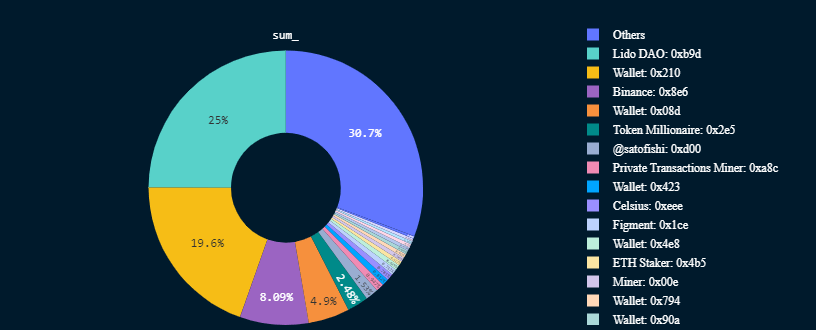

According to Nansen panel, Lido DAO is responsible for most withdrawals. The liquid participation platform accounts for 25% of all withdrawals processed.

It is followed by Binance, which has withdrawn 84,145 staked ETH, which is equivalent to 8.11% of the ETH withdrawn. Other centralized entities like bankrupt lender Celsius, Figment, and Satofishi are also among the top addresses that have withdrawn their staked tokens.

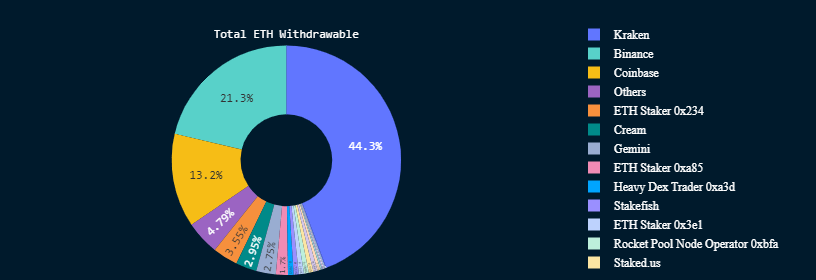

Centralized exchanges dominate pending withdrawals

Meanwhile, centralized exchanges (Kraken, Coinbase, Binance, and Gemini) dominate the platforms waiting for withdrawals of your staked ETH.

CryptoSlate previously reported that these platforms account for 78% of the entities hoping to withdraw their staked Ethereum. At press time, these platforms want to withdraw 736,500 ETH.

Recent regulatory issues in the United States are forcing these platforms to retire their assets in order to comply with the Securities and Exchange Commission (SEC).

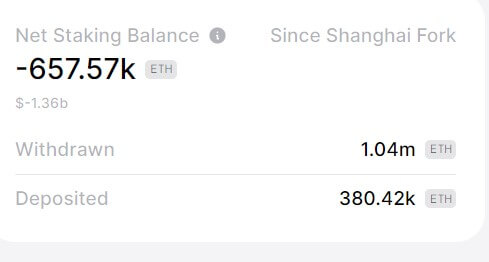

More than 380,000 ETH have been deposited since the Shapella update

Since the Shanghai hard fork, the staked ETH balance has decreased by 3.8% to 17.3 million ETH despite investors depositing 380,420 ETH, according to Token Unlocks.

This means there has been a net decrease of 657,570 ETH ($1.36 billion) in ETH staked as of press time.

Meanwhile, Lookonchain reported that some addresses withdrawing your staked ETH immediately re-staked them. According to the on-chain detective, three wallets out of the top 15 withdrawal addresses re-staked 19,844 ETH.

Lookonchain further noted that some addresses that were withdrawing their assets were also selling them. The researcher singled out three wallets that sent 71,444 ETH to no-name centralized exchanges.

ETH has been one of the best performing digital assets since the Shapella upgrade. The cryptocurrency has risen by more than 12% over the past week and has sent the broader market into a green run.