The amount of Ethereum (ETH) staked has risen 18% to more than 16 million since the network completed its transition to a proof-of-stake (PoS) network last year, according to CryptoSlate data.

The 16 million ETH staked equals roughly 13.28% of the total ETH supply, with a value of $22.42 billion, 500,213 total validators, and 87,121 distinct depositor addresses, according to Dune Analytics. data.

Lido is the dominant participation platform

Lido is the dominant staking platform, controlling 29.08% of staked Ethereum. Around 4.65 million ETH, worth $6.8 billion, has been staked through it, according to the official Lido. website,

Other major staking platforms, including centralized exchanges (CEXs) like Coinbase, Kraken, and Binance, hold about 26.7% of staked Ethereum, according to Dune analytics data.

Cumulatively, the top four ETH staking platforms control 55.78% of the Ethereum staked.

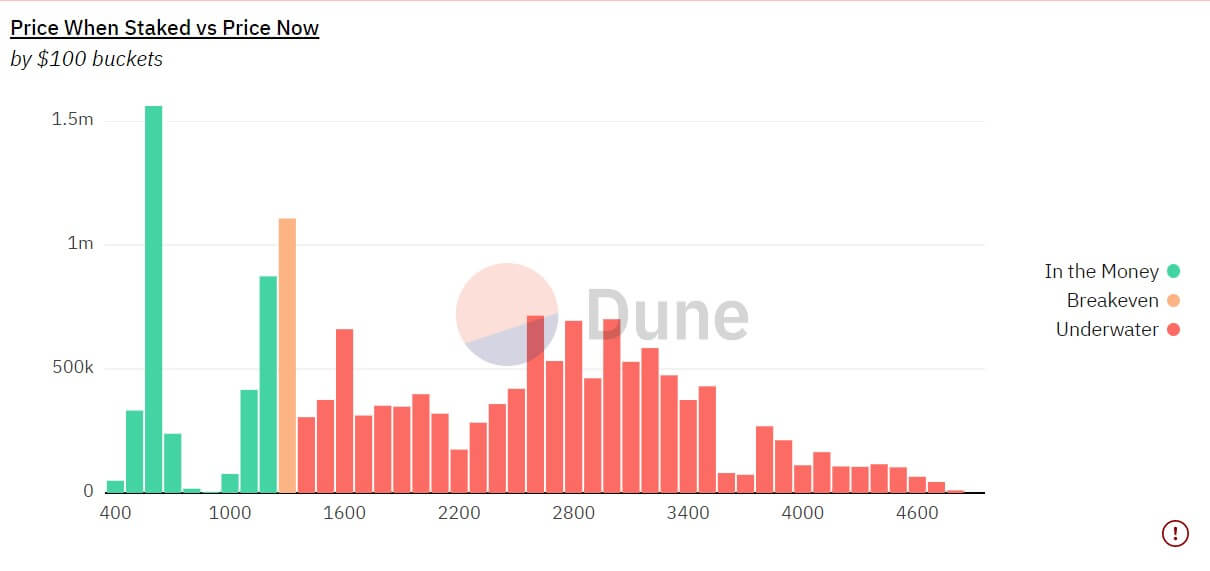

72% ETH staked at a loss

Currently, 71.7% of Ethereum participants are losing in terms of ETH holdings staked, leaving just 28.3% currently in profit.

Profit participants staked their coins when ETH was trading at approximately $1,300, as shown in the chart below.

With ETH trading more than 70% below its all-time high (ATH), cryptocurrency investors who staked their assets on the ATH have been hit the hardest by the bear market.

Staked ETH has gained attention in light of the upcoming Shanghai update which will allow punters the ability to withdraw their staked ETH.