The upcoming Ethereum upgrade in Shanghai will allow users to withdraw staked Ether (ETH), which will increase the liquidity and competitiveness of the network while also bringing its participation rate closer to its competitors.

The Shanghai Update is an Ethereum hard fork tentatively scheduled for March. It implements five Ethereum enhancement proposals, the main one being EIP-4895, which allows users to withdraw their locked tokens representing Ether staked from the Beacon Chain.

The ability to withdraw staked Ether could increase market liquidity and make it easier for users to access their funds. Ethereum’s liquid staking platforms, which sprung up largely to ease blockchain’s prohibitive locking and staking requirements, could also benefit from the upgrade.

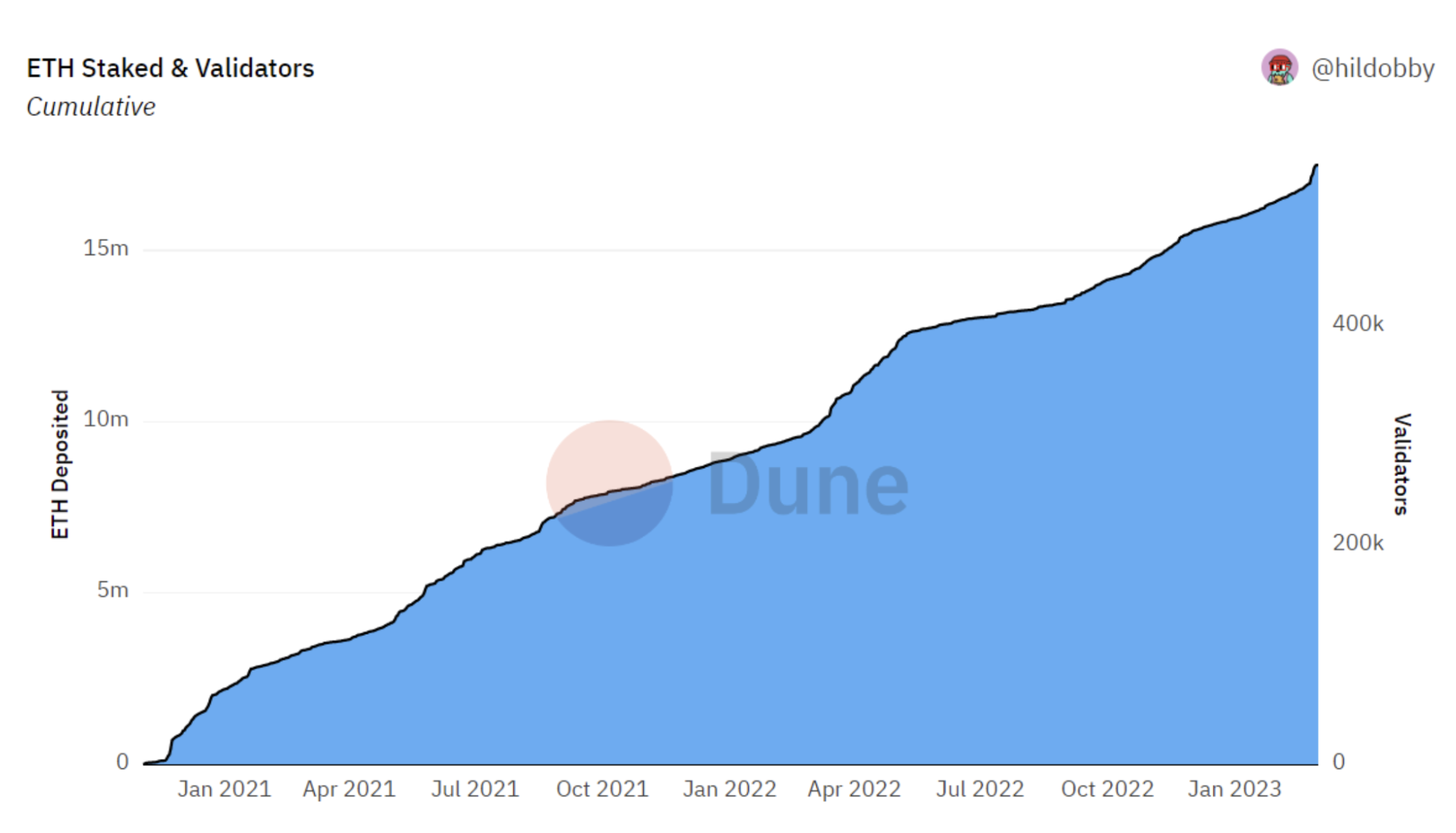

Since the Ethereum network moved to proof-of-stake (PoS) in September 2022, increasing the percentage of Ether staked has become important to help secure the protocol. But many have been hesitant to stake their ETH due to the unavailability of withdrawals. Consequently, only about 15% of ETH is currently stakedwhile all other major Layer 1 networks have a participation rate greater than 40%.

According to The DeFi Investor, many investors will opt for a liquid staking option after the Shanghai update, as they can use liquid staking derivatives in other decentralized finance networks without losing staking yield.

Because?

Because liquid staking derivatives can be used in DeFi without giving up staking performance.

After withdrawing bet $ETH becomes available, revenue from liquid betting providers is likely to take off.

revenue increases -> your tokens also benefit

— The DeFi Investor (@TheDeFinvestor) January 4, 2023

The DeFi investor went on to say that once the staked ETH becomes available for withdrawal, revenue from liquid staking providers will likely increase significantly, which may have a positive impact on their token prices.

Also, the increased competition between these platforms will likely benefit their users through lower fees and additional benefits in exchange for their loyalty.

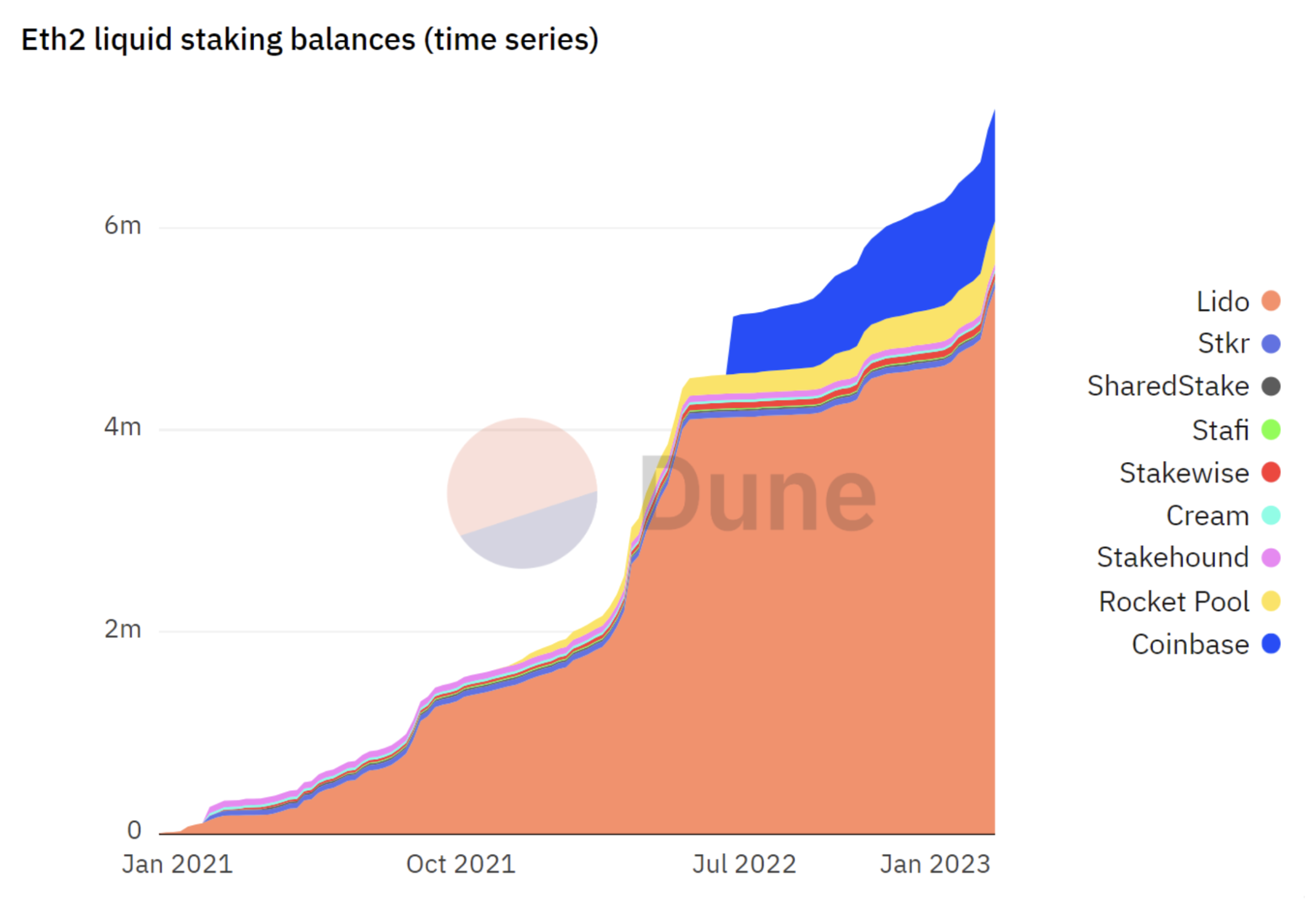

Lido is the largest provider of ETH with liquid participation and is a market leader in its segment. Other notable liquid staking providers include Rocket Pool, Ankr, Coinbase, and Frax Finance, all of which are set to enjoy increased usage post-Shanghai.

Ethereum leads liquid staking activity

Ethereum Beacon Chain deposits across all staking providers have been on an upward trend since the chain officially opened for deposits in late 2020, indicating strong and sustained interest in staking ETH following the Shanghai upgrade. While Lido captures the majority of liquid staking on Ethereum, competition is heating up, with multiple vendors coming out with product enhancements, potentially reducing the risk of any single staking provider being a centralization point for the Ethereum network. .

Liquid staking in the tokens of other Layer 1 networks is also possible. For example, Polkadot DOT (DOT) can be invested in liquid via Ankr, Cosmos ATOM (ATOM) via StaFi, and the SOL (SOL) by Solana in Lido and Marinade Finance.

While competing networks have their own fledgling liquid staking solutions, Ethereum maintains the lead, with over 7 million ETH in liquid staking across all sources. By comparison, at least 3.6 million SOLs are in liquid participation: 1.21 million SOLs through Marinade Finance and 2.39 million SOLs through Lido.

Liquid staking and staking pools give Ethereum an advantage over competitors by improving interoperability for decentralized applications in the ecosystem. This increased participation strengthens the security and usefulness of all protocols that use Ethereum’s PoS consensus mechanism.

Providers like Lido and Rocket Pool remove the barrier to entry for ETH holders to participate without committing to 32 ETH or running a validation node.

That brings Ethereum closer to networks like Solana, which have a lower barrier to entry for staking.

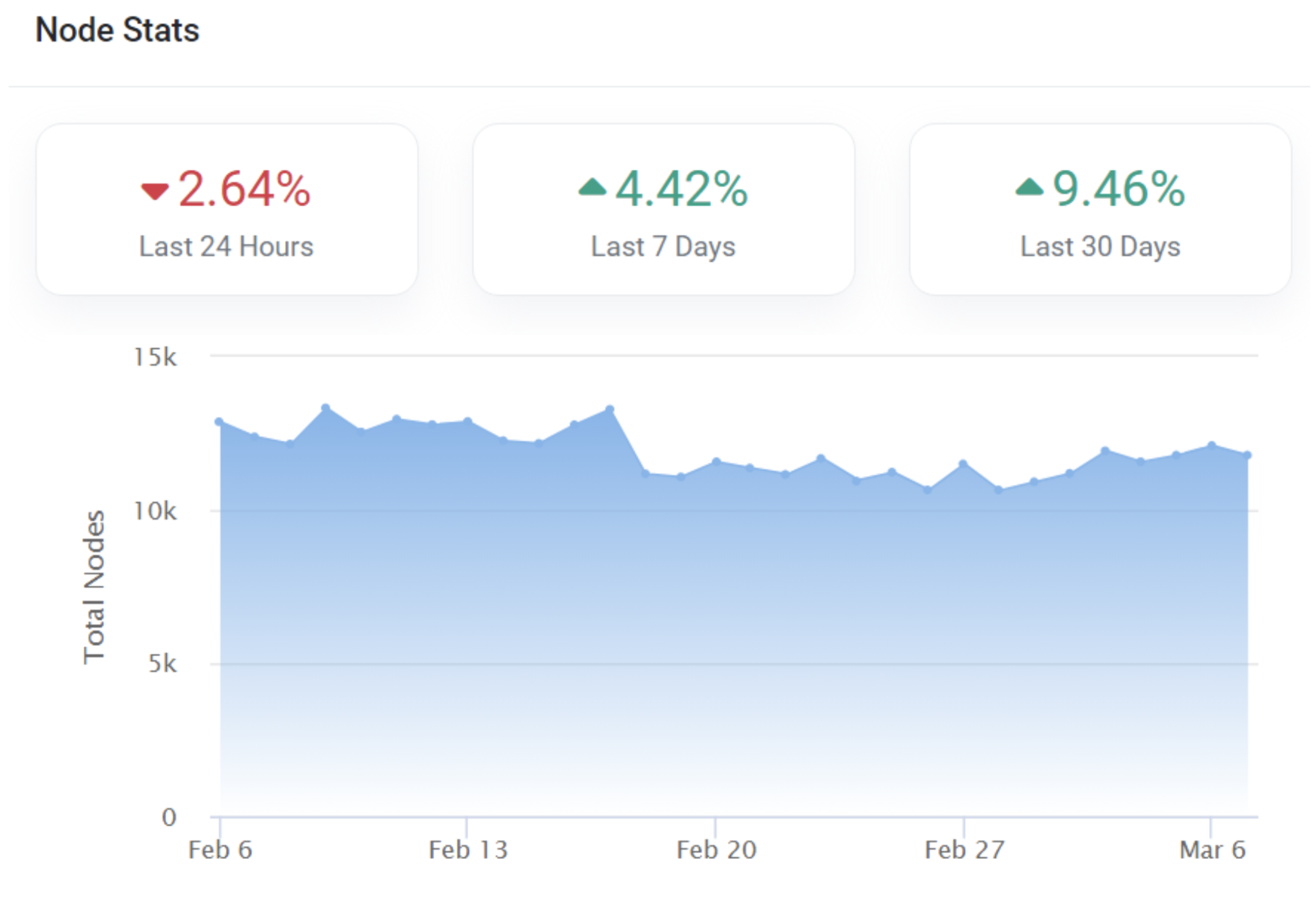

While the concentration of ETH staked through third parties raises decentralization concerns on Lido and Coinbase in particular, there has been a roughly 9% increase in total validation nodes on the network over the past 30 days, raising the total number of Ethereum nodes to 11,786. at the time of writing. That means centralization problems are growing and shrinking simultaneously.

Total Ethereum nodes from February 6 to March 8, 2023. Source: Etherscan/Ethereum Node Tracker

With the Shanghai update reducing staking risk through improved liquidity and reduced lock-in requirements, institutions can also view Ethereum and ETH staking as an asset in a more positive light.

Shanghai makes it quite attractive for large institutions to bet long-term on $ETH.

▻ Liquidity is improved

▻ Uncertain blocking requirements disappear

▻ Withdrawals are enabledNow, large institutions are looking at ETH staking as a potential risk-free, decentralized return.

— Ethereum Stadium (@staderlabs_eth) February 16, 2023

However, the United States Securities and Exchange Commission has recently cracked down on participation protocols that it considers investment products. While providers like Lido are working toward further decentralization, whether the SEC will classify them as securities and how an unfavorable verdict could affect the reorganization of ETH staking providers remains to be determined.

A turbulent macro outlook also looms over cryptocurrencies in 2023, which may lead to more ETH holders opting out and selling on the open market after the Shanghai update, though the Ethereum Foundation limits the amount of ETH you can. go out daily.

However, Ethereum staking deposits have continued to grow regardless of source, and savvy investors will likely find solutions to whatever regulatory hurdles the space challenges.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

NEWSLETTER

NEWSLETTER