Ether (eth) is trading higher on December 1, despite its inability to break above the $2,100 resistance. This level has prompted several rejections over the past three weeks, which is especially concerning given Ether's 16.2% gains in November.

However, the current positive momentum is supported by several factors, including spot ETF applications and the expansion of the ethereum ecosystem, driven by layer 2 solutions.

eth benefits from ETF expectations and negative news related to competing blockchains

A pivotal development occurred on November 30: the U.S. Securities and Exchange Commission (SEC) began the process of reviewing Fidelity's Ether spot ETF proposal, filed on the 17th. of November. green light. If approved, these ETFs would reinforce Ether's status as a digital commodity, reducing the likelihood of it being treated as a security.

Even though analysts predict that the SEC could delay its decision until early 2024, the provisional deadlines for VanEck and ARK 21Shares applications of December 25 and 26, respectively, have kept the market interested. The growing interest of large mutual funds in Ether products is creating a favorable impact on its price.

The growth of the ethereum network is noteworthy, especially in transaction activity and layer 2 development. The ethereum layer 2 ecosystem has become increasingly important as the average transaction fee has remained for above $4 during the last few months. These layer 2 solutions offer more cost-effective and flexible options than the base layer.

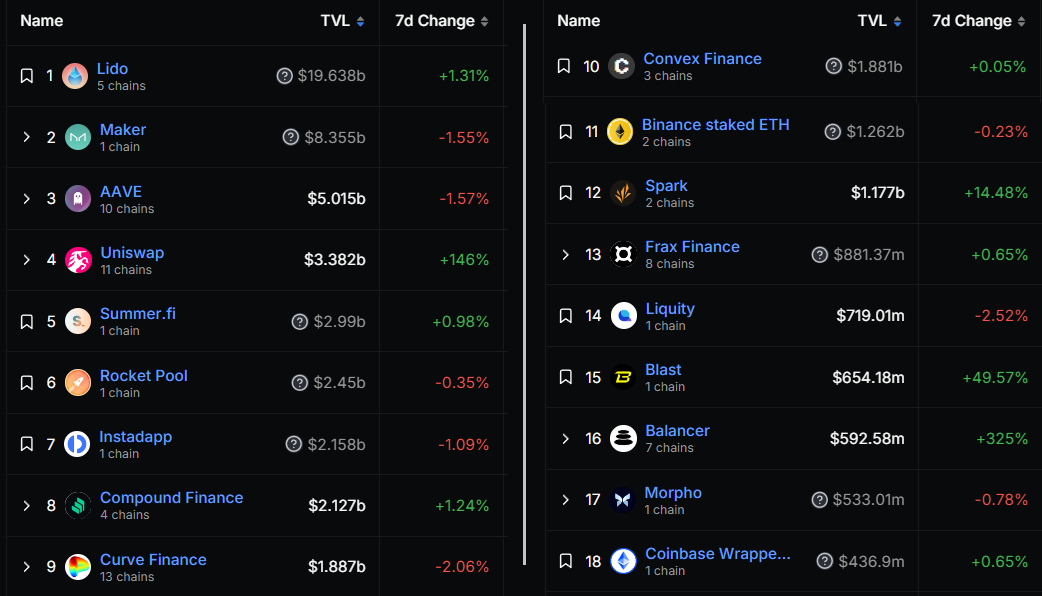

This growth is reflected in ethereum's total value locked (TVL), which recently hit a two-month high of 13 million eth, driven by a 13% weekly gain in Spark and a 60% increase in deposits from ethereum. Blast users.

In contrast, Tron, another leading blockchain in terms of TVL, saw a 12% drop in the last ten days. Recent high-profile attacks linked to Tron founder Justin Sun have also influenced investor confidence towards ethereum.

TVL growth builds on ethereum layer 2 innovations

Blast, an ethereum layer 2 project, has impressively amassed $647 million in TVL, a testament to the vibrant development within this space. Despite facing criticism for smart contract centralization and flexibility issues, Blast's self-promoted features such as autocompounding and stablecoin yields are attracting significant attention. On the other hand, Blast has faced criticism for its centralization and flexibility in updating its smart contracts.

In particular, Blast is just one part of a larger ecosystem. ethereum's leading scaling solutions, Arbitrum and Optimism, have a combined TVL of $2.94 billion. In the context of TVL, it is revealing to compare ethereum's robust Layer 2 ecosystem with other blockchains. Although these solutions are still subject to significant base layer settlement fees, there is no denying the impressive growth and increased activity they have experienced over time.

Related: Why is the cryptocurrency market on the rise today?

Take Solana (SOL) as an example: its entire TVL, which encompasses projects such as Marinade Finance, Jito, marginfi, Solend and Orca, is currently valued at $671 million. This stark contrast highlights the advantage that ethereum's Layer 2 solutions have over its competitors, such as Cardano (ADA), BSC Chain (BNB), and Avalanche (AVAX), blockchains primarily focused on native scaling solutions. However, ethereum's approach, leveraging layer 2 technologies, appears to have gained more traction and user trust, as evidenced by its growing activity.

In essence, Ether's recent push towards the $2,100 resistance level is largely influenced by the expected approval of spot ETFs in the US and increased market share in decentralized applications.

The continued evolution and attractiveness of ethereum's layer 2 solutions, which mitigate high transaction costs, are also playing a crucial role in attracting users and sustaining the positive trajectory of the Ether market.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts and opinions expressed here are solely those of the author and do not necessarily reflect or represent the views and opinions of Cointelegraph.

NEWSLETTER

NEWSLETTER