While the Shanghai upgrade of the Ethereum blockchain, also known as Shapella, allowed the validator to eventually withdraw its staked assets, the price of ETH, interestingly, rose.

As the long-awaited Shanghai update approached, experts expected a price drop as a considerable amount of ether was scheduled to be withdrawn. However, the price of the asset has risen 2.3% in the last 24 hours and ETH is trading at approximately $1,920 at the time of writing.

According Wu Blockchain, participants withdrew 17,350 ETH just two hours after the Shanghai update, while only 128 coins were deposited. According to the tweet, around 319,000 ETH, roughly $563 million, is expected to be withdrawn.

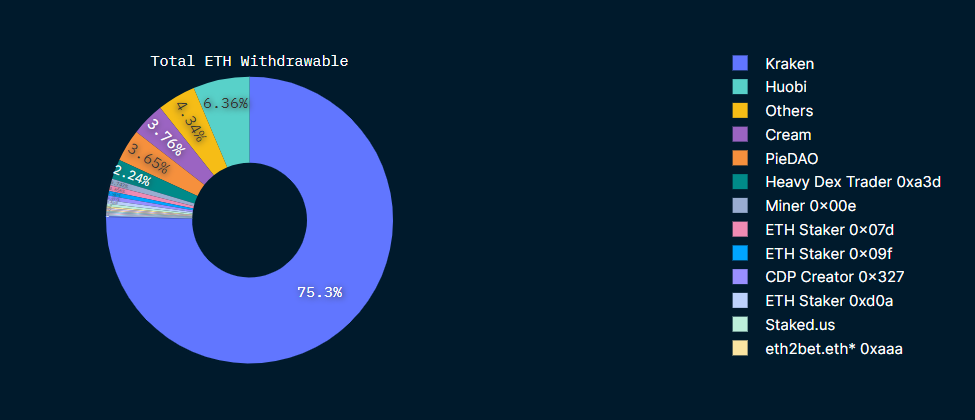

Furthermore, data provided by on-chain analytics platform Nansen suggests that the Kraken exchange tops the list of entities withdrawing Ethereum, accounting for 75.3%, over 533,000 ETH, of total withdrawable coins.

Huobi comes in second with a much lower percentage than Kraken: it has about 45,000 ETH mineable, about 6.3%. According to the data, 19,633 validators are waiting to exit the second largest blockchain, which is 3.46% of the total 567,207.

According to Nansen, the average price of ether staked is $1,963. In simple terms, this means that most validators could take a loss at the current price.

NEWSLETTER

NEWSLETTER