Ethereum (ETH) price is struggling to break above the $1600 resistance and this is the altcoin’s third attempt since September 2022. Some would say that the 33% rally year to date could be interpreted as a failed trading opportunity. break the $200 billion market capitalization mark.

If the price of Ethereum were to exceed $1,600, it would return Ether to one of the top 60 tradable assets globally, surpassing giant multinational companies such as Nike (NKE), Novartis (NVS), Cisco (CSCO) and Toyota (TM). .

Unfortunately, at least for bullish traders, the derivatives markets are not hinting that Ether will finally break the $1,600 resistance – at least, not until the US Federal Reserve reverses its course of tightening the economy.

The Bulls’ frustrations can be explained in part by Silvergate Bank’s $1 billion net loss in the last quarter. The crypto-friendly bank laid off roughly 40% of its workforce on Jan. 5 and is now facing a class action lawsuit over its dealings with FTX and Alameda Research. The lawsuit alleges that Silvergate aided and abetted FTX’s fraudulent activities and breaches of the exchanges’ fiduciary duty.

The flow of negative news continued on Jan. 17, when Japan Financial Services Agency Office of Strategy Development and Management Deputy Director General Mamoru Yanase argued that the cryptocurrency sector should face the same regulation as cryptocurrency. traditional banks and brokers.

The fact that Ether continues to trade above $1,500 is positive, but the most recent price rally closely followed an 8% gain by the Russell 2000 Index. Additionally, investors fear that data showing a decline in inflation have been the main driver of the cryptocurrency market rally, so any pullback in the stock market could trigger another selloff.

Consequently, investors believe that Ether could retrace its recent gains if the US Federal Reserve continues to raise interest rates. Let’s look at Ether derivatives data to understand if the surprise bomb had a positive impact on investor sentiment.

Ether’s 33% rally was not enough to instill confidence

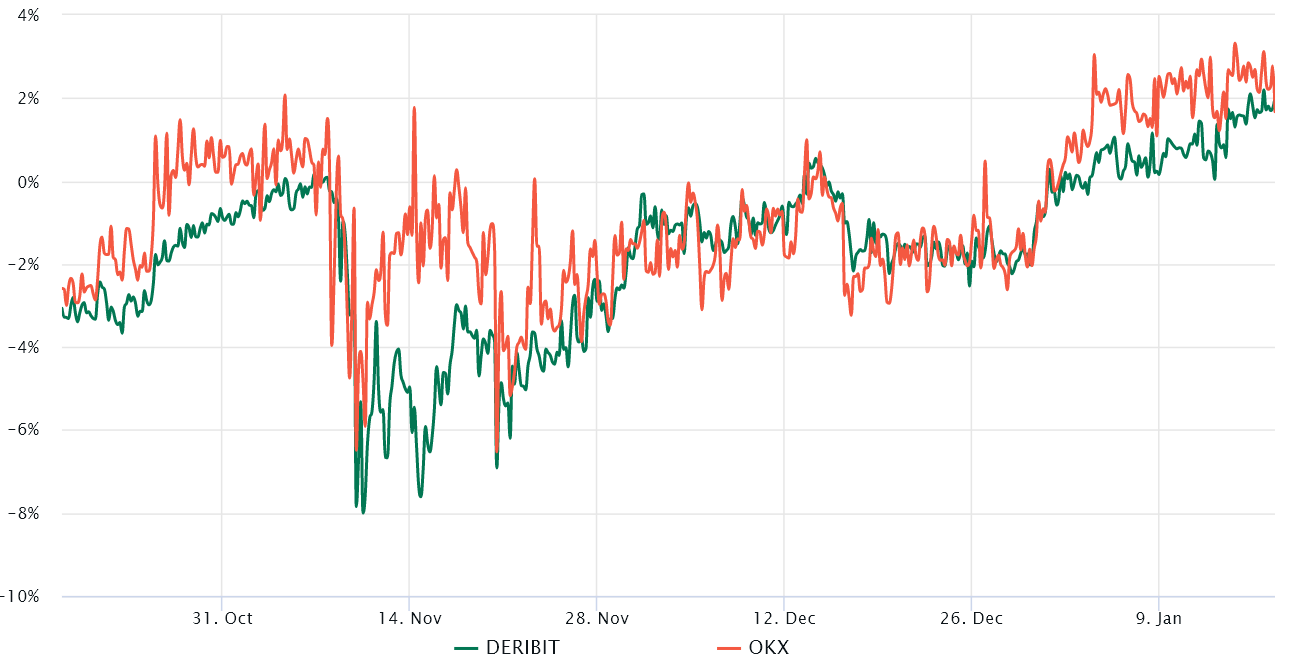

Retail traders often avoid quarterly futures because of the difference in prices from the spot markets. Meanwhile, professional traders prefer these instruments because they avoid the fluctuation of funding rates in a perpetual futures contract.

Two-month futures annualized premium should trade between +4% and +8% in healthy markets to cover costs and associated risks. However, when futures are trading at a discount compared to regular spot markets, it shows a lack of confidence from leveraged buyers, which is a bearish indicator.

The chart above shows that derivatives traders remain in “scare mode” because the Ether futures premium is below the 4% threshold. These data indicate the absence of buyer demand leverage, although they do not indicate that traders expect additional adverse price action.

For this reason, traders should analyze the Ether options markets to understand whether investors are pricing in higher odds for surprise adverse price moves.

Options markets are neutral adding strength at $1.6K resistance

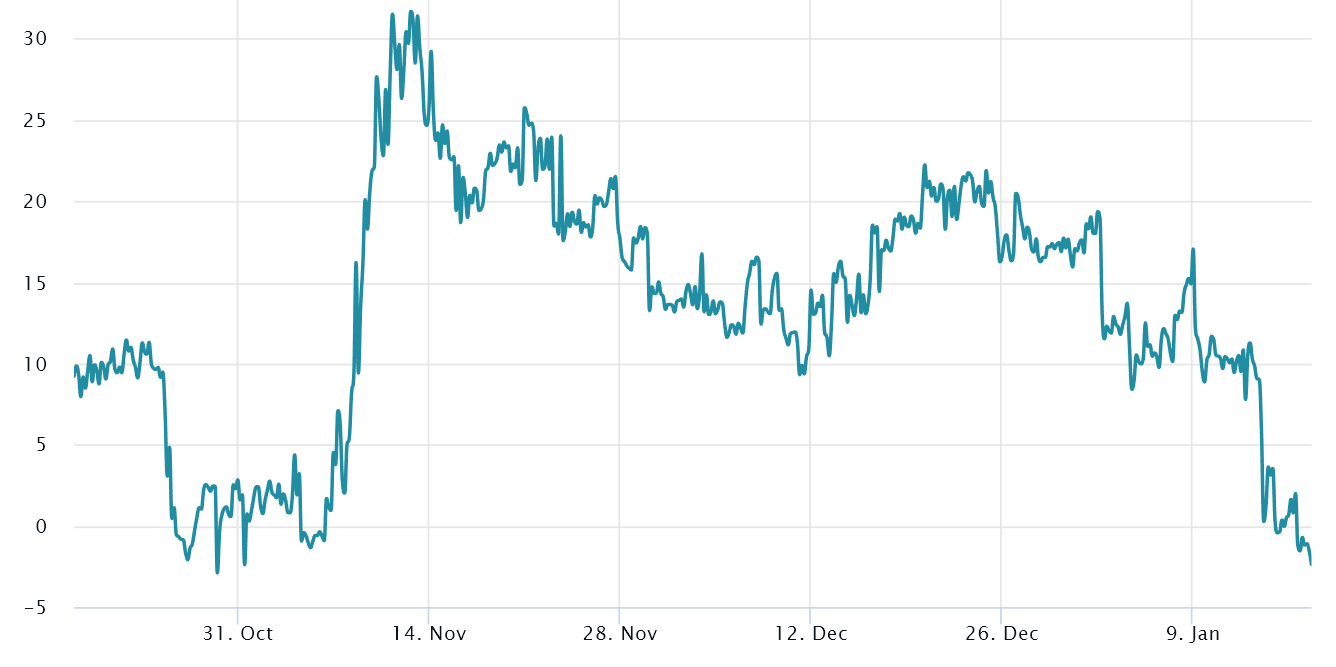

The 25% delta bias is a telltale sign when market makers and arbitrage desks are overcharging for upside or downside protection.

In bear markets, option investors give higher odds of a price dump, driving the bias indicator to rise above 10%. On the other hand, bullish markets tend to drive the bias indicator below -10%, which means bearish put options are discounted.

The delta bias has improved considerably since January 14, moving from a positive 10% neutral to bearish to options price neutral. The move indicated that options traders became more comfortable with downside risks, as the 60-day delta bias sits at negative 2%.

Related: Bitcoin and Ethereum Correct as Bitzlato Takes Down, Tech Layoffs and Economic Concerns Dominate Headlines

Whales and market makers have yet to turn bullish on options markets, but the lack of fear after a 33% rally is encouraging. Both the options and futures markets suggest that professional traders fear that the $1600 resistance will continue to have a negative impact on price.

In essence, a more effective move from the Fed is likely to be needed before crypto investors turn bullish, either signaling that the interest rate hike is coming to an end or a change in strategy to curb inflation. .

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.