Ethereum token Ether (ETH) continued its losing streak against Bitcoin (BTC) for the fifth day in a row, as the price of BTC topped $30,000 for the first time since June 2022.

ETH/BTC Bullish Reversal Fails Midway

On April 11, the ETH/BTC pair fell nearly 1.6% to 0.0634 BTC to retest multi-month lows.

The ETH/BTC level is down 6.75% from its local peak of 0.0679 BTC set six days ago. It is also just 2% above the pair’s local low of 0.0622 BTC on March 20, showing that Ether’s bullish reversal attempt against Bitcoin is close to failure.

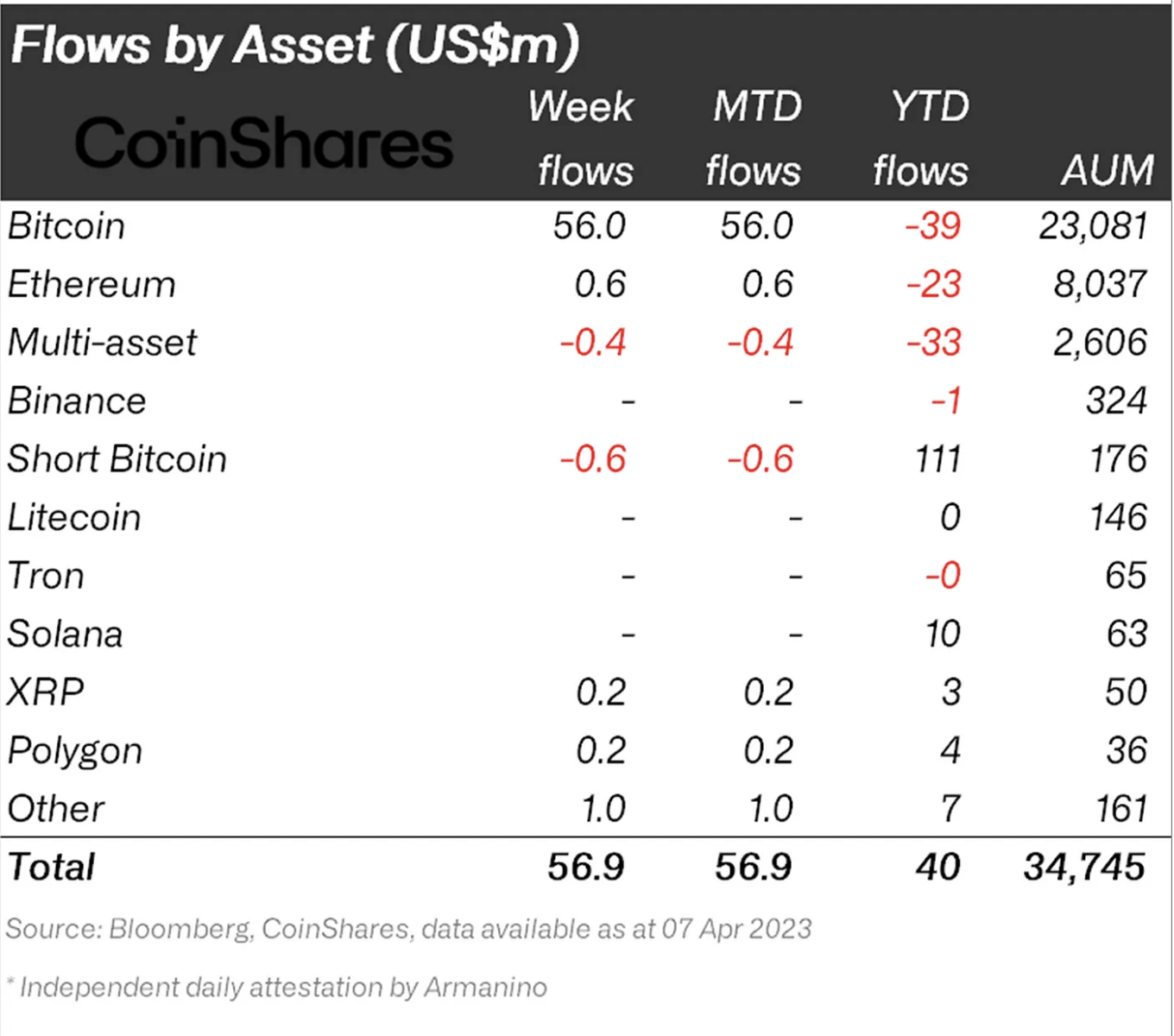

Interestingly, institutional interest also seems to be leaning more toward Bitcoin than Ethereum, according to CoinShares Weekly Report. It shows that Bitcoin-focused mutual funds witnessed $56 million worth of inflows in the week ending April 7.

By comparison, Ethereum-based funds received just $600,000 despite the hype surrounding its expected Shanghai hard fork on April 12.

Another ETH price bounce attempt ahead?

ETH/BTC’s continued decline has led it to retest its multi-month uptrend line support (buy zone) near 0.0635 BTC for a possible price bounce towards its downtrend line resistance (buy zone). sale) about 0.0750 BTC.

In other words, a 16.5% price rally for June, as covered in the analysis above.

The bullish reversal outlook is based on the ETH/BTC price rally in July 2022 after testing the same rising trend line for support. Notably, the pair rallied around 60% to reach the downtrend line resistance near 0.0856 BTC.

Related: 3 Reasons Why Ethereum Price May Hit $3K In Q2

Conversely, a decisive break below the uptrend line support would raise the possibility that ETH/BTC will test its 200-week exponential moving average (200-week EMA; the blue wave) near 0.0563 BTC, up 10 % less than current price levels.

Like the uptrend line support, the 200-week EMA was instrumental in halting Ether’s price decline against Bitcoin in July 2022. This makes it the most likely downside target in the coming months. .

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

NEWSLETTER

NEWSLETTER