Ether (ETH) price declined 9.8% from February 19-25 after price resistance at $1,725 came in stronger than expected. Still, the correction was insufficient to break the 6-week ascending channel and did not cause Ether derivatives metrics to turn bearish.

Ether’s price resilience can be partly explained by the operational failure of some of its smart contract blockchain competitors. For example, Solana (SOL) faced a 20-hour test court on February 25, which was only resolved after a network update coordinated by the validators. The network restart also involved purging some of the last slots, though Solana’s developers said “no confirmed user transactions were reversed or affected.”

NEM (XEM) experienced a “chain downtime” on Feb. 27 that lasted for 15 hours, causing multiple exchanges to halt deposits and withdrawals and the developers vowing to release an update to prevent further bad behavior. Interestingly, the last post from the official NEM account on Twitter, excluding a Merry Christmas greeting, was a “Please Wait” image posted in July 2022.

The regulatory environment remains bleak for cryptocurrencies, with the latest victims being global payment processing companies Visa and Mastercard. According to a Reuters report published on Feb. 28, firms are delaying launching new partnerships with crypto firms until market conditions improve and a more transparent regulatory framework is in place.

In more positive news, Ethereum’s Sepolia testnet successfully forked on February 28 in preparation for the Shanghai upgrade. The highly anticipated mainnet upgrade expected in March should finally allow validators to withdraw their staked Ether from the Beacon Chain. The developers are now preparing the Goerli testnet to enter a similar stage.

Let’s look at Ether derivatives data to understand if the retest of $1,560 support on Feb. 25 has affected crypto investor sentiment.

ETH futures show higher demand for leverage longs

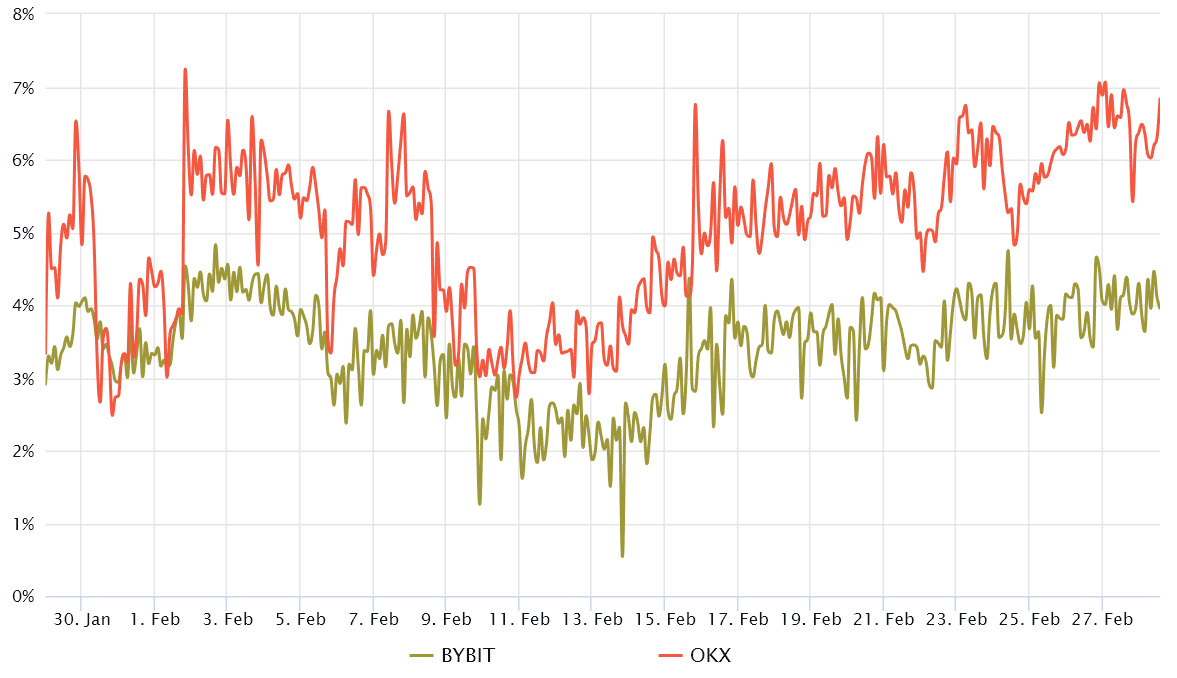

The two-month futures annualized premium should trade between 5% and 10% in healthy markets to cover costs and associated risks. However, when the contract is trading at a discount (backwardation) compared to traditional spot markets, it shows a lack of confidence on the part of traders and is considered a bearish indicator.

The above chart shows that derivatives traders turned slightly bullish as the Ether futures premium (on average) flirted with the 5% threshold on February 26. More importantly, it shows resilience even as the Ether price declined by almost 10% between Feb 19 and Feb 25.

Increased demand for leveraged (bullish) long positions does not necessarily translate into an expectation of positive price action. Consequently, traders need to analyze the Ether options markets to understand how whales and market makers are pricing the probabilities of future price movements.

Options risk metrics show resilience despite 10% price drop

The 25% delta bias is a telltale sign when market makers and arbitrage desks are overcharging for upside or downside protection.

In bear markets, option investors give higher odds of a price dump, driving the bias indicator to rise above 10%. On the other hand, bull markets tend to drive the bias metric below -10%, which means that bear put options are less in demand.

Related: Vitalik Buterin says that “there is still a lot to do” for the high fees of Ethereum txn

The delta bias flirted with the bearish 9% level on Feb 27, indicating the stress of professional traders. However, the situation improved on February 28 when the index rose to 5, indicating similar upside and downside risk appetite.

It makes sense for fundamental analysts to avoid adding bullish positions ahead of the Shanghai update, especially since Ethereum developers have a history of delaying significant changes to the network.

Despite the variety of worrisome factors, the futures and options markets indicate that professional traders are bullish conservative and confident that the upward pattern will continue. From a technical analysis standpoint, investors seem to believe that the uptrend will continue unless Ether breaks below the channel support at $1520.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

The views, thoughts, and opinions expressed herein are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

NEWSLETTER

NEWSLETTER