Key points

Share this article

<img alt="Follow crypto Briefing on Google News” width=”140″ height=”41″ src=”https://technicalterrence.com/wp-content/uploads/2024/04/HashKey-Group-to-Launch-Ethereum-Layer-2-Network.png”/><img src="https://technicalterrence.com/wp-content/uploads/2024/04/HashKey-Group-to-Launch-Ethereum-Layer-2-Network.png" alt="Follow crypto Briefing on Google News” width=”140″ height=”41″/>

ethereum spot exchange-traded funds (ETFs) are set to launch on July 23, and initial inflows into these products could impact the price of the cryptocurrency. eth-etf-be-sell-the-news-event” rel=”noopener nofollow noreferrer”>according According to a report by Kaiko, following the SEC's approval of changes to the securities rules for these funds, ETF issuers have been finalizing details with the SEC, including fee structures disclosed in recent S-1 filings.

“The launch of futures-based eth ETFs in the US late last year was met with disappointing demand, with all eyes now on the launch of the ETFs with high hopes for rapid asset accumulation,” said Will Cai, Head of Indexes at Kaiko. “While the full demand picture may not be known for several months, the eth price could be sensitive to early day inflow figures.”

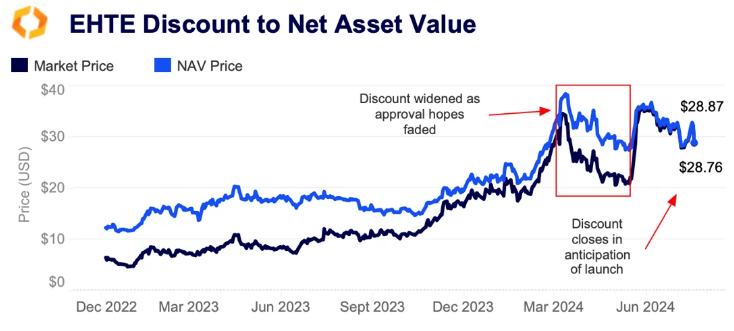

Grayscale plans to convert its ETHE fund into a spot ETF and launch a mini-trust with $1 billion from the previous fund. The ETHE fee remains at 2.5%, higher than its competitors.

ETHE's discount to net asset value (NAV) has narrowed recently, suggesting that traders can redeem shares at the NAV price at the time of conversion to make a profit.

NEWSLETTER

NEWSLETTER