The historic September 2022 Merge upgrade, which marked ethereum‘s transition from proof-of-work (PoW) to proof-of-stake (PoS), resulted in an overall decline in compliance with standards set by the Office of Foreign Assets Control . (OFAC).

OFAC-compliant ethereum blocks censor certain transactions, which has a negative impact on the neutrality of the ethereum ecosystem. In early August 2022, OFAC sanctioned Tornado Cash and several Ether (eth) addresses associated with it due to their ability to mask and anonymize transactions.

Prior to the Merge update, ethereum‘s OFAC compliance increased exponentially as entities such as crypto exchanges opted to run MEV-Boost censorship relays on their validators. The list of top censorship violators is made up of popular platforms such as Binance, Celsius Network, Bitfinex, Ledger Live, Huobi (HTX), and Coinbase, according to MEV Watch. data.

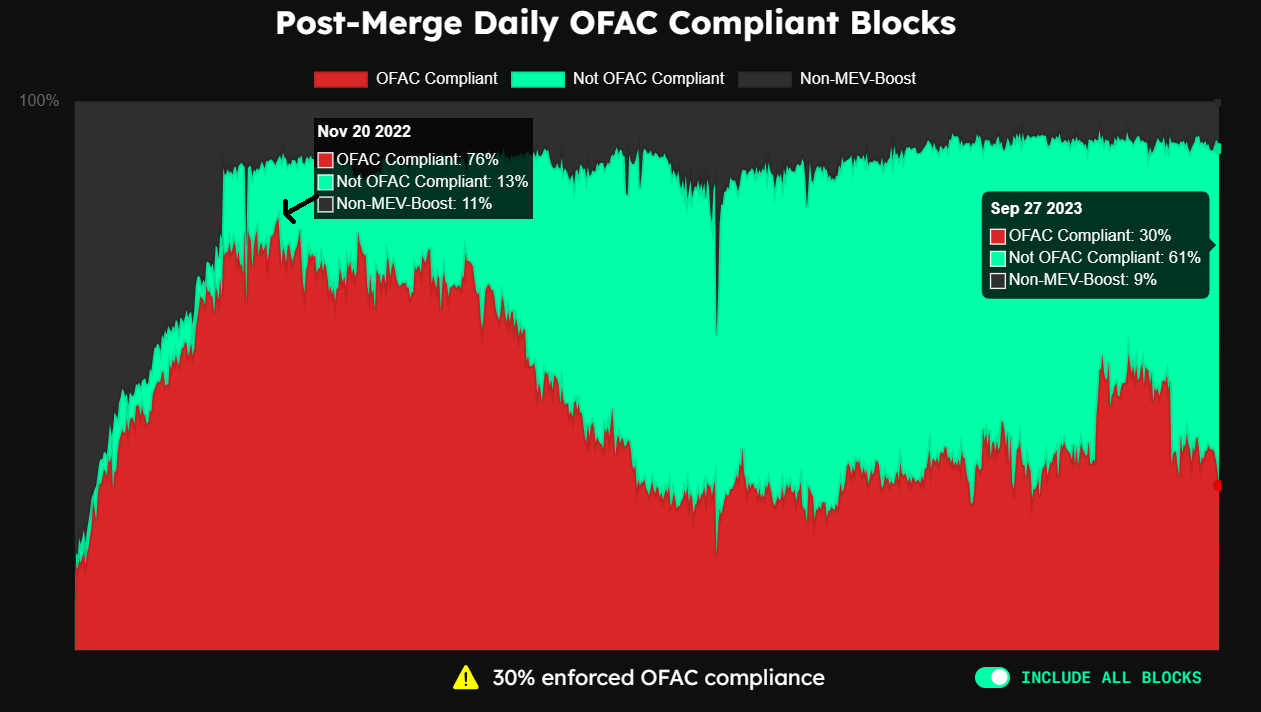

However, overall OFAC compliance of ethereum blocks has decreased significantly. As of November 2022, 78% of total ethereum blocks were compliant with OFAC regulations. As of today, September 27, ethereum‘s OFAC compliance fell to 30%, recording an overall reduction of 57%.

Countering OFAC compliance requires operators to use non-censorship relays in accordance with OFAC compliance requirements. There are seven main MEV boost relays that are most commonly used: Flashbots, BloXroute Max Profit, BloXroute Ethical, BloXroute Regulated, BlockNative, Manifold, and Eden. However, not all systems meet OFAC compliance, according to MEV Watch:

“Of the 7 major relays available, only 3 are non-censorship based on OFAC compliance requirements.”

It is also important to note that not all blocks built by OFAC-compliant relays are censored; however, all blocks created by OFAC-compliant relays will censor when non-compliant transactions are transmitted to the network.

While OFAC regulations primarily target organizations based in the United States, validators outside the US should consider running uncensored retransmissions for the benefit of the network.

Related: US Treasury Sanctions Cartel-Linked ethereum Wallet for ‘Illicit Fentanyl Trafficking’

Amid ethereum‘s reduced OFAC compliance, Grayscale made the decision to abandon all rights to ethereum PoW tokens (ETHPoW). However, the decision was attributed to lack of liquidity in the market. According to an official announcement:

“As such, it is not possible to exercise the rights to acquire and sell ETHPoW tokens, and on behalf of the shareholders of the record date, Grayscale is abandoning the rights to these assets.”

On the other hand, some cryptocurrency investment firms such as ETC Group have attempted to launch dedicated EthereumPoW exchange-traded products (ETPs).

Magazine: ‘“ai has killed the industry”: EasyTranslate boss talks about adapting to change

NEWSLETTER

NEWSLETTER