The price of Ether (eth) has been consolidating within a range of approximately $ 130 in the last seven days, since $ 2,000 is still a strong resistance on general expenses.

Cointelegraph Markets Pro and Bitstamp data show that the eth price ranges from a strict range between $ 1,810 and $ 1,960.

Daily eth/USD table. Source: Cointelegraph/<a target="_blank" data-ct-non-breakable="null" href="https://www.tradingview.com/x/fZJnJjP5/” rel=”null” target=”null” text=”null” title=”https://www.tradingview.com/x/fZJnJjP5/”>Commercial view

The price of Ether remains set below $ 2,000 for several reasons, including the decrease in the activity of the weak network of ethereum and the decrease in TVL, ETF flows of ethereum spot negative and weak technicians.

ETF exits from ethereum Negative

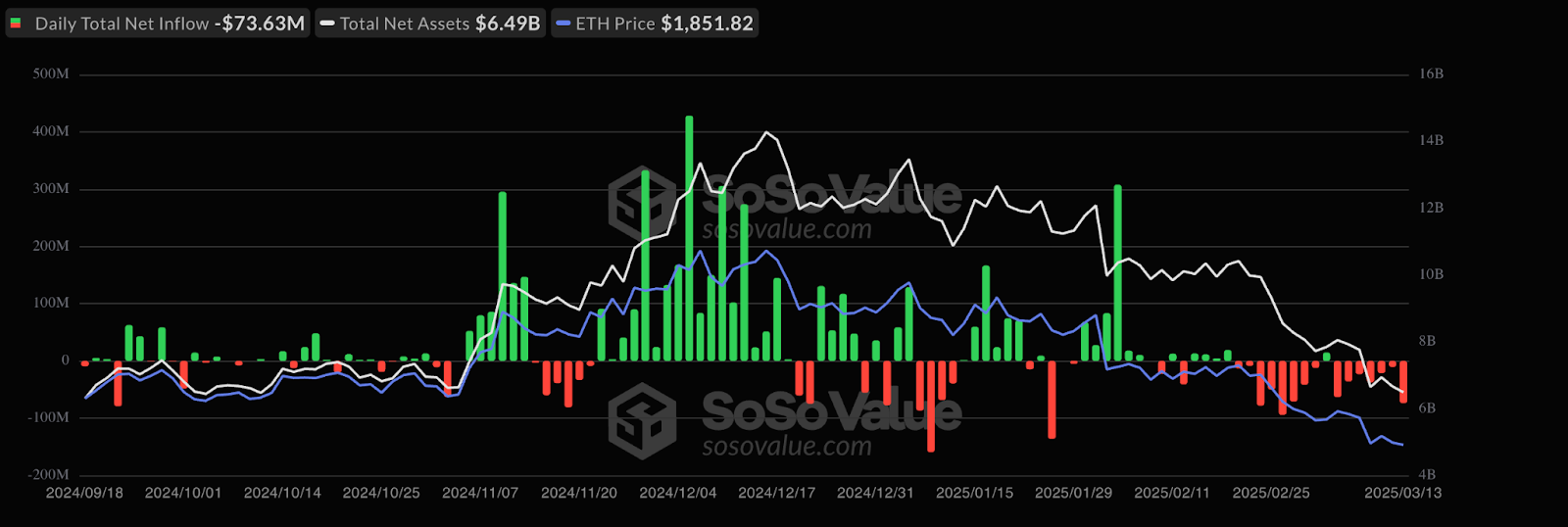

The low yield in the price of Ether can be attributed to the risk behavior of investors, which is visible in the entire point of funds (ETF) quoted in ethereum exchange. The eth exits of these investment products have persisted for more than two weeks.

The ETF Spot Ether based in the USA.

ETF Ether flow chart. Fountain: <a target="_blank" data-ct-non-breakable="null" href="https://sosovalue.com/assets/etf/us-eth-spot” rel=”null” target=”null” text=”null” title=”https://sosovalue.com/assets/etf/us-eth-spot”>Sótar

At the same time, other ethereum investment products saw exits for a total of $ 176 million. This takes the monthly ETP outings of ETHHe at $ 265 million, in which Coinshares Research Chief James Butterfill, described as the “worst in the registry.”

He noticed:

“This also marks the 17th consecutive day of departures, the longest negative streak since our records began in 2015”.

The weak activity of the chain hurts the price of eth

To understand the key drivers behind Ether's weakness, it is essential to analyze the metrics of the ethereum chain.

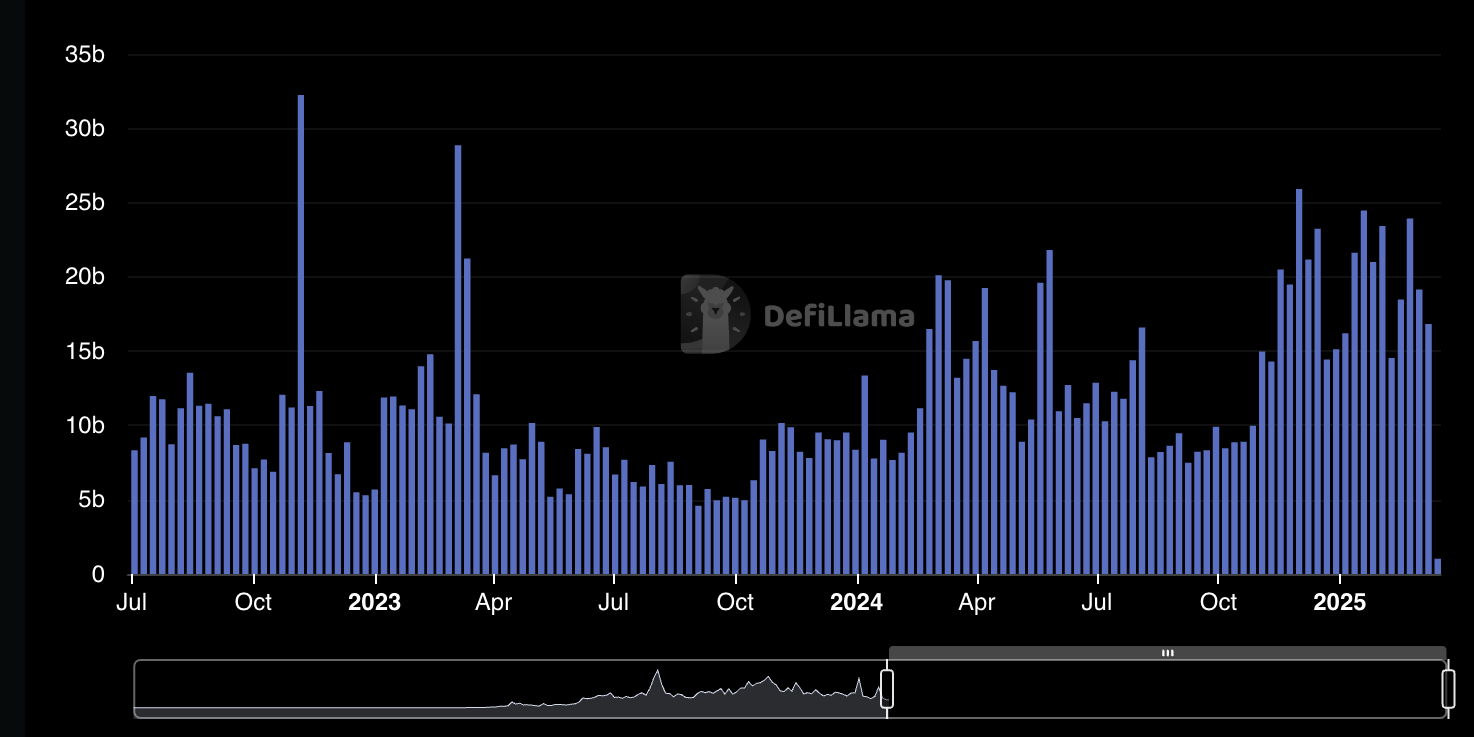

The ethereum network maintained its leadership based on the 7 -day decentralized exchange volume (DEX). However, the metric has been decreasing in recent weeks, falling by approximately 30% in the last seven days to reach $ 16.8 billion on March 17.

ethereum: 7 -day DEX volumes, USD. Source: Defillama

The key weaknesses for ethereum included a 85% drop in the activity in the Maverick protocol and a 45% decrease in Dodo volumes.

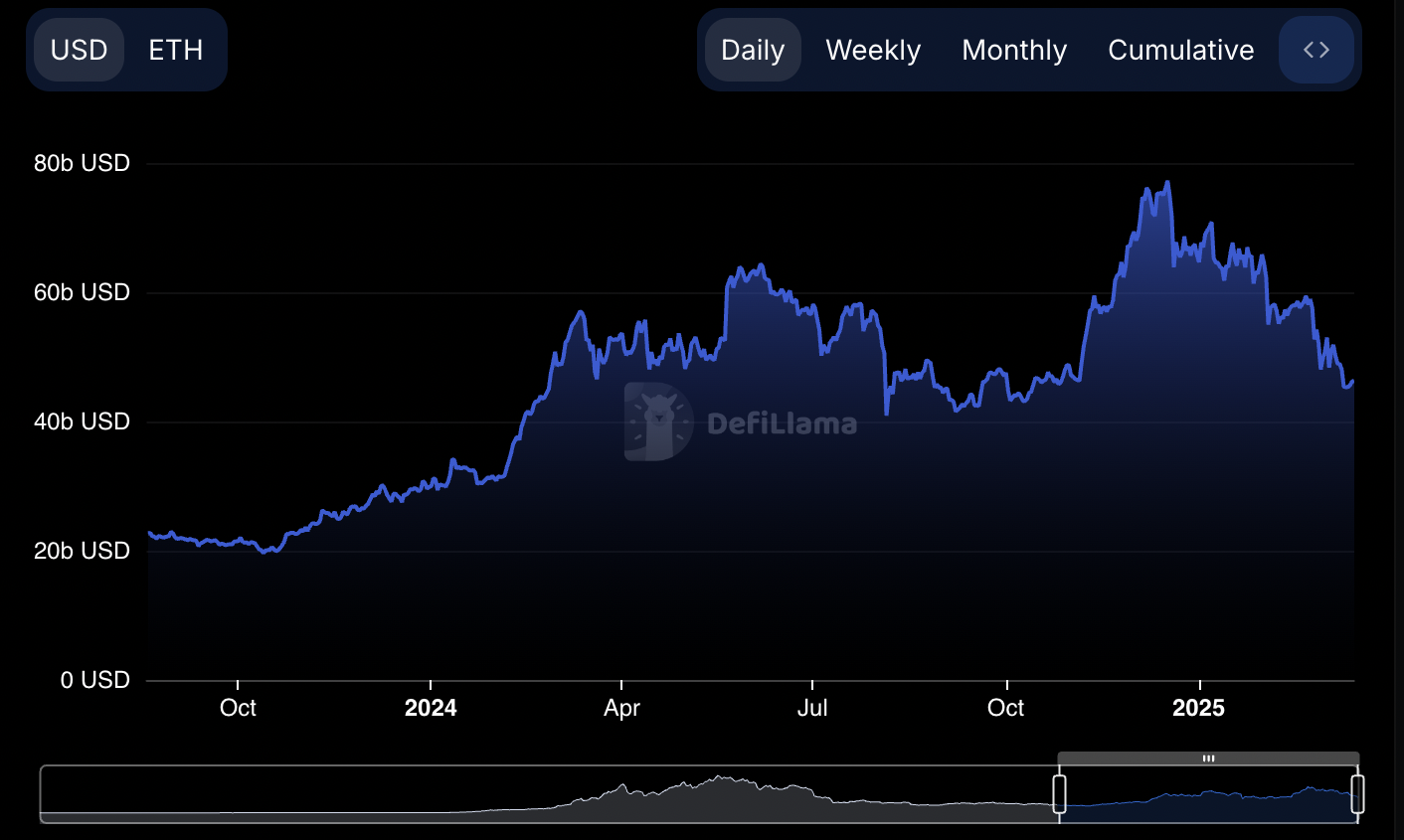

In the same way, the total value of blocked ethereum (TVL) decreased by 9.3% monthly, 47% less than its January maximum of $ 77 billion to $ 46.37 billion on March 11.

ethereum: Total blocked value. Source: Defillama

Lido was one of the weakest artists in ethereum deposits, with TVL falling 30% for 30 days. Other notable decreases included Eigenlayer (-30%), Ether.fi (-29%) and manufacturer (-28%).

The objective of Ether's bear flag is $ 1,530

Meanwhile, Ether technicians show a potential <a target="_blank" data-ct-non-breakable="null" href="https://crypto.news/crypto-trading-101-bull-and-bear-flags/” rel=”null” target=”null” text=”null” title=”null”>Bear flag In the four -hour table, which suggests more inconvenient in the next few days or weeks.

Related: eth can bottom at $ 1.6K, the SEC delays multiple cryptographic ETF, and more: Hodler's Digest, March 9-15

A bear flag is a downstream characterized by a small upward tilt channel formed by parallel lines against the prevailing lower trend. It is resolved when the price breaks decisively below its lower trend line and falls as much as the height of the prevailing bearish trend.

eth bulls have the support of the lower flag limit at $ 1,880. A closed daily candlestick below this level would indicate a bearish rupture of the graphic formation, projecting a decrease to $ 1,530. Such movement would represent a decrease of 20% of the current price.

Daily eth/USD table. Source: Cointelegraph/<a target="_blank" data-ct-non-breakable="null" href="https://www.tradingview.com/x/bToI2EMy/” rel=”null” target=”null” text=”null” title=”https://www.tradingview.com/x/bToI2EMy/”>Commercial view

The relative force index is positioned in the negative region in 48, suggesting that market conditions still favor disadvantage.

The Bulls will try a daily candlestick near the average flag limit at $ 1,930 (adopted by the 50 SMA) to defend support for $ 1,880. They must exceed the price above the upper limit of the $ 1,970 flag to invalidate the pattern of the bolt table of the bear.

This article does not contain advice or investment recommendations. Each investment and trade movement implies risk, and readers must carry out their own investigation by making a decision.

NEWSLETTER

NEWSLETTER