After ethereum (eth) exceeded the psychologically significant price level of $ 2,000 yesterday, its next great price obstacle is $ 2,400. Ali Martínez experienced crypto analyst <a target="_blank" href="https://x.com/ali_charts/status/1902399416260284502″ target=”_blank” rel=”noopener nofollow”>emphasized That eth must clear this level to recover the bullish impulse.

ethereum needs to eliminate $ 2,400 to become bullish

ethereum has risen almost 4.5% during the past week, increasing from approximately $ 1,800 on March 13 to $ 1,992 at the time of writing. However, Martínez points out that despite the recent ascending movement, eth must conquer the level of $ 2,400 to confirm an upward change.

While $ 2,400 remains around 20% of current price levels, multiple cryptographic analysts believe that eth could be on the verge of a reversal of bullish trends. Merlijn cryptographic analyst, the merchant, stressed that eth has left a symmetrical triangle pattern in the 4 -hour table.

The analyst added that Eleh's most hate rally is about to get on. ” Merlijn's evaluation aligns with his partner analyst Ted, who noted that a short budget could quickly boost eth to $ 3,000.

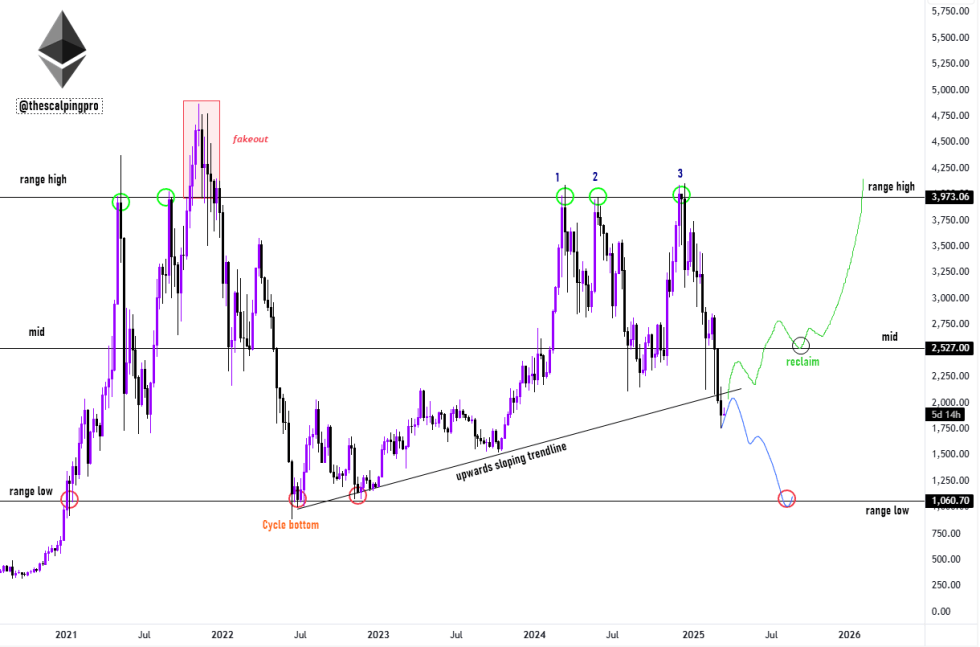

Similarly, in an x publication, cryptographic analyst crypto César suggested that eth can be close to the bottom of the cycle of this market and could soon experience a strong investment of ascending trends. The analyst shared a table that shows eth bunching in a long -standing line of trend several times since mid -2012.

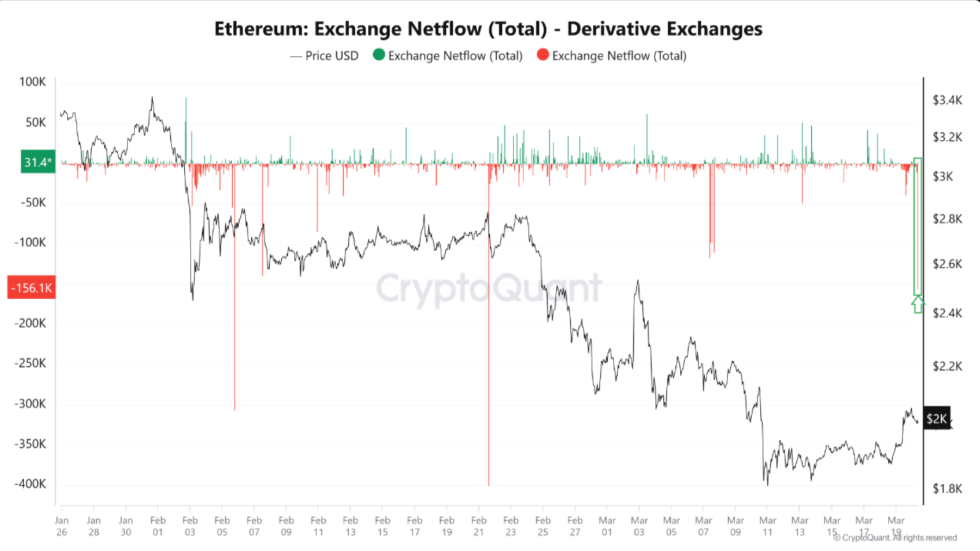

In addition, supporting the upward case, the AMR Taha analyst explained in a post quicktake cryptocant that more than 150,000 eth have left the exchanges of derivatives in the last two days. Taha pointed out that such great departures often point out the accumulation of institutional investors, a traditionally bullish indicator.

eth threatens the drop of $ 1,060

Despite optimistic signals, some analysts warn that eth can face more disadvantage before any significant rise movement. In an x post, crypto Trader Mags suggested that eth could be blocked with a low $ 1,060 range if a significant support level is not maintained.

In addition, other analysts caution That eth could fall as low as $ 800 if it breaks down from an ascending triangle pattern. <a target="_blank" href="https://sosovalue.com/assets/etf/us-eth-spot” target=”_blank” rel=”noopener nofollow”>Data Of the criticized exchange funds (ETF), the Sosovvalue tracker also indicates a diminishing institutional confidence in eth.

In particular, the ETF Spot eth -based in the USA. UU. They have seen continuous net exits since March 5. From now on, total net assets maintained in Spot eth Ethf remain slightly above $ 7 billion, representing approximately 2.8% of eth total supply.

That said, ethereum's MVRV ratio falling to 0.9 could indicate a bullish Configuration for digital asset, although such effects generally have been developing time. At the time of publication, eth is traded at $ 1,992, 1.7% less in the last 24 hours.

Unsplash.com, x, Cryptoquant and TradingView.com graphics

Editorial process For Bitcoinist, he focuses on the delivery of content completely investigated, precise and impartial. We maintain strict supply standards, and each page undergoes a diligent review of our technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.

NEWSLETTER

NEWSLETTER