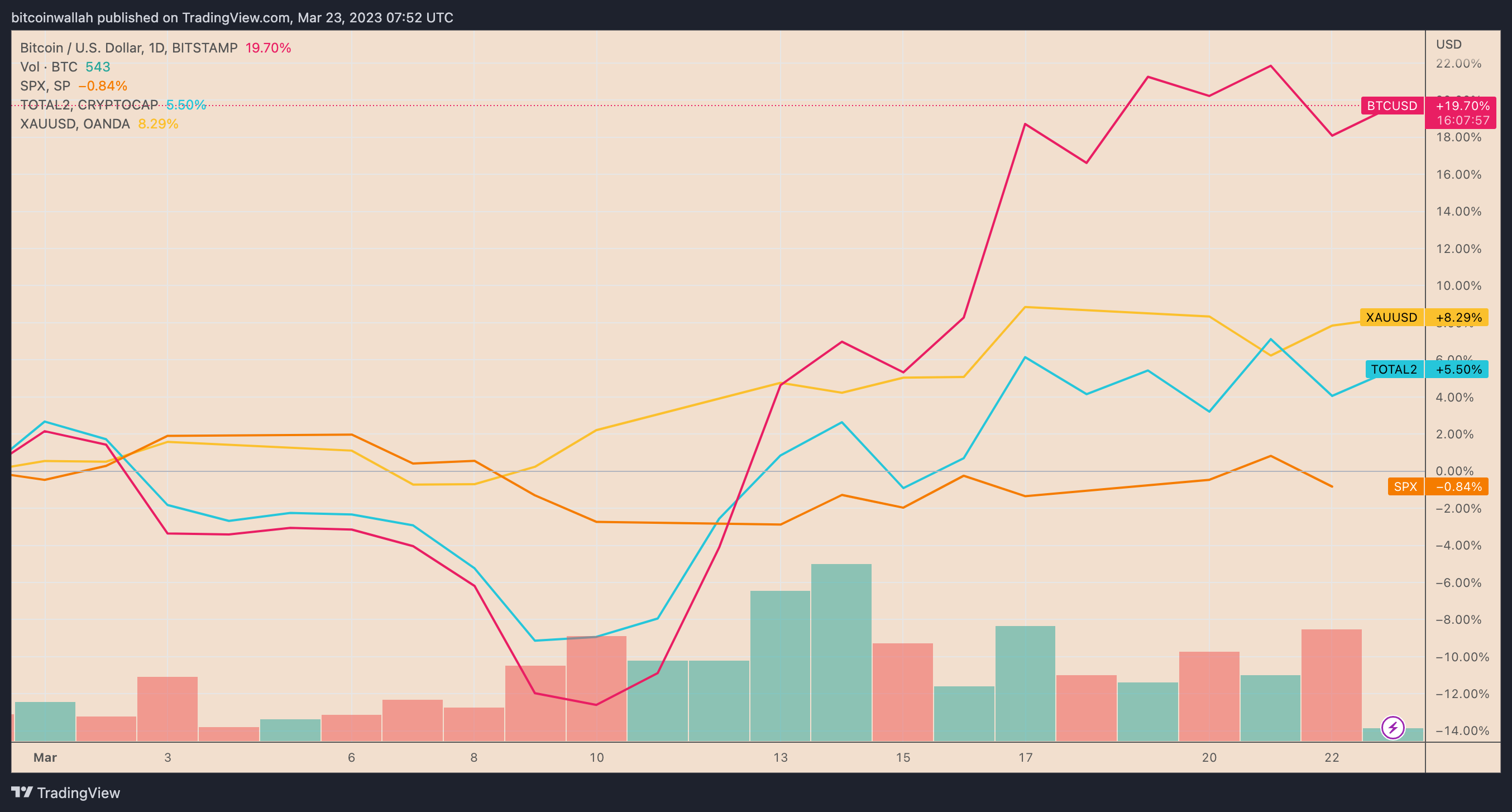

Ethereum’s native token Ether (ETH) continues its multi-month downtrend against Bitcoin (BTC) in March, rising 5.5% against the latter’s 19.5% gains in a period one-month-to-date (MTD) time frame.

Bitcoin eclipses Ethereum amid banking crisis

As of March 23, the ETH/BTC pair is down roughly 9% month-to-date (MTD) at 0.0633, while staying on track to record its worst month since September 2022, when it fell 11 .75%.

From a fundamental perspective, traders preferred Bitcoin over Ether, hoping it would protect them from the ongoing banking turmoil in the US and other parts of the world. The narrative has gained momentum in recent weeks as Wall Street investors like Cathie Wood view Bitcoin as a potential “flight to safety” asset.

‼️CATHIE WOOD: #BitcoinThe response to the banking crisis is the most dramatic example of innovation solving problems. #Bitcoin it was a flight to safety. pic.twitter.com/1lTD2Drto3

— Bitcoin Archive (@BTC_Archive) March 21, 2023

As a result of growing speculation, Bitcoin outperformed traditional assets after March 8, when signs of trouble appeared at Silicon Valley Bank. In doing so, BTC also fared better than the combined altcoin market, including Ethereum.

ETH paints fractal bullish vs. BTC

But from a technical perspective, Ethereum is positioned for a comeback against Bitcoin.

At least two technical indicators raise the possibility of ETH/BTC rallying sharply in the coming weeks.

Related: Ethereum Price At $1.4K Was A Bargain, And A Rally Towards $2K Looks Like The Next Step

First, the pair’s three-day RSI has dipped below 30, which technical analysts consider an “oversold” area.

Second, Ether’s decline against Bitcoin has brought its price close to its ascending support level (buy zone on the chart below).

A similar scenario in the June-July 2022 session preceded a roughly 60% rally towards the ETH/BTC downtrend line resistance (sell area on the chart above). If the fractal plays out, the pair could rally towards the same resistance level by June 2023.

In other words, Ether has a decent chance to rally by more than 15% to around 0.075 BTC. Conversely, a break below the uptrend line support will invalidate the bullish fractal.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.