ethereum (eth) is in the news again, but this time it is good news for buyers. Recent data show that more than 90% of <a target="_blank" href="https://www.coingecko.com/en/coins/ethereum” target=”_blank”>ethereum Users are now making money because the price of the cryptocurrency has risen to impressive levels. According to IntoTheBlock, this upward trend is the best time in five months for people holding eth to make profits.

Inspired by bitcoin's return above $96,000, the token jumped to $3,680, its highest level since June. While bitcoin cleared the way, ethereum's momentum is clearly seen as it broke barriers with ease. Although it is trading 25% below its all-time high (ATH) of $4,890, ethereum's fundamentals and market vibe point to a bright future ahead.

<blockquote class="twitter-tweet”>

90.8% of <a target="_blank" href="https://twitter.com/search?q=%24ETH&src=ctag&ref_src=twsrc%5Etfw”>$eth

Interestingly, the 9.2% of holders still at a loss hold only 2.8% of the total supply. This suggests that potential selling pressure from this group may have limited impact as <a target="_blank" href="https://twitter.com/search?q=%24ETH&src=ctag&ref_src=twsrc%5Etfw”>$eth continues with an upward trend. pic.twitter.com/qG4Xgi0Cq3

– IntoTheBlock (@intotheblock) <a target="_blank" href="https://twitter.com/intotheblock/status/1862085630760747179?ref_src=twsrc%5Etfw”>November 28, 2024

Trust in whales and long-term retention

More positive news comes from a closer examination of ethereum investment patterns. Currently, only 9.2% of eth holders are losing money and only own 2.8% of the total tokens. This means that the market is unlikely to be greatly affected by any selling pressure these investors create.

On top of that, ethereum's long-term holder base is also strong. The number of eth holders holding more than a year has increased to approximately 74%, signifying confidence in the long-term value of the token. Considering that only 23% of eth was purchased last year and only 3% last month, most investors seem to be holding out for the long term.

x/d3jCp5mJ/” alt=”” />

Declining supply, bullish momentum

Another reason giving a bullish outlook for ethereum is the decreasing supply on centralized exchanges. According to analysts, it has continued to decline since last year, reducing eth in centralized reserves. The more demand there is that exceeds supply during a bull run, the more prices will rise.

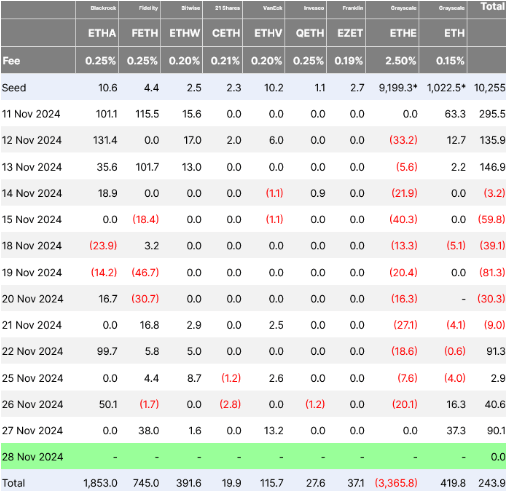

ethereum's recent surge has also been helped by huge <a target="_blank" href="https://farside.co.uk/ethereum-etf-flow-all-data/” target=”_blank”>spot ETF entrieswho have more than 90 million dollars. These institutional investments demonstrate growing confidence in the future of ethereum.

ethereum: the path to ATH seems clear

eth is already outperforming the largest crypto market, with a 12% weekly gain. Its eth/btc ratio has increased by 18%, indicating strength relative to bitcoin. Analysts believe that if ethereum can retest and surpass the $4,000 resistance, the path to its all-time high would be more compelling.

With a value increase of 5.92% compared to the previous day, its price has decreased slightly to <a target="_blank" href="https://coinmarketcap.com/currencies/ethereum/” target=”_blank”>$3,610, at the time of writing. Based on market indications and sentiment, ethereum has a tendency to rewrite the previous high to make its way further.

Featured image of DALL-E, TradingView chart

<script async src="https://platform.twitter.com/widgets.js” charset=”utf-8″>

NEWSLETTER

NEWSLETTER