The price of Ether (eth) has declined 14.7% from its high of $2,120 on April 16, 2023. However, two derivatives metrics indicate that investors have not felt this optimism in over a year. This discrepancy warrants an investigation into whether the recent optimism is a broader response to bitcoin (btc) surpassing $34,000 on October 24.

One possible reason for the increased enthusiasm among investors using eth derivatives is the general market enthusiasm regarding the possible approval of a spot bitcoin exchange-traded fund (ETF) in the United States. According to Bloomberg analysts, the ongoing amendments to the spot bitcoin ETF proposals can be seen as a “good sign” of progress and imminent approvals. This development is expected to push the entire cryptocurrency market to higher price levels.

Interestingly, comments issued by US SEC Chairman Gery Gensler in 2019 reveal his perspective. During the 2019 MIT bitcoin Expo, Gensler called the SEC’s position at the time “inconsistent” because they had denied multiple spot bitcoin ETF applications, while futures-based ETF products that do not involve physical bitcoin They existed since December 2017.

Another potential factor in the optimism of ethereum investors using derivatives may be the price of the Dencun upgrade scheduled for the first half of 2024. This upgrade will improve data availability for layer 2 accumulators, ultimately will lead to a reduction in transaction costs. Additionally, the upgrade will prepare the network for the future implementation of sharding (parallel processing) as part of the blockchain “Surge” roadmap.

ethereum co-founder Vitalik Buterin highlighted in his October 31 statement that independent Layer 1 projects are gradually migrating and potentially integrating as Layer 2 solutions of the ethereum ecosystem. Buterin also noted that the current costs associated with accrued fees are not acceptable to most users, particularly for non-financial applications.

Challenges for ethereum competitors

ethereum‘s competitors face challenges as software developers realize the costs associated with maintaining a complete record of a network’s transactions. For example, SnowTrace, a popular blockchain exploration tool for Avalanche (AVAX), announced its closure supposedly due to high costs.

Phillip Liu Jr., head of strategy and operations at Ava Labs, pointed out the difficulties users face when self-validating and storing data on single-layer chains. Consequently, the significant processing capacity required often leads to unexpected problems.

For example, on October 18, the Theta Network team encountered an “edge case error” after a node upgrade, causing mainchain blocks to halt production for several hours. Similarly, the layer 1 blockchain Aptos Network (APT) experienced a five-hour outage on October 19, resulting in deposits and withdrawals from exchanges being halted.

In essence, the ethereum network may not currently offer a solution to its high fees and processing capacity bottlenecks. Still, it has an eight-year track record of continuous updates and improvements toward that goal with few major interruptions.

Assessing Bullish Sentiment in eth Derivatives Markets

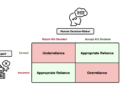

After evaluating the fundamental factors surrounding the ethereum network, it is essential to investigate the bullish sentiment among eth traders in the derivatives markets, despite the negative performance of eth, which has fallen 14.7% from its high of 2,120 dollars in April.

The Ether futures premium, which measures the difference between two-month contracts and the spot price, has reached its highest level in more than a year. In a healthy market, the annualized premium, or base rate, should typically be within the 5% to 10% range.

This data is indicative of the growing demand for leveraged long positions in eth, as the futures contract premium increased from 1% on October 23 to 7.4% on October 30, surpassing the neutral to bullish threshold of 5 %. This increase in the metric follows a 15.7% rally in the price of eth over two weeks.

Analysis of options markets provides more information. The 25% delta bias in Ether options is a useful indicator of when arbitrage desks and market makers are overcharging for upside or downside protection. When traders anticipate a drop in the price of Ether, the bias metric rises above 7%. In contrast, excitation phases tend to have a negative bias of 7%.

Related: 3 Reasons Why ethereum Price Has Dropped Against bitcoin

Notice how Ether options’ 25% delta bias reached a negative 16% level on October 27, the lowest in over 12 months. During this period, protective puts were trading at a discount, a characteristic of excessive optimism. Furthermore, the current 8% discount for puts is a complete reversal from the 7%+ positive bias that persisted through October 18.

In short, the drivers of bullish sentiment among Ether investors in derivatives markets remain somewhat elusive. Traders may be waiting for the approval of Ether spot ETF instruments following the possible approval of bitcoin, or they may be betting on planned upgrades that aim to reduce transaction costs and eliminate the competitive advantage of other blockchain networks such as Solana ( SOL) and Tron (TRX).

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.

NEWSLETTER

NEWSLETTER