The price of Ether (ETH) rallied 16% between January 14 and 21, reaching a high of $1,680 before facing a 5.4% rejection. Interestingly, the same resistance level resulted in a substantial correction at the end of August 2022 and again at the beginning of November 2022.

On one hand, traders are relieved that Ether is trading 35.5% higher year to date, but the repeated corrections following retests of the $1680 resistance may have weakened trader confidence. investors.

The negative news flow may have limited investor appetite for Ether after troubled cryptocurrency firm Digital Currency Group (DCG) faced more legal trouble this week. On January 23, a group of Genesis Capital creditors filed a lawsuit alleging violations of federal securities laws. In addition, the plaintiffs allege that the lending company made false and misleading statements through a scheme to defraud existing and potential digital asset lenders.

Another new concern for Ether holders arose on Jan. 22 after a “temperature check” proposal to implement the Uniswap v3 protocol on the BNB Chain received overwhelming support from the Uniswap community. 80% of Uniswap UNI governance token holders have voted to implement the additional version of the decentralized exchange protocol.

On the bright side, Ethereum developers have created a test environment for the upcoming Shanghai network upgrade. According to Ethereum developer Marius Van Der Wijden, the testnet appears to have been created to test betting withdrawals, which are currently disabled on the mainnet. More than 14.5 million ETH (worth $23 billion) has been deposited into the Ethereum staking contract, and the multiple delays in allowing withdrawals came under heavy criticism.

Let’s look at Ether derivatives data to understand if the $1,680 price rejection has affected crypto investor sentiment.

ETH futures finally enter the neutral area

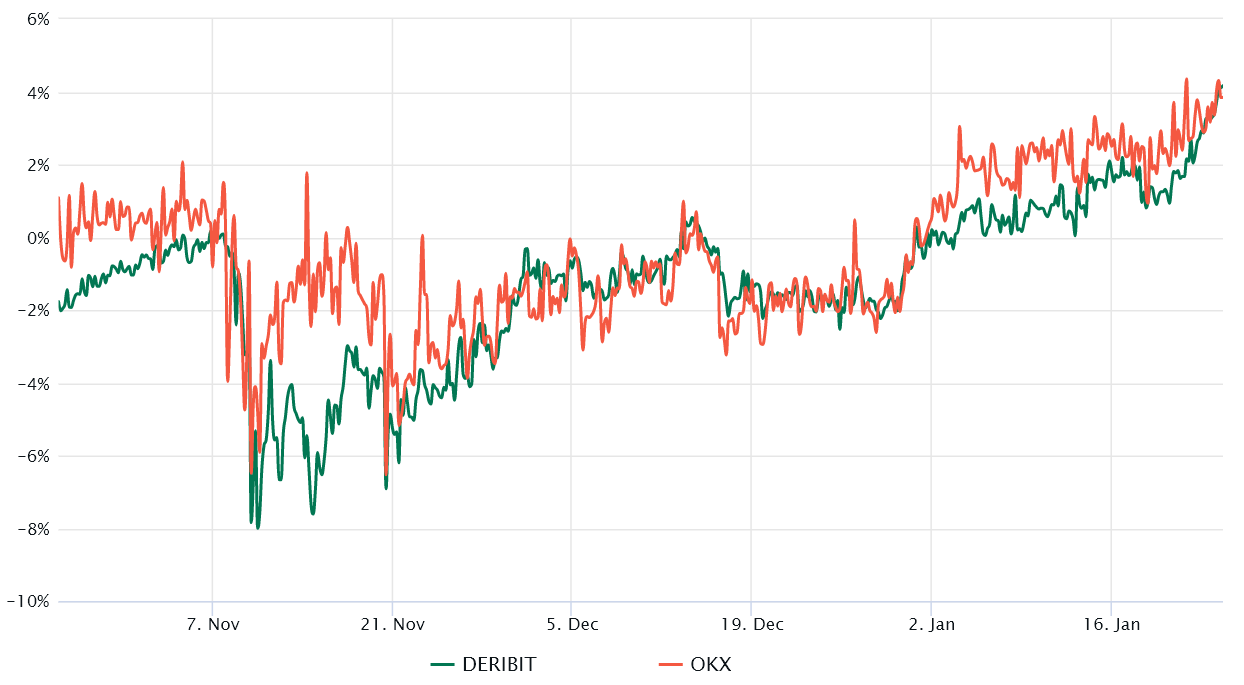

Retail traders often avoid quarterly futures because of the difference in prices from the spot markets. Meanwhile, professional traders prefer these instruments because they avoid the fluctuation of funding rates in a perpetual futures contract.

The three-month futures annualized premium should trade between 4% and 8% in healthy markets to cover costs and associated risks. When futures are trading at a discount compared to regular spot markets, it shows a lack of confidence from leveraged buyers and this is a bearish indicator.

The chart above shows that derivatives traders are no longer bearish because the Ether futures premium reached the 4% threshold for neutral markets. Therefore, bulls may celebrate that the indicator turned at a modest premium, but that does not mean that traders expect the immediate outcome of positive price action.

For this reason, traders should analyze the Ether options markets to understand how whales and market makers are pricing the probabilities of future price movements.

Options traders comfortable with downside risk

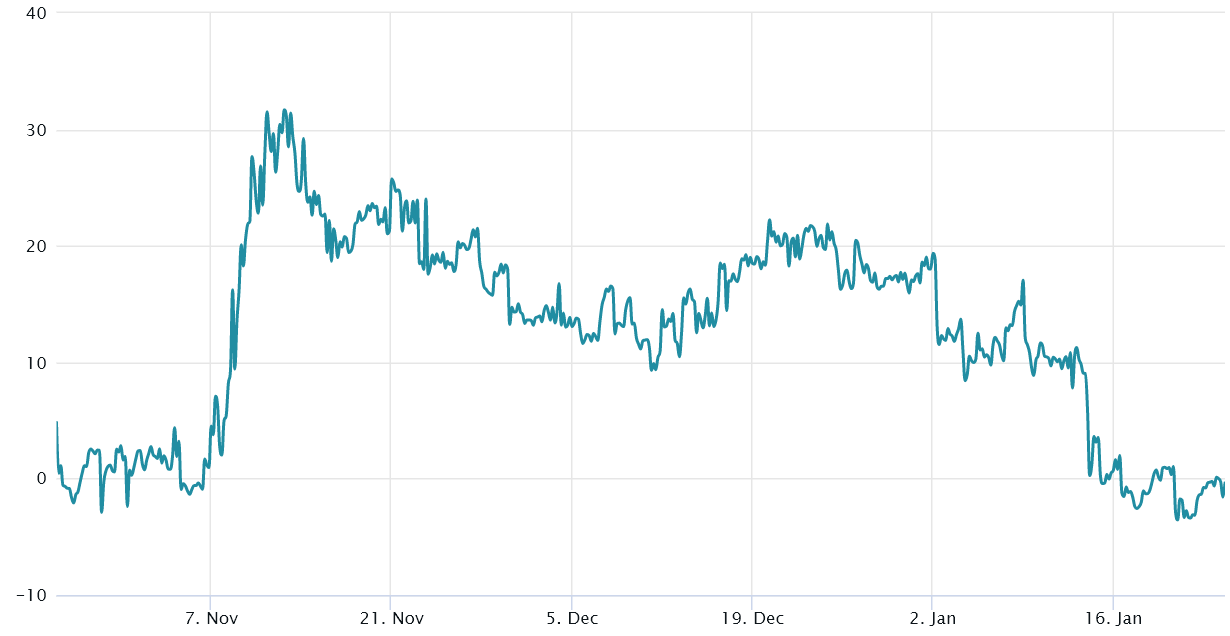

The 25% delta bias is a telltale sign when market makers and arbitrage desks are overcharging for upside or downside protection.

In bear markets, option investors give higher odds of a price dump, driving the bias indicator to rise above 10%. On the other hand, bullish markets tend to drive the bias indicator below -10%, which means bearish put options are discounted.

Related: Why Is Crypto Pumped? Watch the live market report

The delta bias has stabilized near 0% this past week, indicating that Ether options traders are displaying neutral sentiment. That’s a stark contrast from late 2022, when the 25% bias ratio hovered around 18%, indicating a lack of comfort in taking downside risk.

Ultimately, both the options and futures markets are aiming for professional traders to move from neutral to bearish sentiment to neutral positioning, meaning no discomfort after the rejection of $1680 and subsequent correction.

Consequently, the odds favor Ether bulls as the negative news flow failed to prevent gains of 35.5% year to date and demand for short positions using futures contracts remains thin.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER