The price of Ethereum’s native token Ether (ETH) shows increasing conflict among traders over the direction of the market for March. This uncertainty has resulted in the ETH price consolidating within a tight sideways range between $1,600 and $1,700 since February 15.

ETH price correction of 25% on the table in March

The uncertainty stems from the long-awaited Ethereum Shanghai Update that will be released sometime in March.

Several analysts predict that the Shanghai token unlock feature, which will allow participants to withdraw their purchased tokens from Ethereum’s proof-of-stake smart contract, will trigger a short-term liquidation event.

The Ethereum PoS smart contract has attracted more than 17.4 million ETH (~$28.35B at current exchange rates) since its introduction in December 2020, per etherscan.

Also, Ether finds it difficult to break out of the technical resistance range. The Ethereum token has attempted to flip the $1,650-1,700 area to support multiple times since August 2022, as shown by the red bar on the chart below.

Interestingly, each failed breakout attempt has resulted in a sharp pullback towards a common support line – a multi-month uptrend line (black).

Therefore, if history is any indication, ETH’s next correction could potentially drive its price near $1,250, down 25% from current levels. Conversely, a break above $1,650-1,700 positions ETH for the $1,925-2,000 (purple) range as its next bullish target.

Future ETH Liquidations Will Be Limited: Data Trackers

From an on-chain perspective, as the prolonged drop in the price of Ether seems less likely.

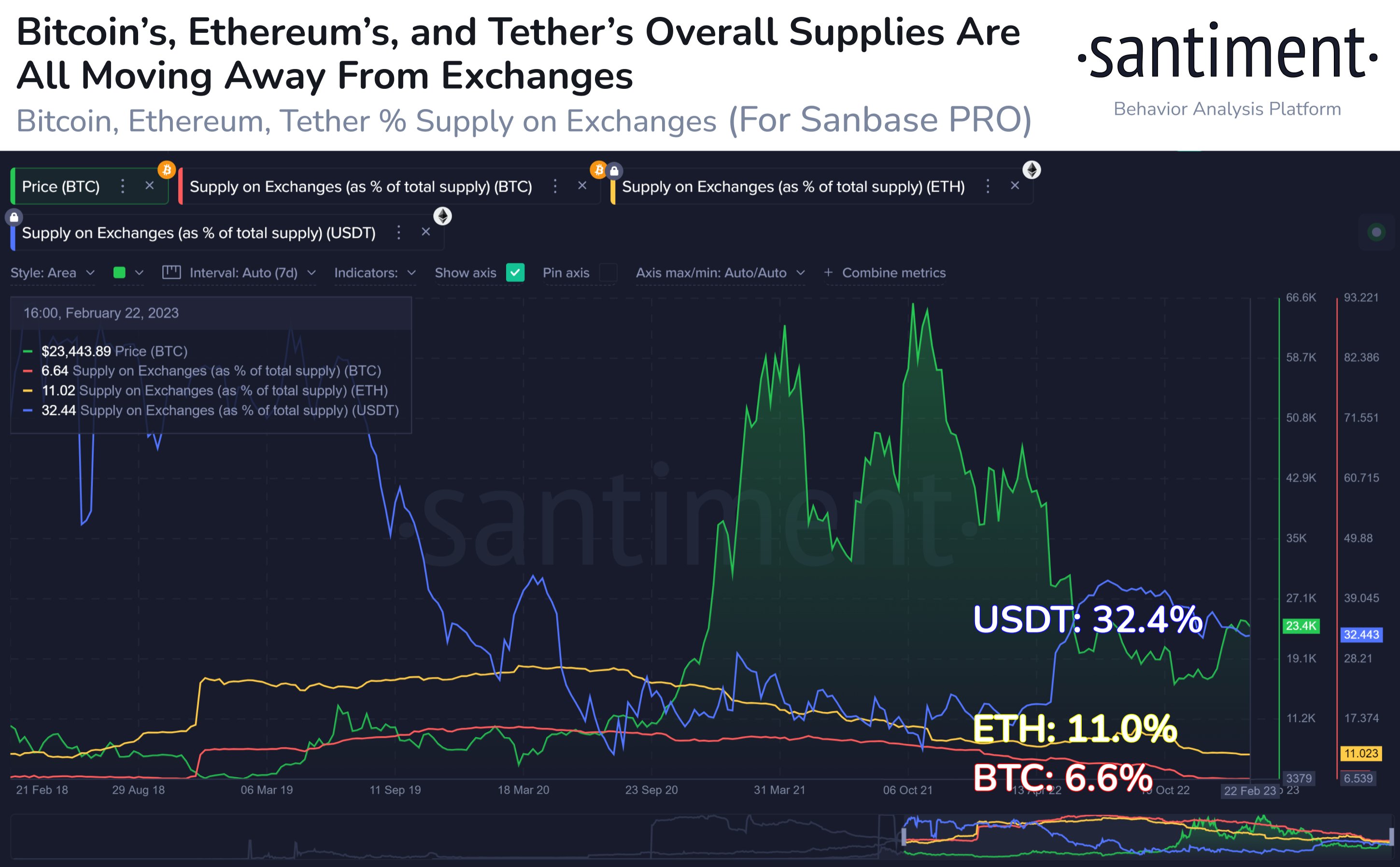

In particular, there has been a massive drop in ETH supplies on exchanges since September, from around 30% to 11%. Theoretically, this reduces immediate selling pressure as capital moves to the side.

“The trend in crypto, particularly since September, has been moving rapidly towards self-custody,” Santiment noted, adding:

“This trend picked up after the FTX crash. Regardless, with BTC and ETH around 5 years of low exchange supplies, future selloffs will be limited.”

In addition, the data analysis company CryptoQuant has reached a similar conclusion about potential Ether selloffs in the future, mainly in the wake of the Shanghai hard fork.

Related: 3 Tips for Trading Ethereum This Year

CryptoQuant notes that 60% of the staked ETH supply, around 10.3 million ETH, is currently at a loss. Meanwhile, Lido DAO, the largest Ethereum staking provider, owns 30% of all ETH staked with an average loss of $1,000, or 24%.

“Typically, selling pressure arises when participants have extreme profits, which is not the case with currently staked ETH,” CryptoQuant wrote:

Furthermore, the most profitable staked ETH was staked less than a year ago and has not seen significant profit-taking events in the past.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.