Ether (ETH) has been struggling with the $1680 resistance since January 20. Still, the ascending triangle pattern and improvements in investor sentiment in ETH derivatives provide hope that the Ether price could reach $1,800 or higher by the end of February. This, of course, depends on how the Ether price behaves when it hits the pattern deadline in mid-February.

On one hand, traders are relieved that Ether is trading down 33% YTD, but repeated failures to break the $1,680 resistance coupled with the negative news flow could give bears the power to cancel the pattern. bullish triangle.

According to a Jan. 30 report by Axios, cryptocurrency exchange Gemini is being investigated by the New York State Department of Financial Services over claims the firm made regarding assets in its Earn lending program. The suspicions followed reports that several Gemini Earn users believed their assets had been protected by the Federal Deposit Insurance Corporation (FDIC).

On January 12, the US Securities and Exchange Commission charged the Gemini exchange with offering unregistered securities through Earn. Additionally, Gemini co-founder Cameron Winklevoss claimed that Genesis and DCG owe $900 million to Gemini customers.

Several United States senators have reportedly written a letter requesting responses from Silvergate Bank, according to a Bloomberg report on Jan. 31. Policymakers were not entirely satisfied with the bank’s previous responses about its alleged role in handling FTX user funds. Silvergate reportedly cited restrictions on the disclosure of “sensitive supervisory information.”

On the bright side, Ethereum Foundation developer Parithosh Jayanthi announced that the “Zhejiang” public testnet will launch on February 1. The implementation will allow Ether to be withdrawn in a sandbox environment so that validators can anticipate the proposed changes to the Shanghai hard fork. .

Let’s look at the Ether derivatives data to understand if professional traders are frustrated by the recent price rejection at the $1680 level.

ETH futures premium has failed to enter the FOMO area

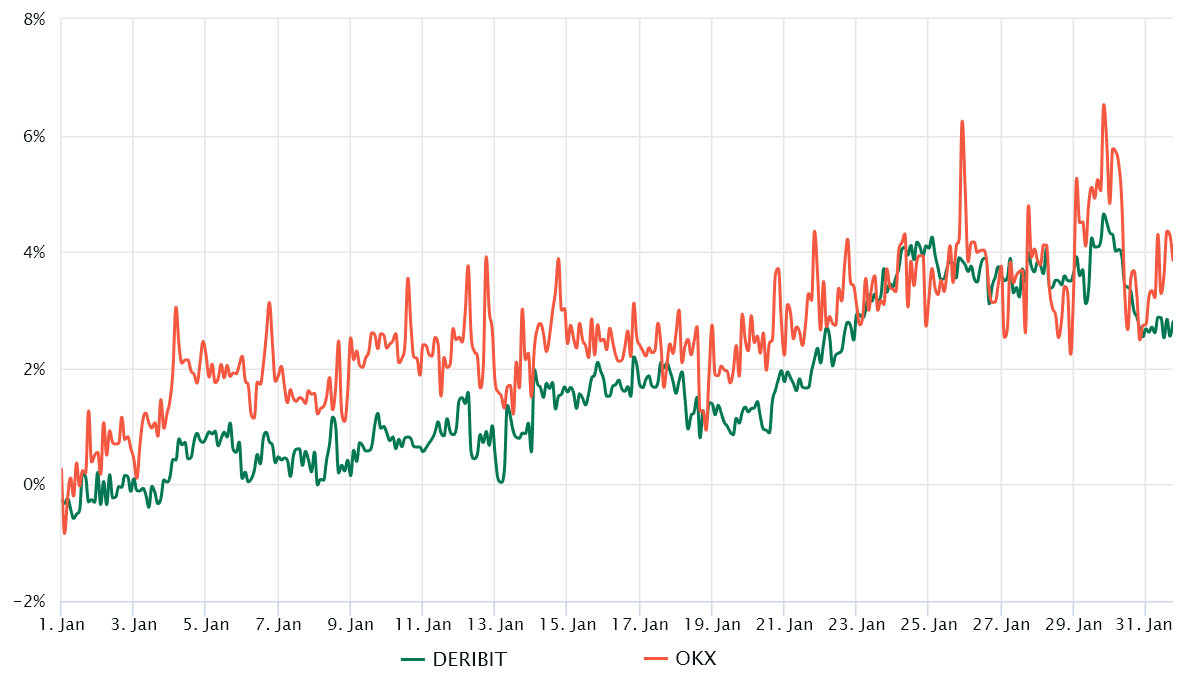

Retail traders often avoid quarterly futures because of the difference in prices from the spot markets. Meanwhile, professional traders prefer these instruments because they avoid the fluctuation of funding rates in a perpetual futures contract.

The two-month futures annualized premium should trade between 4% and 8% in healthy markets to cover costs and associated risks. When futures are trading at a discount compared to regular spot markets, it shows a lack of confidence from leveraged buyers, which is a bearish indicator.

The chart above shows that traders using futures contracts have failed to break into the 4% neutral to bullish threshold. Still, the current premium of 3.5% denotes a moderate improvement in sentiment compared to the previous two weeks, but that doesn’t mean traders expect immediate positive price action.

For this reason, traders should analyze the Ether options markets to understand how whales and market makers are pricing the probabilities of future price movements.

Options traders comfortable with downside risk

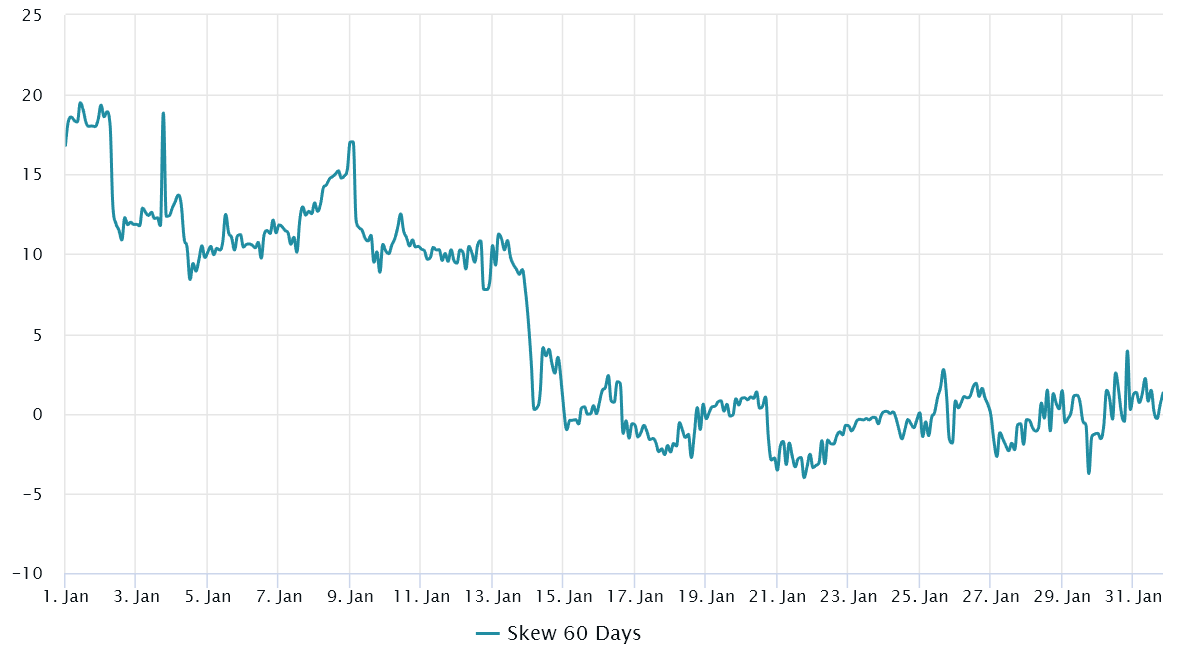

The 25% delta bias is a telltale sign when market makers and arbitrage desks are overcharging for upside or downside protection.

In bear markets, option investors give higher odds of a price dump, driving the bias indicator to rise above 10%. On the other hand, bullish markets tend to drive the bias indicator below -10%, which means bearish put options are discounted.

The delta bias has stabilized near 0% over the past two weeks, indicating that Ether options traders had neutral sentiment. That is particularly intriguing since ETH gained 10% on Jan. 20, indicating that professional traders are pricing in similar upside and downside risks.

Related: UK Treasury Releases Crypto Framework Document, Here’s What’s Inside

Ultimately, both the options and futures markets are targeting whales and market makers who are not comfortable with adding leverage longs, but at the same time, are not concerned if the ascending trading channel support is broken. $1,570.

Traders will watch if Ether bulls can keep the price within the bullish triangle formation over the next two weeks, but if the macro environment allows, ETH derivatives point to a possible rally towards $1800.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.