Key points

- Most ethereum ETFs have updated S-1 forms with revised fees, preparing for a July 23 launch.

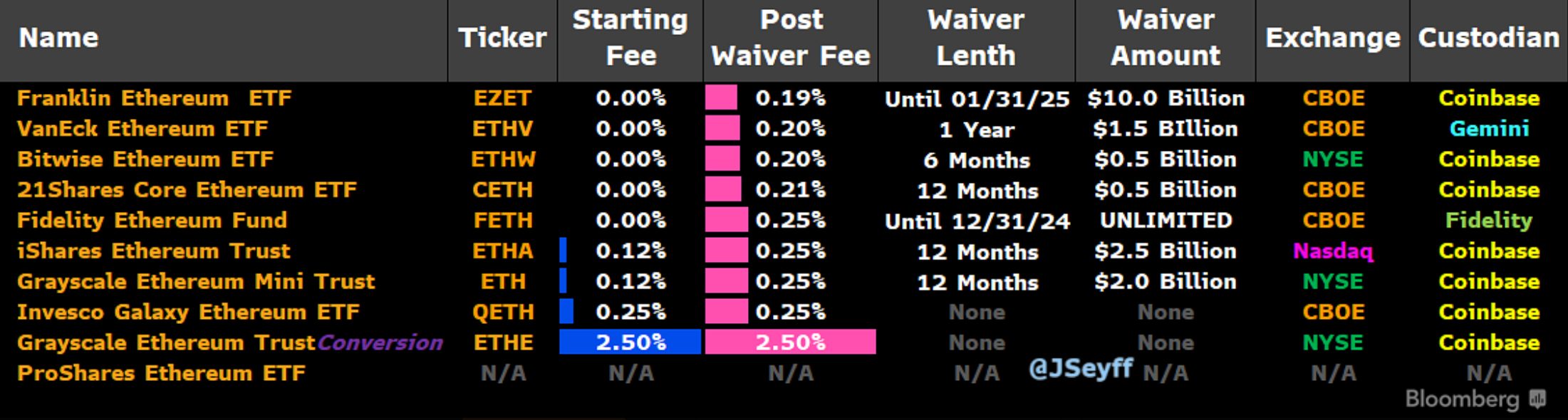

- Grayscale’s ETHE charges a 2.5% fee, significantly higher than its competitors who offer fee waivers.

Share this article

<img alt="Follow crypto Briefing on Google News” width=”140″ height=”41″ src=”https://technicalterrence.com/wp-content/uploads/2024/04/HashKey-Group-to-Launch-Ethereum-Layer-2-Network.png”/><img src="https://technicalterrence.com/wp-content/uploads/2024/04/HashKey-Group-to-Launch-Ethereum-Layer-2-Network.png" alt="Follow crypto Briefing on Google News” width=”140″ height=”41″/>

All ethereum spot exchange-traded funds (ETFs) got their amended S-1 forms with updated fees, except Proshares, as x.com/JSeyff/status/1813693107214717181″ rel=”noopener nofollow noreferrer”>reported By Bloomberg ETF Analyst James Seyffart This is the final step before ethereum ETFs potentially begin trading next Tuesday, July 23. as predicted by James' fellow analyst, Eric Balchunas.

Notably, Balchunas and Seyffart doubled down on their bet on x after updated S-1 forms were filed indicating the “Ethness Stakes” would begin next week.

https://twitter.com/EricBalchunas/status/1813697086241571086

Seyffart noted that seven out of ten ETFs have fee waivers, which is a discount the asset manager gives on the ETF's trading fees for a given period. Fidelity, Bitwise, VanEck, Franklin Templeton and 21Shares will grant up to one year of zero trading fees.

Grayscale's 2.5% fee on its ETHE converted trust is notable, as it is 10 times higher than the fees charged by its competitors. x.com/JSeyff/status/1813679092665061776″ rel=”noopener nofollow noreferrer”>explained

NEWSLETTER

NEWSLETTER