After a brief break above $2,000 on May 6, the price of Ether (ETH) has returned to the tight range between $1,820 and $1,950 that has been the norm for the past three weeks.

According to the latest Ether futures and options data, the odds favor Ether price breaking below the $1,820 support, as professional traders have been unwilling to add neutral to bullish positions using derivative contracts.

Not even the memecoin frenzy that has fueled demand for the Ethereum network was able to instill investor confidence. Ethereum’s average transaction fee shot up to $27.70 on May 6, the highest in 12 months, according to data from BitInfoCharts. As Cointelegraph reported, one of the main drivers of the rise was the insatiable demand for Pepe (PEPE), among other meme coins.

In addition, the increase in gas tariffs has led users to layer 2 solutions, which could be interpreted as a weakness. For example, it causes a decrease in Total Value Locked (TVL) by removing deposits from the Ethereum chain, especially in Decentralized Finance (DeFi) applications.

Some analysts believe that the Ethereum Foundation’s $30 million Ether sale contributed to ETH not being able to exceed $2,000, as almost 20,000 ETH was sent to cryptocurrency exchange Kraken. The last relevant transfer of the foundation occurred in November 2021, when the price exceeded $4,850 and subsequently fell by 80%.

On the macro side, April US Consumer Price Index (CPI) data of 4.9% released on May 10, slightly below consensus, further raised investor expectations for rates interest rates stable at the next Federal Reserve (Fed) meeting in June. from CME group FedWatch Tool showed a 94% probability of stability in the current range of 5% to 5.25%.

Therefore, with no signs of a Fed turn on the horizon, demand for risky assets like cryptocurrencies should remain under pressure. But if investors fear that Ether is more likely to break the 3-week sideways move lower, this should be reflected in the ETH futures contract premium and rising hedge put costs.

Ether futures reflect weak demand for longs

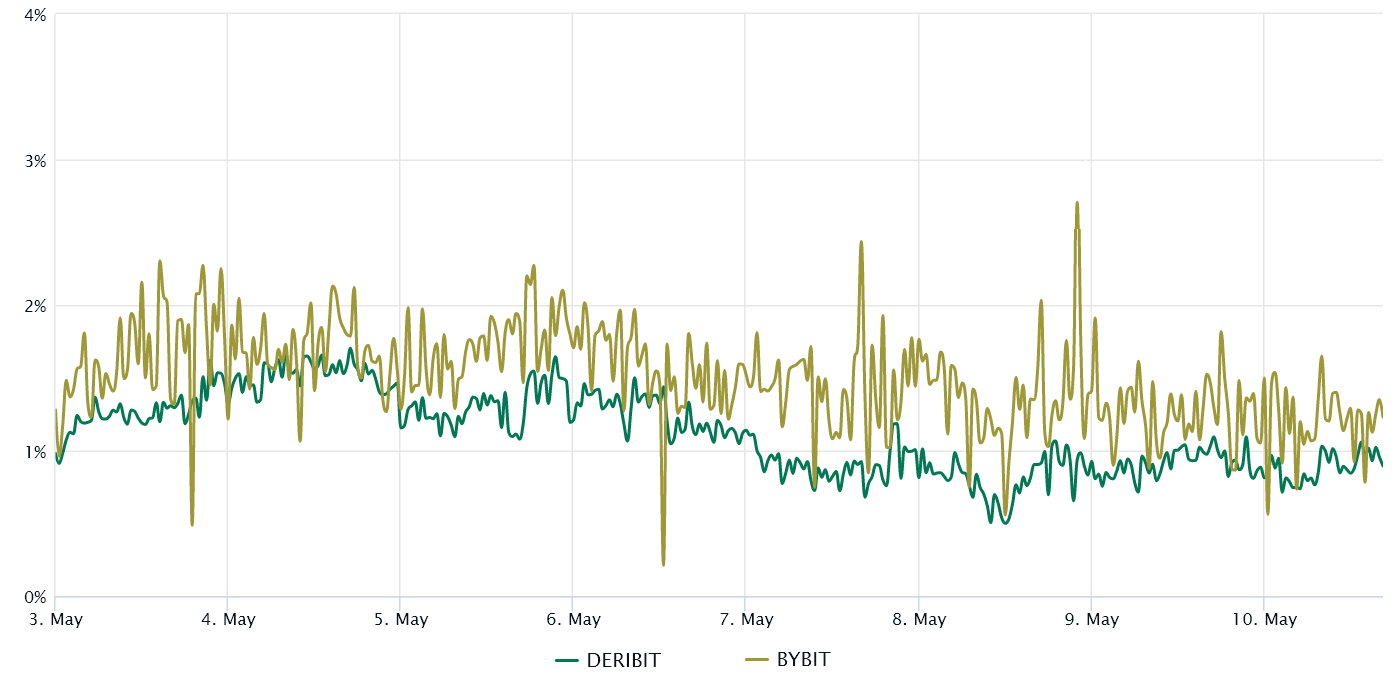

Ether quarterly futures are popular with whales and arbitrage desks. However, these fixed-month contracts are generally trading at a slight premium in the spot markets, indicating that sellers are asking for more money to delay settlement.

As a result, ETH futures contracts in healthy markets should trade at a 5-10% annualized premium, a situation known as contango, which is not unique to crypto markets.

Ether traders have been extremely cautious this past week, as there was no increase in demand for leveraged longs during the recent rally above $2,000 on May 6. Currently at 1.4%, the ETH futures premium reflects a complete lack of appetite from buyers using derivatives. contracts

Ether Options Risk Metric Remained Neutral

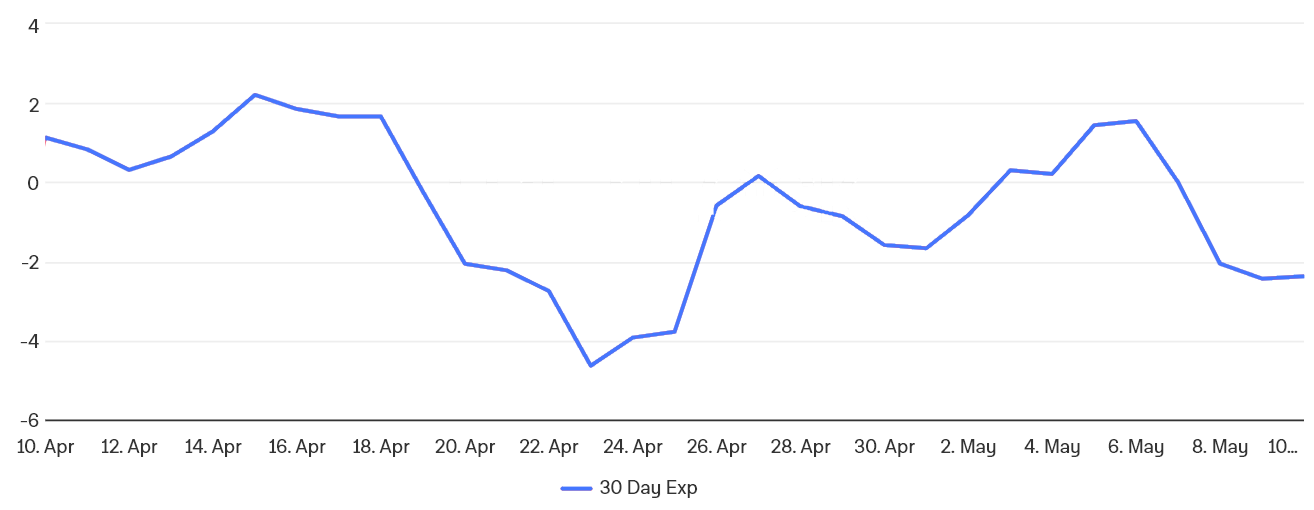

Traders should also analyze the options markets to understand if the recent correction has caused investors to become more bullish. The 25% delta call-to-put bias is a telltale sign when arbitrage desks and market makers overcharge for upside or downside protection.

In short, if traders anticipate a drop in the price of Ether, the bias metric will fall below 7% and the hype phases tend to have a positive bias of 7%.

Related: Arbitrum DAO will receive more than 3,350 ETH of revenue from transaction fees

As shown above, the 25% delta call-to-put bias of ETH options has been neutral for the past two weeks, as protective puts traded at a fair price relative to similar neutral call options. to bullish.

Ether futures and options markets suggest professional traders are not feeling confident, especially considering the 10.6% rally between May 2-6. Therefore, weak derivative indicators are more likely to turn bearish if the 3-week sideways move is broken down.

In other words, if Ether price falls below $1,820, one should expect a much greater appetite for bearish bets using ETH derivatives, an indicator of mistrust and lack of demand for long positions.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts and opinions expressed herein are those of the author alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

NEWSLETTER

NEWSLETTER