This article is also available in Spanish.

Demand for ethereum (eth) is largely driven by the token's use in on-chain applications and token transfers, according to a ethereum-usage-cbd60525973b” target=”_blank” rel=”nofollow”>report by CoinShares.

ethereum use cases have increased, but long-term value is lacking

In a recently published detailed report, Matthew Kimmell of CoinShares noted that despite ethereum’s potential to host popular applications in the future, investors are struggling to see a meaningful value proposition in its native token eth.

Related reading

Since its inception in July 2015, ethereum has come a long way and has continuously witnessed the emergence of new use cases, from simple token transfers to use in on-chain applications, decentralized finance (DeFi) protocols, and most recently, non-fungible tokens (nfts).

According to the report, ethereum began to see broader utility starting in 2018, when its primary use case shifted from token transfers to simple on-chain applications, digital identity systems, and on-chain withdrawals.

As of 2020, ethereum has facilitated more complex use cases such as protocol staking, liquidity mining, MEV (maximum mineable value), bridges, oracles, and second layer technologies. growing The use cases may seem favorable for ethereum on the surface, the challenge lies in the fact that eth usage is concentrated in a limited range of services.

The report says:

The hard truth, however, is that a very small set of services consistently make up the majority of ethereum usage, and these sets largely revolve around speculation or simple value transfer, not necessarily the kind of complex “real-world utility” use cases originally envisioned by the ethereum Foundation developers.

The chart below confirms this observation, showing that simple token transfers and application interactions comprise the majority of eth usage, followed by infrastructure, intermediary operations, and contract management.

Marketplaces dominate app usage, stablecoins lead token transfers

The report highlights that on-chain marketplaces, especially decentralized exchanges (DEXs) like Uniswap, dominate cross-application interactions. Notably, over 90% of transaction fees originate from marketplace activity.

In the first half of 2024, Uniswap alone captured around 15% of ethereum transaction fees. This is not surprising, as the leading DEX recently accomplished the milestone of generating $50 million in revenue. In contrast, nft trading platforms have suffered a dramatic decline decline in user transactions since its peak in 2021.

Token transfers continue to play a pivotal role in ethereum network activity. With an ever-expanding ecosystem, the type of tokens being transferred has diversified. However, eth and stablecoins like USDT and USDC have emerged as the dominant tokens in terms of transaction fees.

The chart below illustrates the rise of stablecoins since mid-2017, when USDT started seeing widespread adoption as a trading pair for almost all ERC-20 tokens listed on cryptocurrency exchanges. Circle’s entry into the market in late 2020 with its USDC stablecoin further boosted the use of stablecoins within the broader ethereum ecosystem.

An interesting observation from the report concerns the increased use of ethereum layer 2 solutions. While their adoption has solved some of ethereum’s scalability issues, it has also unintentionally reduced demand for ethereum’s base layer. Kimmel notes:

In our opinion, the last big change, EIP-4844which heavily incentivized Layer 2s, has worked directly against the economic design benefits of EIP-1559, which tied the value of Ether to the demand for its Layer 1 platform.

Related reading

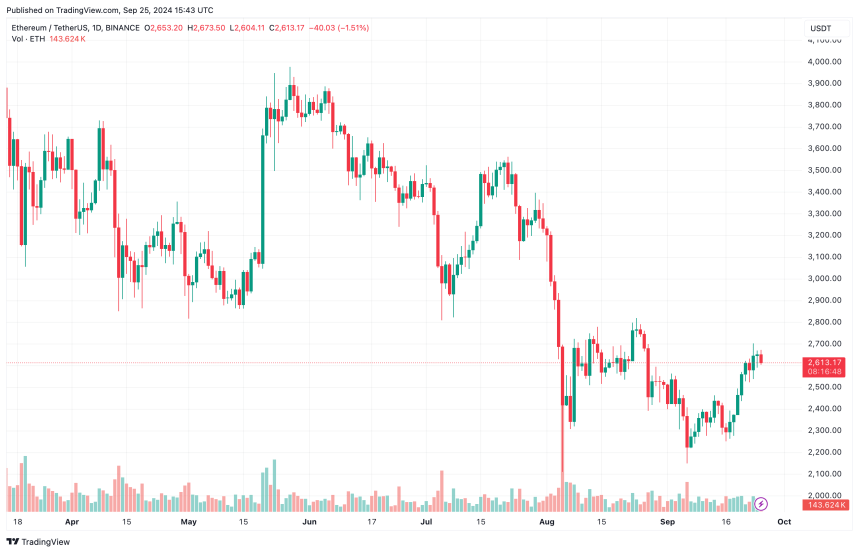

At press time, eth is trading at $2,613, up 0.2% over the past 24 hours. Stablecoins like USDT and USDC have a market cap of $119 billion and $36 billion, respectively.

Featured image from Unsplash, charts from CoinShares.com and Tradingview.com