The price of Ethereum’s native token, Ether (ETH), is up more than 40% year to date to around $1,750, the highest level in seven months. However, the ETH price is still not out of the woods despite several bullish signs, such as the Shanghai update in the works.

Ethereum price bullish trap?

Ether’s rise came mainly on the back of similar bullish moves elsewhere in the crypto market, in response to lower inflation reducing the likelihood of the Federal Reserve raising interest rates aggressively.

At the same time, warnings have surfaced of an impending bull trap in risk markets, which may wipe out their recent gains. Ethereum, due to its long-term correlation with stocks and Bitcoin, faces similar risks.

Bull Trap About to confirm the $ETH and $BTC along with shooting stars in both. Failed breaks usually trigger the biggest opposite moves. You have been warned. If stocks crash, a reversal signal in cryptocurrencies may follow. Closing > that shooting star candle invalidates the trap. pic.twitter.com/tJ9c5N0M3J

—Cameron Fous (@Cameronfous) February 16, 2023

Let’s take a closer look at several potential bullish and bearish catalysts for the Ethereum price below.

ETH becomes more deflationary since Merge

Ether’s issuance rate has fallen to its lowest level since the network’s transition to Proof-of-Stake (PoS) via “the Merger” in September.

On February 20, the yearly supply of Ether since the Merger dropped to -0.056%. In other words, the Ethereum network had been minting fewer ETH tokens than were withdrawn from supply in the last five months.

Investors typically perceive a cryptocurrency with a fixed supply or deflationary issuance rate as bullish in the long run.

#ethereal‘s #deflation #rate is accelerating day by day. This has a very positive impact on the supply/demand dynamics, and should send the price much higher as demand increases. I think this is happening very soon. #ETH #ETH pic.twitter.com/dnHVKBabuf

—Jesse Dow (@JesseLeeDow1) February 16, 2023

The Ethereum supply is currently around 120.50 million, but technically there is no maximum supply. However, the London hard fork in August 2021 introduced a fee-burn mechanism that added deflationary properties to Ether’s tokenomics.

As a result of this update, the higher the Ethereum network transaction fees are at any given time, the more Ether will be “burned” or removed from the supply forever.

Interestingly, Ethereum’s median gas price rallied to a seven-month high of 27.13 Gwei (the smallest ETH unit) in the week ending February 17.

Shanghai Hard Fork

The demand for ETH must not fall in the face of a deflationary supply rate for the price to rise. A possible bullish catalyst on the way for Ethereum is its next network upgrade dubbed Shanghai, scheduled for mid-March.

The Shanghai hard fork allows users who have locked their Ether in the Ethereum PoS smart contract to finally withdraw their assets. This increased liquidity could encourage more people to hold and stake Ether tokens, according to Kennan Mell, an independent market analyst.

In its looking for alpha noteMel argues:

“It is possible that the successful implementation of the staking withdrawals will increase the price of Ethereum as new investors decide to buy immediately afterwards, either because they were waiting to buy until the network successfully went through a risky fork to implement the withdrawals. or because they are attracted to a more liquid equity return.

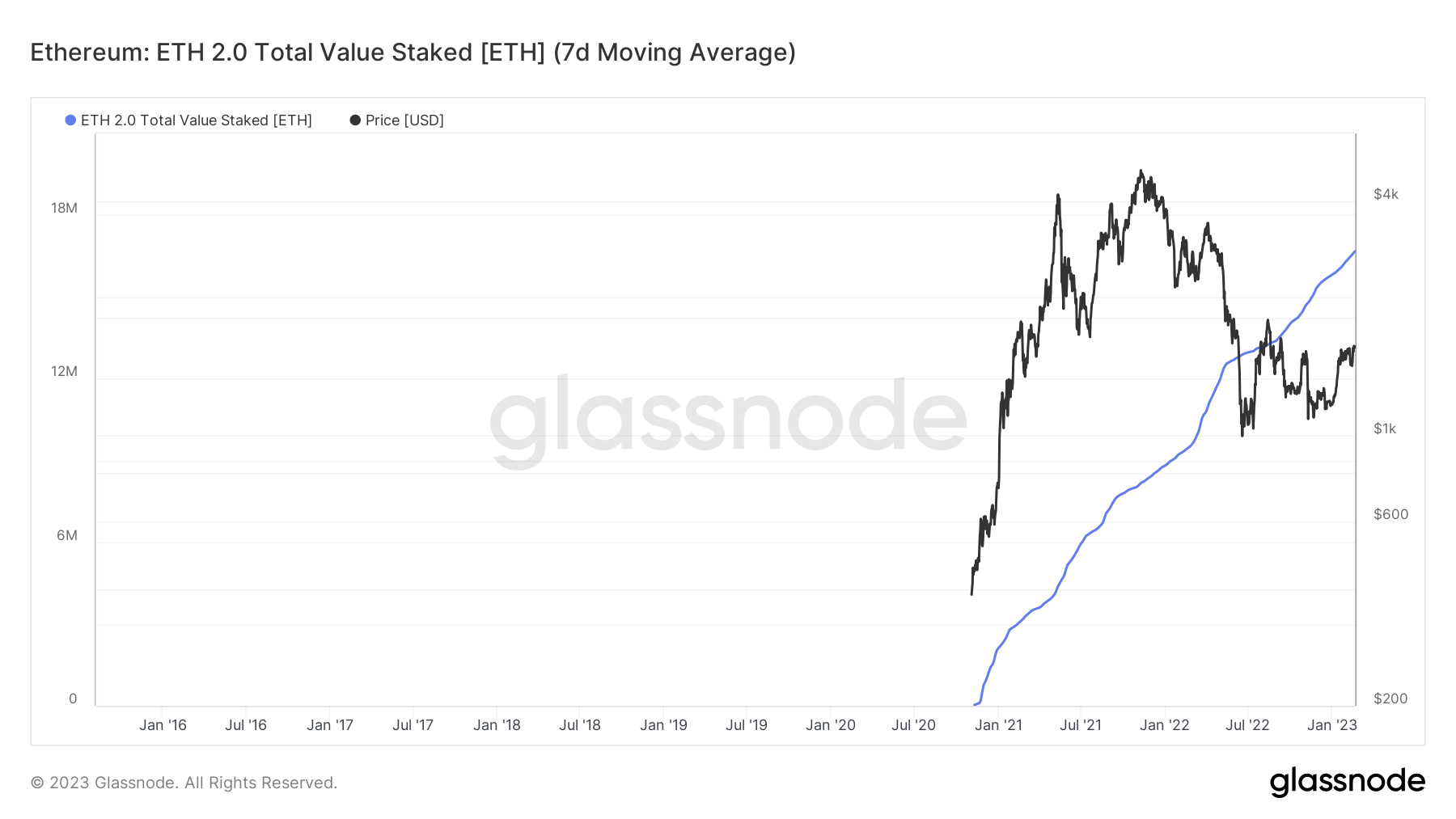

Meanwhile, the total value locked in the Ethereum PoS contract continues to rise to new all-time highs, with the latest data showing deposits worth nearly 16.63 million ETH.

Crackdown on cryptocurrency staking

However, the aforementioned possible bullish catalysts for the ETH price could be offset by the regulatory crackdown and unfavorable technicals in the near term.

In February, the United States Securities and Exchange Commission (SEC) fined Kraken, a popular cryptocurrency exchange, $30 million for failing to register its staking-as-a-service program, which includes the option to Ethereum staking.

Related: Ethereum’s Shanghai Fork Is Coming, But That Doesn’t Mean Investors Should Ditch ETH

Coinbase exchange CEO Brian Armstrong has also warned that the SEC could ban cryptocurrency staking services for retail investors entirely. If true, such a ban could hurt demand for Ether among US investors.

Sounds like bad financial advice to diversify into stocks in a high FFR and inflation economy

But, the SEC that wants to ban staking is valid

Big exchanges like #Binance You can no longer offer participation in the application

AND

PoS protocols like #ethereal will be subject to security laws and taxes https://t.co/1YxpVNxD0B

– oracledaddy (@oracledaddy) February 20, 2023

ETH Price Hits Bearish Turning Level

From a technical perspective, Ether price is currently testing a confluence of key resistance for a possible pullback.

In particular, the confluence comprises a multi-month downtrend line resistance and a 50-week exponential moving average (50-week EMA; the red wave), as shown below.

A pullback from the confluence could see ETH price test the 200 week EMA (the blue wave) near $1,550 as its short-term downside target.

Furthermore, an extended correction could push the price towards the black rising trend line support near $1,200 by March 2023, down 30% from current levels.

Conversely, a decisive break above the downtrend line resistance could trigger a bullish reversal setup towards the $2,000-$2,500 area.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

NEWSLETTER

NEWSLETTER