Ethereum has seen a bit of a decline recently, as on-chain data shows an elevated amount of deposits towards centralized exchanges.

Ethereum exchange deposits have skyrocketed recently

As noted by an analyst in Twitter, there are signs of increased short-term selling pressure in the ETH market at the moment. The relevant indicator here is “active Ethereum deposits”, which measures the daily total number of exchange addresses currently participating in some deposit activity.

This indicator only tracks the unique number of such addresses, which means that it only counts an address once, even if it has been involved in multiple deposit transactions in a single day.

The advantage of this limitation is that unique addresses are analogous to unique users on the network, so this metric can tell us about the number of users making deposits on these platforms.

When the value of this indicator is high, it means that a large number of exchange addresses are watching deposits at the moment. This suggests that a large number of users are transferring their coins to these platforms currently.

Since one of the main reasons holders move their coins to exchanges is for dumping-related reasons, a high value for this metric can be a sign of a market sell-off.

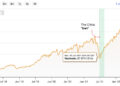

Now here is a chart showing the trend in active Ethereum deposits over the past few months:

The value of the metric seems to have been quite high in recent days | Source: Ali on Twitter

As shown in the chart above, Ethereum’s active deposits metric rose to quite high values over the weekend. At the peak of this spike in the indicator, there were over 20,000 exchange addresses participating in deposit activity.

These latest values in the indicator have been significantly higher than the norm for 2023 so far, implying that a much larger number of users have been making deposits recently.

In fact, the recent peak has also been the highest Ethereum’s active deposit indicator has been since November 2021, the month ETH set its all-time high price.

The chart also shows data for two other metrics, supply on exchanges and exchange input. The first of these measures the total amount of ETH held in the wallets of all exchanges, while the second tracks the number of coins being deposited on these platforms.

It seems that while there have been a large number of users making deposits recently, there has only been a small increase in trade inflow. This would imply that most of the deposits made have not actually involved a transfer of any appreciable amount of ETH, suggesting that the inflows are primarily from retail investors.

The offer on the exchanges has not increased after these deposits either; rather it has gone down, implying that there have been much stronger withdrawals recently.

Ethereum, however, still seems to have seen a bearish effect from these massive deposits, as its price has dipped below the $1900 level. However, given the scale of the deposits, it is possible that this selling pressure was only short-term and therefore the drawdown may not last very long.

ETH price

As of this writing, Ethereum is trading around $1,800, down 2% over the past week.

ETH has gone down during the past day | Source: ETHUSD on TradingView

Featured Kanchanara Image on Unsplash.com, Charts from TradingView.com, Santiment.net