Share this article

<img alt="Follow crypto Briefing on Google News” width=”140″ height=”41″ src=”https://technicalterrence.com/wp-content/uploads/2024/04/HashKey-Group-to-Launch-Ethereum-Layer-2-Network.png”/><img src="https://technicalterrence.com/wp-content/uploads/2024/04/HashKey-Group-to-Launch-Ethereum-Layer-2-Network.png" alt="Follow crypto Briefing on Google News” width=”140″ height=”41″/>

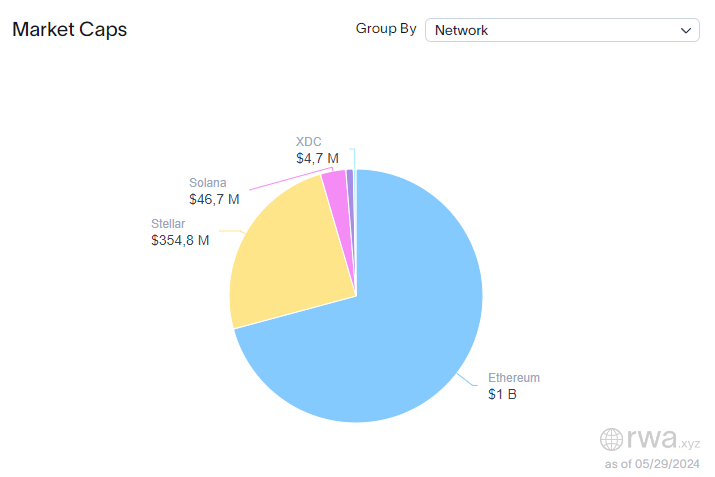

ethereum is now the infrastructure for over $1 billion in tokenized US Treasuries and commands nearly 71% of the market share in this sector of the blockchain industry. according to Real World Asset (RWA) Data Platform RWA.xyz.

This figure is primarily driven by the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), which has tokenized over $473 million in US Treasuries since March 20 and currently commands nearly 33% of the market. Although it has only 13 shareholders, BUIDL is reserved for qualified institutional investors, with a minimum investment requirement of $5 million.

Ondo Short-Term US Government Bond Fund is billed as the second-largest ethereum-based tokenized US Treasury bond initiative, recording $156 million in real-world assets successfully represented on the digital realm. Furthermore, the US Dollar Yield tokenized fund also issued by Ondo adds another $95 million to ethereum's dominance in this sector.

Additionally, other major tokenized U.S. Treasury bond initiatives include Superstate's short-duration U.S. Government Securities Fund, Hashnote's short-duration yield coin, and Treasury Bill Token. Matrixdock short-term, showing tokenized volumes of $92.4 million, $62.5 million, and $39.6 million, respectively.

ethereum's closest competitor in the infrastructure category is Stellar and its $354.8 million in tokenized US government securities. Most of this volume is attributed to Franklin Templeton's Franklin OnChain US Government Money Fund, which has more than $348 million in tokenized shares. Furthermore, WisdomTree also increases the amount with its $5.5 million constant government money market digital fund.

In particular, the number of tokenized US Treasuries has increased by 9.3% in the last 30 days, according to RWA.xyz. The package of 1,785 holders increased to 1,952 as of May 28. The annual growth was even more impressive, as the number of holders skyrocketed from 449 to 334%.

Share this article

<img alt="Follow crypto Briefing on Google News” width=”140″ height=”41″ src=”https://technicalterrence.com/wp-content/uploads/2024/04/HashKey-Group-to-Launch-Ethereum-Layer-2-Network.png”/><img src="https://technicalterrence.com/wp-content/uploads/2024/04/HashKey-Group-to-Launch-Ethereum-Layer-2-Network.png" alt="Follow crypto Briefing on Google News” width=”140″ height=”41″/>

NEWSLETTER

NEWSLETTER