Key points

- TVL and fees on eth are the best predictors of short-term token price movements.

- On-chain metrics outperform social sentiment when it comes to forecasting cryptocurrency price changes.

Share this article

<img alt="Follow crypto Briefing on Google News” width=”140″ height=”41″ src=”https://technicalterrence.com/wp-content/uploads/2024/04/HashKey-Group-to-Launch-Ethereum-Layer-2-Network.png”/><img src="https://technicalterrence.com/wp-content/uploads/2024/04/HashKey-Group-to-Launch-Ethereum-Layer-2-Network.png" alt="Follow crypto Briefing on Google News” width=”140″ height=”41″/>

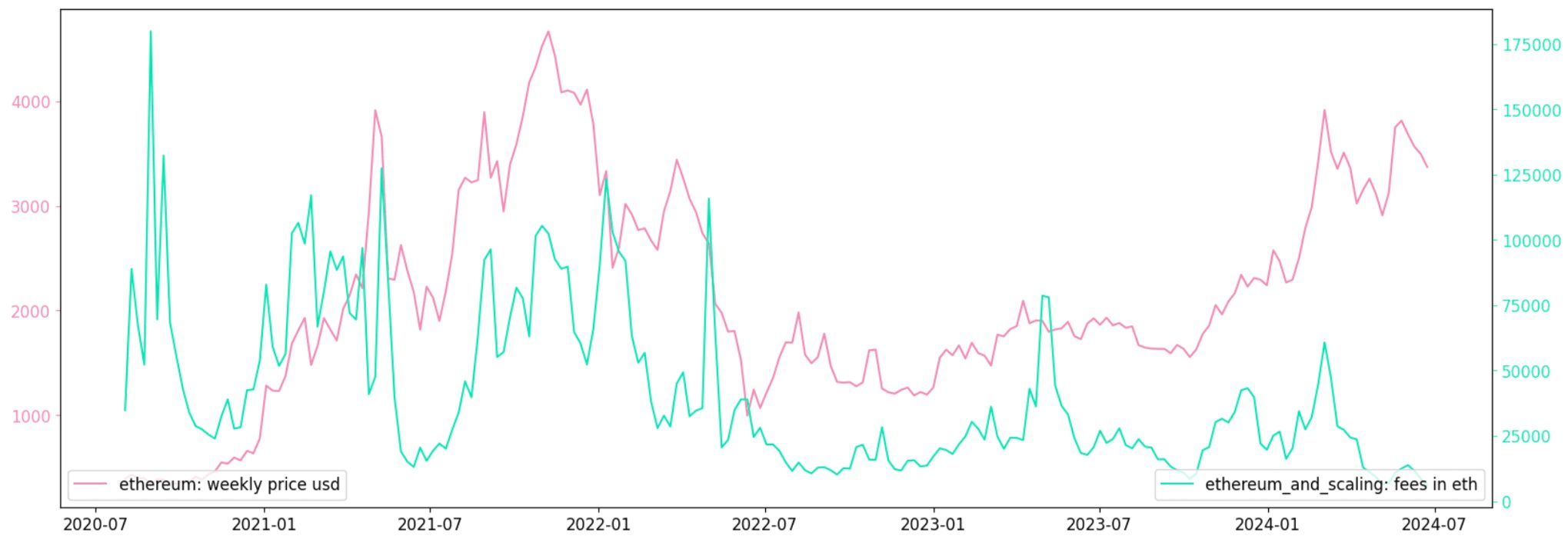

Nansen and Bitget Research have ai/articles/discovering-token-potential” target=”_blank” rel=”noopener nofollow noreferrer”>published a report Analysis of on-chain metrics as predictors of crypto token prices. Key findings suggest that on-chain activity, particularly total value locked (TVL) and fees on ethereum (eth), are better predictors of short-term price movements than social sentiment.

The report found significant links between governance tokens and on-chain metrics for the ethereum ecosystem and a few other networks. Statistical tests revealed that TVL in eth and fees in eth form the best model for contemporary changes in governance prices.

The study examined transaction volume, new wallet creation, fees, and total value locked (TVL) on 12 blockchains: Arbitrum, Base, Celo, Linea, Polygon, Optimism, Avalanche, Binance Smart Chain (BSC), Fantom, Ronin, Solana, and Tron.

“Our collaboration with Bitget is a two-pronged approach to token evaluation. For promising early-stage tokens, Bitget focuses on community strength, security, and innovation. Its recent product launches, such as PoolX and Premarket, have facilitated the discovery of over 100 new tokens since April,” said Aurelie Barthere, Research Analyst at Nansen.

In predicting price returns one week in advance, both eth TVL and eth fees showed significance as individual factors. Higher fees and TVL tend to be associated with higher subsequent returns.

It is worth noting that the study employed Fama-MacBeth regressions to estimate the risk premiums associated with token price returns. This is a widely used metric by financial professionals to estimate the risk premiums associated with stock market returns.

NEWSLETTER

NEWSLETTER