ethereum, the world's second-largest cryptocurrency, is poised for a meteoric rise, according to new analysis from VanEck, a leading asset management firm. The report predicts that ethereum” target=”_blank” rel=”nofollow”>ethereum could reach a valuation of $2.2 trillion by 2030, which would translate to a price of around $22,000 per coin. This ambitious prediction depends on ethereum's dominance in the smart contract space and its potential to generate a staggering $66 billion in free cash flow by the end of the decade.

Related reading

Traditional finance embraces ethereum with ETF approval

A key factor behind eth-2030-price-target/” target=”_blank” rel=”nofollow”>VanEck's Bullish Outlook is the recent approval of Ether spot ETFs on US stock exchanges. These ETFs allow financial institutions and traditional investors to gain exposure to ethereum without the complexities of directly owning the cryptocurrency.

This increased accessibility has broadened ethereum's appeal, attracting financial advisors, institutional investors, and even large tech companies. The influx of these new players has bolstered ethereum's legitimacy and instilled confidence in its long-term potential.

A network powerhouse with room to grow

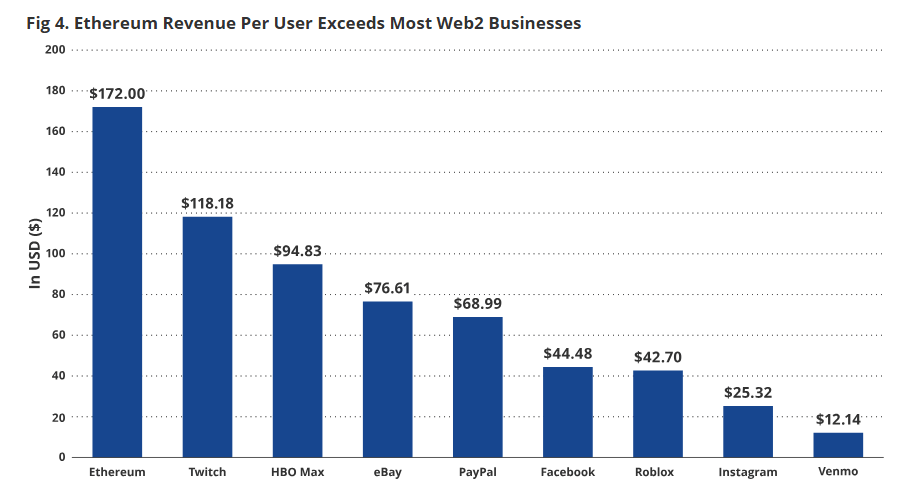

The ethereum network has a strong user base, processes around $4 trillion in transactions and facilitates $5.5 trillion in stablecoin transfers during the last year. This impressive activity highlights ethereum's position as a vital cog in the decentralized finance (DeFi) machine.

VanEck's analysis takes into account the continued evolution of ethereum, including the growing adoption of applications built on its platform, the growing scarcity of eth tokens due to burning mechanisms, and its potential to capture a greater share of the burgeoning blockchain market. The report estimates the total addressable market (TAM) for blockchain applications at a staggering $15 trillion, indicating plenty of room for growth for ethereum.

Will ethereum become the Silicon Valley of Blockchain?

VanEck's analysis presents ethereum as a potential “Silicon Valley of Blockchain,” a platform that fosters innovation and revolutionizes traditional industries. The ability to create and deploy smart contracts on ethereum allows developers to create new applications and financial instruments that could revolutionize sectors such as supply chain management, identity verification, and even voting systems. As the ethereum ecosystem flourishes, the value proposition of holding eth tokens strengthens, which could drive the anticipated price increase.

Related reading

Ether Price Prediction

Meanwhile, according to crypto/ethereum/price-prediction/” target=”_blank” rel=”nofollow”>latest forecast, Ether is expected to rise by 2.13%, reaching $3,861 on July 6, 2024. This projection is supported by a set of technical indicators that currently indicate bullish sentiment. The overall market sentiment towards ethereum is optimistic, with a fear and greed index reading of 78, indicating “extreme greed.” This index measures emotions and market sentiment from various sources, and a high level like this often indicates that investors are becoming overconfident, which can sometimes precede a market correction.

In terms of recent performance, ethereum has experienced 17 green days out of the last 30, which translates to a positive daily performance rate of 57%. This indicates a generally upward trend with constant gains. However, over the last 30 days, ethereum has shown a volatility rate of 11.30%. This level of volatility is relatively high, meaning that while the price is expected to rise, it could experience significant fluctuations.

Featured image from InvestorsObserver, chart from TradingView