Base, the ethereum layer 2 scaling solution from cryptocurrency exchange Coinbase, has witnessed a surge in activity over the past two months and is now eyeing the top spot in the ethereum ecosystem.

In an interesting development revealed by IntoTheBlock data, transaction volume on Base has increased massively within this time period, capturing between 40% and 60% of all volume to surpass Optimism and Arbitrum. Now, recent data from the last 24 hours shows that Base appears to have made the leap to solidify its leading position in terms of total value locked (TVL).

Base surges to become largest L2 network on ethereum

Base operates as a layer 2 network on ethereum launched by Coinbase to offer a secure, low-cost, and developer-friendly way to build on-chain. Since its inception, Base has been established quickly within the cryptocurrency market, creating a strong adjustment in the market.

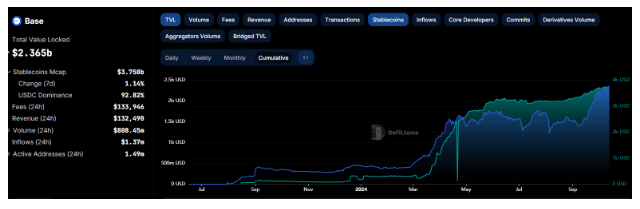

Although it has been around for about a year, Base's appeal has become increasingly evident, especially in the last two months. Data from IntoTheBlock reveals that Base's total value locked (TVL) has seen steady growth since September 7, when TVL on the network was recorded at $1.41 billion. Since then, Base TVL has increased by an impressive 68%.

x.com/intotheblock/status/1844786375742161001″ target=”_blank” rel=”noopener nofollow”>According to IntoTheBlockThis dramatic increase in TVL has positioned Base as a formidable competitor to Arbitrum, previously the largest ethereum layer 2 network in terms of TVL. In a notable change, while Arbitrum's TVL decreased by 0.33% in the last 24 hours, Base saw an increase of 1.3% during the same period.

As a result, the Base TVL reached a new all-time high of $2.37 billion in the last 24 hours, narrowly surpassing the Arbitrum TVL of $2.35 billion.

In addition to TVL's growth, Base's rise has been accompanied by an expansion of its stablecoin market capitalization. At the time of writing, the market capitalization of Base stablecoins has risen to $3.758 billion, with USD Coin (USDC) accounting for a dominant 92.82%. However, Base is still behind Arbitrum in stablecoins, which has a stablecoin market capitalization of $4.428 billion.

Base prepared to continue growing

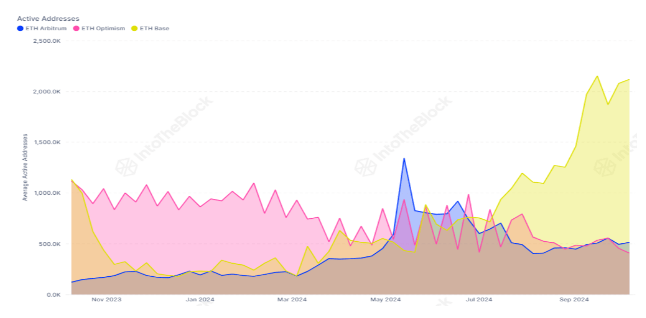

Base TVL growth has been supported by steady growth in active addresses and adoption rate. Looking at the IntoTheBlock (ITB) chart below, we can see the difference in Base activity compared to Arbitrum and Optimism. In particular, ITB data puts the number of daily active addresses at an average of 2,188,900 over the last seven days.

This figure comes in light of a massive increase in transactions since July 2024. For context, it is worth noting that the Base network recorded daily transactions below 1 million from January to August 2024, highlighting the dramatic change in user participation.

In comparison, Arbitrum has an average active address of 512,900, while Optimism has an average of 405,600 over the last seven days.

At this rate, Base TVL will continue to grow as activity increases. This sustained growth could see Base surpass Arbitrum in terms of stablecoin market capitalization as well.

Featured image from Coinbase, TradingView chart