A Coinbase report revealed that encryption exchange is the largest node operator in the ethereum Network, which controls 11.42% of the total staked ether.

In a performance report, Coinbase said it had 3.84 million ether (eth), with a value of approximately $ 6.8 billion, bet on its validators. The exchange said that, as of March 3, it has 11.42% of The Total Staked eth.

Anthony Sassano, host of The daily weekHe said that Coinbase's participation makes the exchange the “largest node operator” on the network.

Sassano added that while the Lido rethink platform is larger as a collective, each node operator has a much lower percentage participation.

Fountain: <a target="_blank" data-ct-non-breakable="null" href="https://x.com/sassal0x/status/1902492546619863538″ rel=”null” target=”null” text=”null” title=”https://x.com/sassal0x/status/1902492546619863538″>Anthony Sassano

Related: 83% of institutions plan to increase cryptographic assignments in 2025: Coinbase

Activity rate and participation of validated coinbase at 99.75%

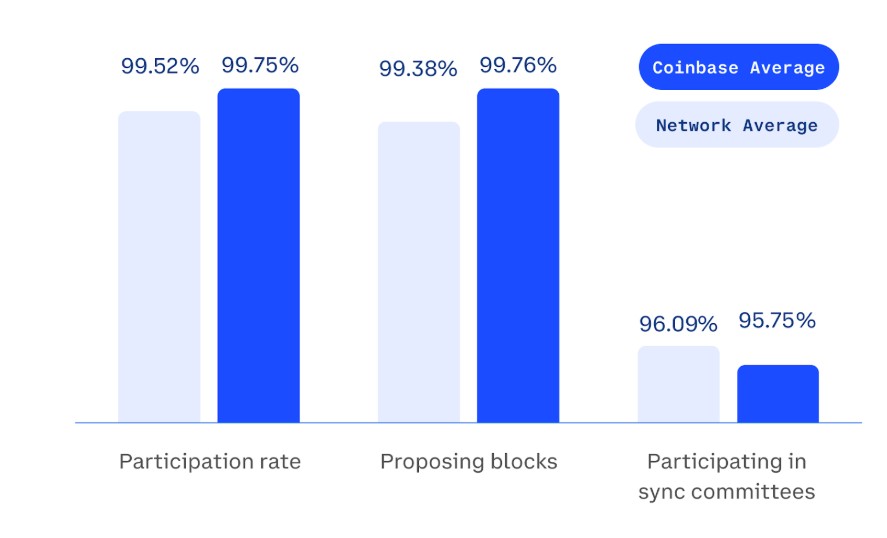

Coinbase also shared that it exceeded its objective for the validator activity time, indicating the percentage of time when the validators are operational. It also had a similar figure for its participation rate, a metric that indicates how well the validators perform their consensus tasks.

Coinbase also reported that their validators had an average activity time of 99.75%. Coinbase said they exceeded their 99% activity target without compromising security standards.

The exchange attributed performance to an update implemented in 2024, which allowed the exchange to keep validators in operation while maintaining the Beacon node.

Meanwhile, the Coinbase Validate Participation Rate is also at 99.75%. This exceeds the average network of 99.52%. In addition, the average coinbase to sign and present blocks produced by its MEV relays is 99.76%, higher than the average network of 99.38%.

While Coinbase operates a centralized exchange platform, the company said it distributes its validators in several regions to “help maintain an ethereum block chain truly distributed and decentralized.” The exchange said that their validators operate in Japan, Singapore, Ireland, Germany and Hong Kong.

Average performance coinbase validader versus ethereum Network. Source: Coinbase

Ether increases above $ 2,000 on March 20

The recent Coinbase report was followed by an increase in eth prices when eth accumulation addresses began to store significantly.

7 -day eth price graph. Source: Coingcko

On March 2, Ether reached a weekly maximum of $ 2,060.73, increasing by 12.3% in seven days. On March 19, the daily negotiation volume reached $ 17.4 billion, since its price exceeded $ 2,000.

The increase occurs when eth price feelings became bassists. On March 11, Yuga Labs Blockchain vice president suggested that eth could fall to $ 200 in a prolonged bearish market.

https://www.youtube.com/watch?v=fwo0hw_94a4

Magazine: Memecoins are dedicated, but Solana '100x better' despite the drop in income

NEWSLETTER

NEWSLETTER