The price of ethereum has been going through a horrible accident, since the second largest cryptography has lost more than half of its value in recent months.

What follows for eth?

Technical analysis

The daily table

ethereum's daily chart shows a clear descending trend in recent weeks, with the price constantly making lower and lowest high ups and downs. The breakdown below multiple levels of support, including the 200 -day mobile average (DMA), pointed out a change in the feeling of the market towards solidity.

Recently, eth has fallen below the psychological level of $ 2,000, testing a significant support zone of around $ 1,900. If the sale pressure continues, there is a low downward potential to $ 1,600.

The RSI is also around over -sales territory, which suggests a possible short -term rebound. However, while eth remains below the key level of $ 2,400, any recovery could be temporary. Bulls need to claim this level and the 200 -day mobile average to reverse the bearish trend, while greater weakness could lead to deeper correction.

The 4 -hour table

The 4 -hour table shows a descending wedge formation, which is generally a bullish investment pattern. The price is now testing the $ 1,900 support zone, and if the level is maintained, you can try to push higher around $ 2,000 and possibly the $ 2,100 resistance line. However, the lack of recovery of the $ 1,900 could lead to a breakdown of the wedge, which could worsen everything.

On the other hand, a decisive rupture above the wedge with a strong volume could confirm a bull reversal, while the consolidation or continuous rejection of resistance can indicate greater downward pressure.

Feelings analysis

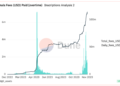

Open interest

The open interest table of ethereum (OI) provides valuable information on market positioning and the merchant's feeling. We can observe a significant decrease in both Price and OI, which suggests a strong disappointment event.

Historically, peaks in OI followed by rapid drops indicate liquidation waterfalls, where long overheated positions are eliminated, they often lead to an impulse down below. The recent Fall of OI is aligned with the rupture of eth below the key support levels of around $ 2,000 and falls to $ 1,800.

Given this data, eth could be in a reduced speculation phase as merchants close positions in the midst of uncertainty. This is aligned with the technical analysis, where eth has fought to claim key levels of resistance. However, a stabilization in OI could indicate that the worst of mass sale has been completed, establishing conditions for a possible relief rally.

However, for a sustainable recovery, open interest must begin to increase again together with the price, confirming a fresh capital that enters long positions instead of only short squeezes. Until then, a greater inconvenience is still possible, especially if eth cannot maintain the support zone of $ 1,800.

Free Binance $ 600 (Cryptopotato Exclusive): Use this link to record a new account and receive an exclusive welcome offer of $ 600 in Binance (Complete details).

Limited offer for Cryptopotate readers at Bybit: Use this link to register and open a free $ 500 position in any currency!

Discharge of responsibility: The information found in Cryptopotato is that of the aforementioned writers. It does not represent Cryptopotato's opinions on whether to buy, sell or make any investment. It is advisable to carry out your own research before making investment decisions. Use information provided under your own risk. See discharge of responsibility to obtain more information.

Cryptocurrency graphics By TrainingView.

<!– ai CONTENT END 1 –>

NEWSLETTER

NEWSLETTER