bitcoin (btc) bounced $ 76,606 on March 11, but the Bulls could not keep the price above $ 84,500 on March 12.

Nansen's principal research analyst, Aurelie Barthere, told Cointelegraph that bitcoin is in a macro correction in an upward market, with the next crucial level “$ 71,000- $ 72,000, higher in the negotiation range prior to the elections.”

Glassnode also projected a similar objective in its March 11 market report. Ochain's analysis firm said the recent sale of sales had been triggered by short -term holders that may have bought near the peak in January. Glassnode added that bitcoin could touch about $ 70,000 if the sale persists.

Cryptoe Daily Market Data. Fountain: Coin360

They are not just cryptographic markets; Even the US stock market has been under pressure in recent days. However, a silver coating for the Bulls is that the US dollar index (DXY) has corrected from its year of several years above 110 to less than 104. bitcoin generally moves in reverse correlation with the dollar, which suggests that a fund can be around the corner.

Could bitcoin try the support of $ 76,606 or increase above $ 85,000? What are the important levels of support and resistance to consider in Altcoins? Let's analyze the graphics of the 10 main cryptocurrencies to find out.

bitcoin pricing analysis

bitcoin broke below the level of $ 78,258 on March 10 and fell to $ 76,606 on March 11, but the Bears could not maintain the lower levels. This suggests a solid purchase of the bulls.

btc/USDT Daily graphic. Source: cointelegraph/tradingView

The relief rally faces the sale near the exponential mobile average of 20 days ($ 87,262), but a positive minor in favor of the Bulls is that the relative force index (RSI) is showing a positive divergence. Buyers will have to boost the price above 20 days to suggest that correction could be terminating. The btc/USDT par can ascend to the single mobile average of 50 days ($ 94,654).

On the negative side, the Bulls are expected to defend the level of $ 73,777 with all their forces because a break under the couple can sink at $ 67,000.

Ether Price Analysis

Ether (eth) fell below the support of $ 1,993 on March 9 and extended the decline, reaching $ 1,754 on March 11.

Daily eth/USDT table. Source: cointelegraph/tradingView

The Bulls are trying to start a recovery, which is expected to face a significant resistance at the $ 2,11. If the price drops sharply from $ 2,111, it will indicate that the bears have turned the level in resistance. That increases the risk of a break below $ 1,754. The eth/USDT torque can fall to $ 1,500.

On the contrary, a break above the 20 -day EMA ($ 2,235) suggests that markets have rejected rest below $ 2,111. The couple can rise to $ 2,800, where bears are expected to intervene.

XRP price analysis

XRP (XRP) fell below the support of $ 2 on March 11, but the Bears could not sustain the lower levels, as seen from the long tail in the candlestick.

XRP/USDT daily graph. Source: cointelegraph/tradingView

The Bears are trying to stop recovery in the 20 -day EMA ($ 2.35). If the price continues lower, the possibility of a break below $ 2 increases. If that happens, the XRP/USDT torque will complete a bold head and shoulder pattern. There is support less than $ 1.77, but if the level is broken, the decrease could extend to $ 1.28.

Contrary to this assumption, if the price breaks above the 20 -day EMA, the couple could reach the 50 -day SMA ($ 2.58) and later at $ 3.

BNB price analysis

BNB (BNB) appeared from $ 507 on March 11, indicating that the Bulls aggressively defend the support zone from $ 500 to $ 460.

BNB/USDT daily. Source: cointelegraph/tradingView

The relief rally is expected to face the sale of 20 days ($ 592). If the price is sharply reduced from the 20 -day EMA, the bears will try to sink the BNB/USDT PAR below $ 500. The pair can fall to $ 460 if you can achieve it.

On the other hand, if the price increases above the EMA of 20 days, it will indicate that the torque can remain within the range of $ 460 to $ 745 for a time more. The Bulls will return to the driver's seat at a break and close above the 50 -day SMA ($ 628).

Solana Price Analysis

Solana (Sun) increased from $ 112 on March 11, indicating that the bulls fiercely defend the $ 110 support.

SOL/USDT Daily Graphic. Source: cointelegraph/tradingView

The RSI shows early signs of forming a positive divergence, which indicates that the bassist impulse could weaken. The first force sign will be a break and will close above the 20 -day EMA ($ 145).

If the price is reduced from the current level or of the 20 -day EMA, it suggests that each minor rally is sold. That increases the risk of a break below $ 110. The Sun/USDT torque could fall to $ 98 and subsequently to $ 80.

Cardano Price Analysis

Cardano (ADA) recovered from the bullish trend line on March 11, suggesting that the bulls are trying to stop the decline.

ADA/USDT DAILY GRAPH. Source: cointelegraph/tradingView

It is unlikely that bears give them easily and are expected to be sold in mobile averages. If the price is reduced from mobile averages, it will indicate the sale in demonstrations. The bears will try to strengthen their position by drawing the price under the bullish trend line. If they do that, the Ada/USDT torque could fall to $ 0.60 and then to $ 0.50.

Contrary to this assumption, a break and a closure above mobile averages suggests that the bulls are back in the game. The pair can meet at $ 1.02.

Dogecoin pricing analysis

Dogecoin (Doge) continued its slide and reached the support of $ 0.14 on March 11. Bulls are trying to defend the level, but they can face the sale at higher levels.

Doge/USDT Diario Diario. Source: cointelegraph/tradingView

If the price is reduced from the EMA of 20 days ($ 0.20), it will suggest that the feeling is still negative and the merchants are selling in demonstrations. That increases the risk of a break below $ 0.14. The Dogado/USDT pair can descend to $ 0.10 if that happens.

Related: This is what happened in crypto today

On the contrary, a break and a closure above the 20 -day EMA suggests that the bears are losing their grip. The couple could rise to the 50 -day SMA ($ 0.25), which can raise a solid challenge again.

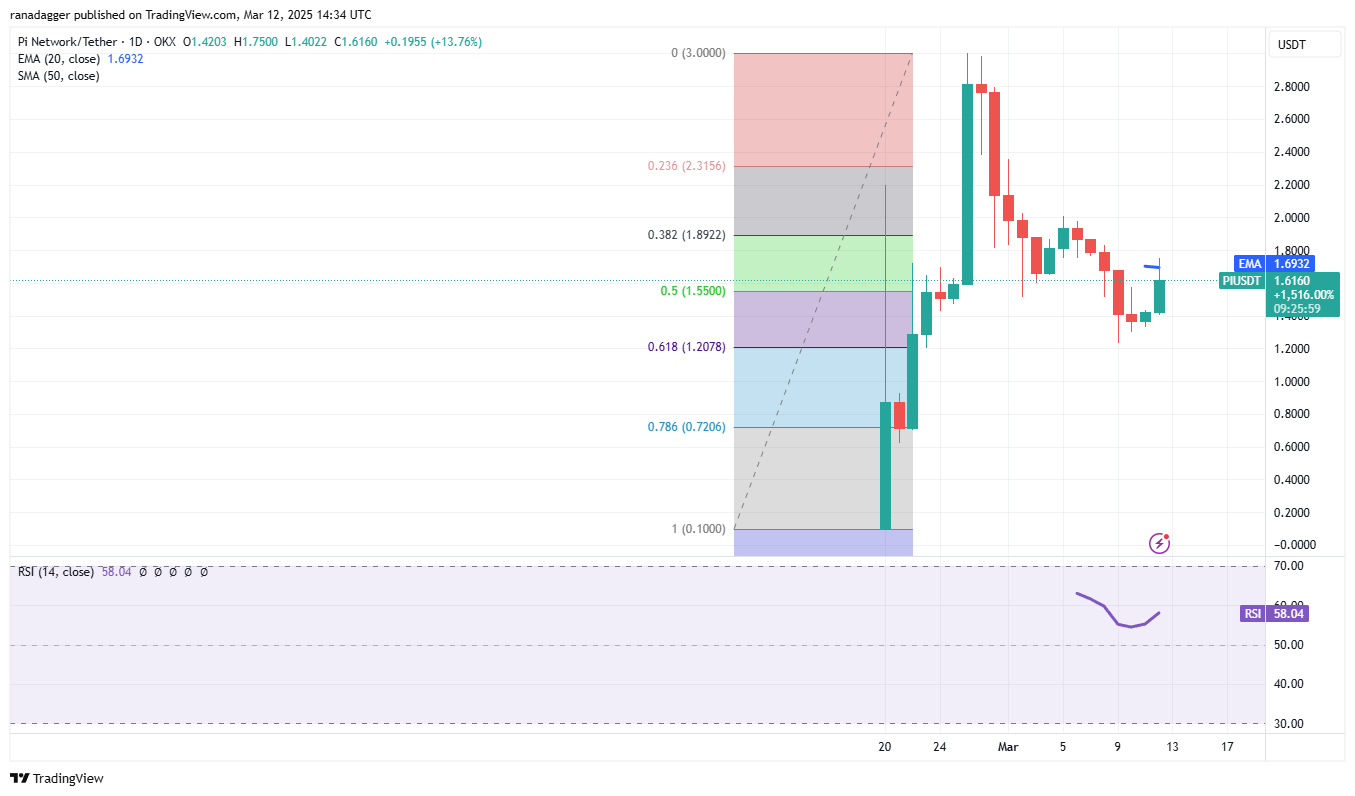

Pi price analysis

Pi (Pi) is taking support at the Fibonacci recoil level of 61.8% of $ 1.20, indicating at lower levels.

PI/USDT Daily Graphic. Source: cointelegraph/tradingView

It is expected that the relief rally in front of the 20 -day EMA ($ 1.69) and then again to $ 2. If the price is reduced from the resistance to general expenses, the PI/USDT pair could range between $ 2 and $ 1.20 for some time.

A break and close above $ 2 suggests that the correction may have finished. The couple could recover at $ 2.40. Alternatively, a break and closure below $ 1.20 could sink the torque at the back of 78.6% of $ 0.72.

One that the Lion Price Analysis

UNUS SED LEO (LEO) has been consolidating just below the level of $ 10 for several days, indicating that bulls cling to their positions while anticipating another higher leg.

Leo/USD Fourth Daily. Source: cointelegraph/tradingView

The Leo/USD pair has formed an ascending triangle pattern, which will be completed in a break and closure above $ 10. If that happens, the pair could resume the upward trend towards the target objective of $ 12.04.

This positive view will be invalidated in the short term if the price is reduced and broken below the bullish trend line. That will deny the upward configuration, starting a fall at $ 8.84 and then at $ 8.30.

Hedera pricing analysis

Hedera (HBAR) bounced the support of $ 0.17 on March 11, indicating that the bulls aggressively defend the level.

HBAR/USDT Daily graphic. Source: cointelegraph/tradingView

The recovery faces the sale in the EMA of 20 days ($ 0.22), as seen from the long wick in the candlestick. If the price continues lower, the bears will make one more attempt to sink the HBAR/USDT torque below $ 0.17. If they succeed, the couple could dive into $ 0.12.

On the contrary, a break above 20 days suggests that the sale pressure is being reduced. The couple could reach the bold trend line, which is an important level to consider. If buyers push the price above the line of bearish trend, the pair could recover at $ 0.29.

This article does not contain advice or investment recommendations. Each investment and trade movement implies risk, and readers must carry out their own investigation by making a decision.

NEWSLETTER

NEWSLETTER