bitcoin (btc) increased from $ 81,500 on March 4, and the Bulls are trying to extend recovery above $ 90,000 on March 5. However, some analysts do not expect bitcoin to develop in the short term. Bitfinex analysts said in a March 3 market report that bitcoin could face a “significant resistance” to $ 94,000.

In another precautionary note, the Xbtmanager cryptocant taxpayer said in a Quicktake post that bitcoin is likely to extend his consolidation for some time. Therefore, risky exchanges should be avoided in the coming months. The analyst said that the time will come to buy when the headlines in the short term, those who have less than 155 days, begin to sell and the long -term holders begin to buy.

Cryptoe Daily Market Data. Fountain: Coin360

While short -term price action remains uncertain, investors trust bitcoin's long -term perspectives. Mexican billionaire Ricardo Salinas said in a Bloomberg interview that 70% of his investment portfolio is in bitcoin -related assets, while the remaining 30% is composed of gold and gold miners.

What are the critical levels of support and resistance in bitcoin and Altcoins? Let's analyze the graphics of the 10 main cryptocurrencies to find out.

bitcoin pricing analysis

bitcoin seems to be forming a symmetrical triangle pattern, indicating indecision between buyers and vendors.

btc/USDT Daily graphic. Source: cointelegraph/tradingView

The btc/USDT PAR reached the exponential mobile average of 20 days ($ 91,174), which is an important resistance to take into account. A break above 20 days suggests that the sales pressure is being reduced. Then, the torque will try to rise above the resistance line of the triangle and load towards the simple mobile average of 50 days ($ 97,259). A break and close above the 50 -day SMA notes that the Bulls are back in the game.

This optimistic view will be denied in the short term if the price is abruptly reduced from the 20 -day EMA and breaks under the triangle. That could result in a new evidence of the minimum intradic of February 28, $ 78,258.

Ether Price Analysis

Ethher (eth) was carried out below $ 2,000 on March 4, but the Bulls bought aggressively at the lowest levels, as seen in the long tail in the candlestick.

Daily eth/USDT table. Source: cointelegraph/tradingView

Buyers have a uphill task ahead, since it is likely that the relief rally in front of a solid resistance of 20 days ($ 2,467) and the next in the line of bearish trend. If the price is reduced from resistance to general expenses, the bears will try to sink and keep the eth/USDT below $ 2,111. If they manage to do that, the couple could fall to $ 1,750.

The first sign of force will be a closure above the line of bearish trend. That suggests that bears are losing their grip. The couple can meet at $ 3,400.

XRP price analysis

XRP (XRP) has been falling within a descending channel pattern for several days, which indicates buying a close support and selling near the resistance.

XRP/USDT daily graph. Source: cointelegraph/tradingView

Both mobile averages have flattened, and the RSI is close to the midpoint, indicating a balance between supply and demand. If the price remains above the 20 -day EMA ($ 2.47), the Bulls will try to push the XRP/USDT torque to the resistance line. A break and close above the channel opens the doors for a rally at $ 3.40.

On the contrary, if the price is reduced from the EMA of 20 days and breaks below $ 2.53, it will suggest that the bears have the advantage. The sale could resume a break and close below $ 1.99. The couple can fall into $ 1.27.

BNB price analysis

BNB (BNB) broke below the support of $ 557 on March 4, but the bears could not maintain the lowest levels.

BNB/USDT daily. Source: cointelegraph/tradingView

The Bulls are trying to start a recovery, which is expected to face the sale of 20 days ($ 619). If the price is abruptly reduced from the 20 -day EMA, it will suggest that the feeling is still negative and merchants are selling in demonstrations. That increases the risk of a break below $ 546. If that happens, the BNB/USDT pair could submerge in $ 500.

This negative view will be invalidated in the short term if the price continues higher and breaks above the 50 -day SMA ($ 646). The couple could rise to $ 686.

Solana Price Analysis

Buyers aggressively defend the support of $ 125 in Solana (Sol), as seen in the long tail in the candlestick of March 4.

SOL/USDT Daily Graphic. Source: cointelegraph/tradingView

There is a resistance less than $ 151, but if that crosses, the sun/USDT torque could reach 20 days ($ 161). Sellers are expected to defend the area fiercely between the EMA of 20 days and $ 180. If the price is reduced from the general expenses zone, the torque can range between $ 180 and $ 125 for a while.

Contrary to this assumption, if the price is reduced and breaks below $ 125, it will indicate that each minor rally is sold. The couple could fall to $ 110 and then to $ 100.

Cardano Price Analysis

Cardano (ADA) has witnessed violent movements in recent days, pointing out a hard battle between bulls and bears.

ADA/USDT DAILY GRAPH. Source: cointelegraph/tradingView

The Ada/USDT bounced in the 20 -day EMA ($ 0.80) on March 4, indicating that the lowest levels attract buyers. If the price remains above $ 1, the bulls will try again to take the torque to $ 1.25.

In general, high volatility periods are followed by a range compression. If the price is not maintained above $ 1, it will indicate the sale in demonstrations. That can maintain the pairs range between the EMA of 20 days and $ 1 for some time.

Dogecoin pricing analysis

Dogecoin (Doge) turned from the EMA of 20 days ($ 0.23) on March 3 and broke under the support line.

Doge/USDT Diario Diario. Source: cointelegraph/tradingView

A little positive for the Bulls is that they have not allowed the price to slide below the $ 0.18 support. Buyers will try to press and maintain the price above the 20 -day EMA. If they can achieve it, it will suggest that the break under the channel may have been a trap for bears. The Dogado/USDT pair could reach the 50 -day SMA ($ 0.28).

On the negative side, a break and closure below $ 0.18 could begin the next stage of the bearish trend at $ 0.14 and, finally, to solid support at $ 0.10.

Related: 3 reasons why bitcoin is sold at Trump Tariff News

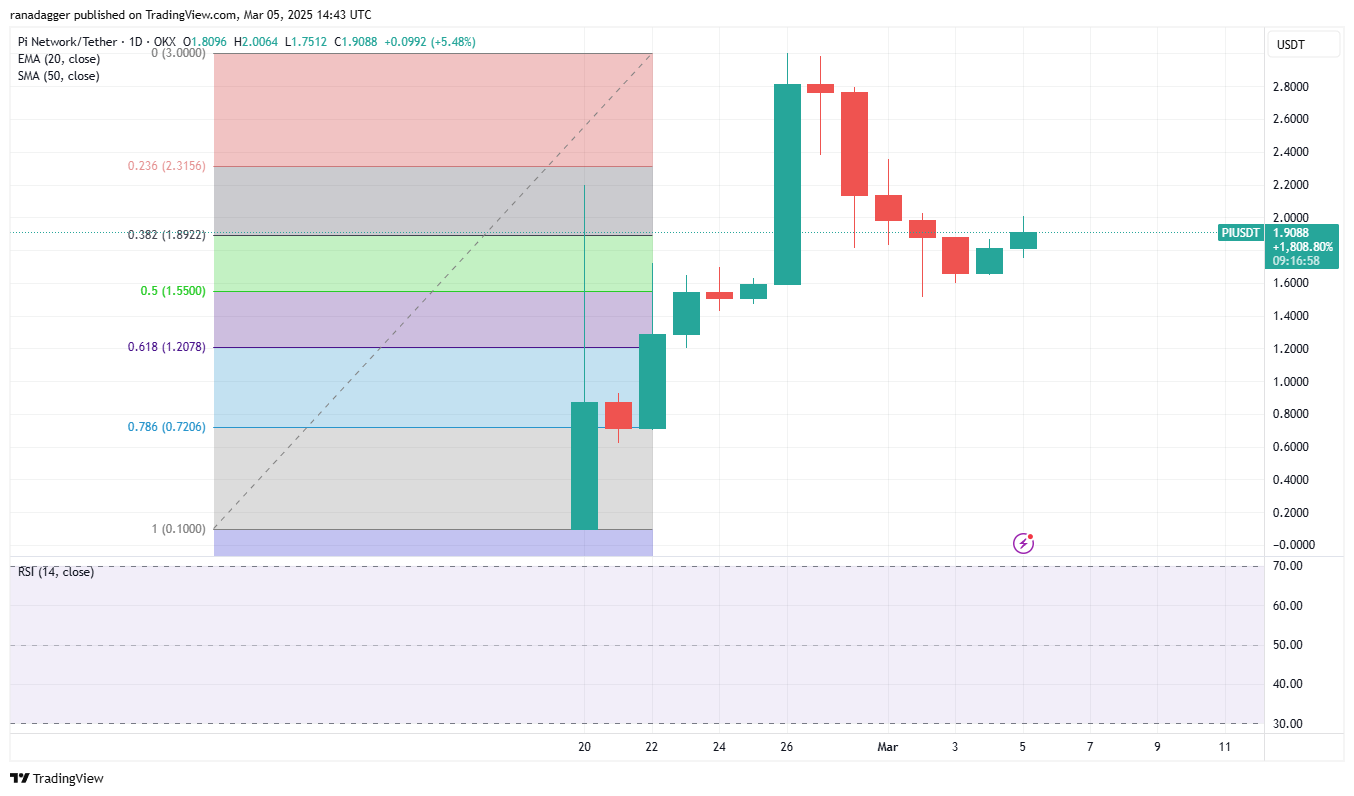

Pi price analysis

Pi (Pi) witnessed a mass demonstration from $ 0.10 on February 20 to $ 3 on February 26, indicating the aggressive purchase of the Bulls.

PI/USDT Daily Graphic. Source: cointelegraph/tradingView

The profit reserve dropped the price on February 27, and the PI/USDT torque is supporting the Fibonacci recoil level of 50% of $ 1.55. The pair will try a relief rally at $ 2.38 and then at $ 2.80. A break and close above $ 3 will indicate the resumption of the upward trend towards $ 4.45.

However, it is unlikely that bears give up easily. They will try to sell the demonstrations and get the price below the $ 1.55 support. If they manage to do that, the torque could fall to the 61.8% of $ 1.20.

Hedera pricing analysis

Hedera (HBAR) has been operating among mobile averages during the last three days, indicating uncertainty about the following directional movement.

HBAR/USDT Daily graphic. Source: cointelegraph/tradingView

The 20 -day EMA ($ 0.23) has begun to appear gradually, and the RSI is just above the midpoint, which suggests a slight advantage for the Bulls. A break and close above the 50 -day SMA ($ 0.26) could start a rally at $ 0.32 and then at $ 0.35.

Alternatively, a break and closing below $ 0.22 suggests that the Bears are back in command. The HBAR/USDT torque can fall to $ 0.17, which is an important level for buyers to defend.

Chainlink Price Analysis

Chainlink (link) slid under the support line of the descending channel pattern on March 4, but the bulls bought the sauce as seen in the long tail in the candle.

Daily graphic link/USDT. Source: cointelegraph/tradingView

Buyers will have to press and maintain the price above the EMA of 20 days ($ 16.67) to suggest that the sales pressure is being reduced. The Link/USDT torque could reach the 50 -day SMA ($ 20.12), which probably acts as strong resistance.

On the contrary, if the price is reduced from the current level and closes below the support line, it will indicate that the bears remain in control. The sale could accelerate below $ 13.08, carrying the torque towards $ 10.

This article does not contain advice or investment recommendations. Each investment and trade movement implies risk, and readers must carry out their own investigation by making a decision.

NEWSLETTER

NEWSLETTER