In a week marked by the historic debut of spot bitcoin ETFs on Wall Street, the cryptocurrency market witnessed an increase in ticketswith bitcoin, ethereum and XRP leading the way.

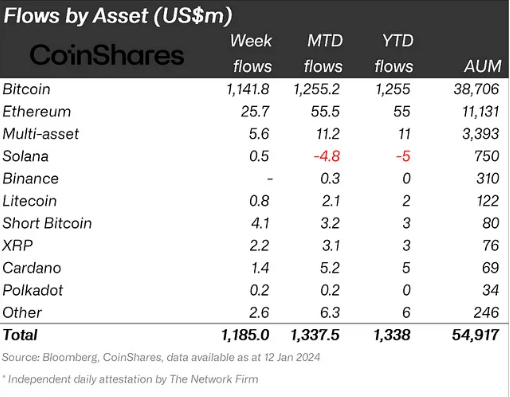

Despite failing to break records set by futures-based ETFs, the influx of $1.18 billion paints a picture of cautious optimism that cautiously welcomes the alpha cryptocurrency into the financial fold.

James Butterfill, head of research at CoinShares, said this figure was still a far cry from the record $1.5 billion for futures-based bitcoin ETFs in October 2021.

bitcoin leads the pack

While bitcoin reigned supreme with $1.16 billion in inflows, its price fell slightly, hinting at investor apprehension. ethereum, however, painted a contrasting picture: its $26 million inflows pushed its price above $2,500. XRP, the resurgent loser, recorded inflows of $2.2 million, the largest among altcoins, and its price rose 1%.

The increase in trading volumes in the three major cryptocurrencies indicates a resounding resurgence in market activity. In just a span of 24 hours, bitcoin experienced an impressive 40% increase in trading volume, underscoring a notable uptick in investor interest.

ethereum reflected this enthusiasm by doubling its trading volume, indicating a significant increase in transactional engagement within the ecosystem. Not to be outdone, XRP witnessed an extraordinary 90% increase in its trading volume, further intensifying the overall market dynamics.

Change in market dynamics

This frenetic surge in trading activity serves as a compelling indicator of a market awakening, with investors cautiously repositioning themselves and testing the waters. Palpable anticipation is evident as investors stand on the brink of decisive action, fingers hovering over the buy button.

The market appears to be undergoing a shift, as participants actively respond to evolving trends and opportunities, marking a potentially pivotal moment in the trajectory of these cryptocurrencies.

bitcoin currently trading at $42,725. Chart: TradingView.com

But the party is not for everyone. Altcoins as Cardano and Solana, once darlings of the cryptosphere, saw their inflows decline. This selective enthusiasm highlights the new discerning palates of investors, who prioritize established players like bitcoin and ethereum over the speculative shine of lesser-known coins.

Geographically, the panorama is no less intriguing. The United States, the land of opportunity for bitcoin ETFs, unsurprisingly led the charge with $1.24 billion in inflows. Europe, however, presented a different picture: Germany, Canada and Sweden recorded notable outflows.

It is not yet known what the long-term impact of spot bitcoin ETFs will be. Some experts anticipate long-term gains, while others remain cautious and question the sustainability of the current rally.

One thing is certain: the cryptocurrency market has taken a hesitant step towards Wall Street, but the path forward remains shrouded in uncertainty. Will bitcoin become Wall Street's darling or will its appeal fade under the harsh gaze of scrutiny?

The next chapter of the cryptocurrency saga is just beginning.

Featured image from Shutterstock