Key notes

- Etfs ethereum also saw net exits of $ 3.6 million, which reflects a cautious feeling ahead of Trump's tariff announcement.

- With President Trump ready to present tariffs sweeping on April 2, merchants remain uncertain about their impact on global markets and cryptography.

- In the midst of macroeconomic uncertainty, gold continues to reach the maximum fresh, with 58% of fund managers that favor it about bitcoin.

The day of the release of the Trump rate on April 2 is here, and investors are making cautious movements, taking out a total of $ 222 million from the United States bitcoin

btc

$ 84 779

24h Volatility:

1.1%

MARKET CAUT:

$ 1.68 t

Volume 24h:

$ 27.62 b

ETF and EE. UU. ethereum

eth

$ 1 872

24h Volatility:

0.5%

MARKET CAUT:

$ 225.94 b

Volume 24h:

$ 15.01 b

ETF in the first two days of this week.

After some tickets during the past week, the US bitcoin ETF flows have become net negatives once again, with the FBTC of Fidelity leading the outputs. Bitwise (Bitb), Ark Invest (ARKB) and Wisdomtree (BTCW) led the exits of $ 60.6 million on March 31, while the Blackrock Ibit was the only background to record positive tickets.

However, on April 1, the departures increased even more to $ 158 million, with FBTC and Arkb leading the position. On the other hand, Ishares bitcoin Trust (Ibit) of Blackrock has been trying to keep the line with only minor tickets. In the same way, ethereum ETFS saw net exits of $ 3.6 million, according to <a target="_blank" href="https://farside.co.uk/eth/” target=”_blank” rel=”nofollow”>Data from the distant partindicating a cautious feeling among institutional investors.

<blockquote class="twitter-tweet”>

The bitcoin Spot ETF saw an output of $ 157.8 million yesterday.

The ethereum ETFS spot saw an output flow of $ 3.6 million.

Institutions are reducing the risk before today's fee announcement! pic.twitter.com/blw5xpej6u

– crypto Rover (@Rovercrc) <a target="_blank" href="https://twitter.com/rovercrc/status/1907281414099247315?ref_src=twsrc%5Etfw”>April 2, 2025

bitcoin investors, ethereum ETF are still cautious before Trump's release day

Before Trump's release announcement on April 2, merchants are adopting a cautious approach to “wait and see”. The president of the United States, Donald Trump, has already suggested his intentions to present new tariffs. As a result, market participants are preparing for volatility ahead as the global tariff war progresses.

Currently, investors are not sure of their broader impact on the economy and cryptographic markets.

<blockquote class="twitter-tweet”>

Market view update

The markets drag higher if the headlines remain neutral to benign this week, then freeze while we wait on April 2, which is the announcement of reciprocal rates day or, as Trump called it, the day of liberation.

April 2 is similar to the night of the elections. It is the biggest event of …

– Alex Krüger (@kRugermacro) <a target="_blank" href="https://twitter.com/krugermacro/status/1903867854790775237?ref_src=twsrc%5Etfw”>March 23, 2025

Despite bitcoin's struggle to attract institutional flows of safe refuge, its long -term perspective remains strong. This is evident since the supply of bitcoin in exchanges has fallen to 7.53%, the lowest level since February 2018, indicating a greater feeling of possession among investors.

bitcoin–ethereum-etf-outflows-surge-ahead-trump-tariff-liberation-day-1.jpg” alt=””/>

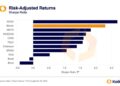

Gold becomes the final winner

While bitcoin sees a strong sales pressure, the price of gold has continued to reach the maximum fresh in the middle of the macro uncertainty ongoing.

<blockquote class="twitter-tweet”>

bitcoin = digital risk, no digital gold

bitcoin is blocking more than actions, but people still call it “digital gold.” But if it were really digital gold, wouldn't it act as gold? Instead, bitcoin behaves as a high -risk asset, as well as penny stocks. So why … pic.twitter.com/jw1lg3SJVU

– Peter Schiff (@peterschiff) <a target="_blank" href="https://twitter.com/PeterSchiff/status/1907222310446092469?ref_src=twsrc%5Etfw”>April 2, 2025

A Bank of America survey revealed that 58% of fund managers favor gold as a safe asset amid commercial war concerns, while only 3% support bitcoin.

next

Discharge of responsibility: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to offer precise and timely information, but should not be taken as financial or investment advice. Since market conditions can change quickly, we recommend that you verify the information on your own and consult a professional before making any decision based on this content.

Bhushan is a Fintech enthusiast and has a good style to understand financial markets. His interest in the economy and finance attracts their attention to the new emerging blockchain technology and cryptocurrency markets. It is continuously in a learning process and remains motivated by sharing your acquired knowledge. In free time, read suspense fiction novels and sometimes explore their culinary skills.

<a target="_blank" href="https://twitter.com/bhushanakolkar?lang=en” rel=”nofollow noreferrer noopener” target=”_blank”>Bhushan Akolkar in x

<script async src="//platform.twitter.com/widgets.js” charset=”utf-8″>

NEWSLETTER

NEWSLETTER