The United States Securities and Exchange Commission (SEC) lawsuit against Binance, accusing the cryptocurrency exchange of violating various securities laws, has directly affected the cryptocurrency market and the balance sheet of the bag.

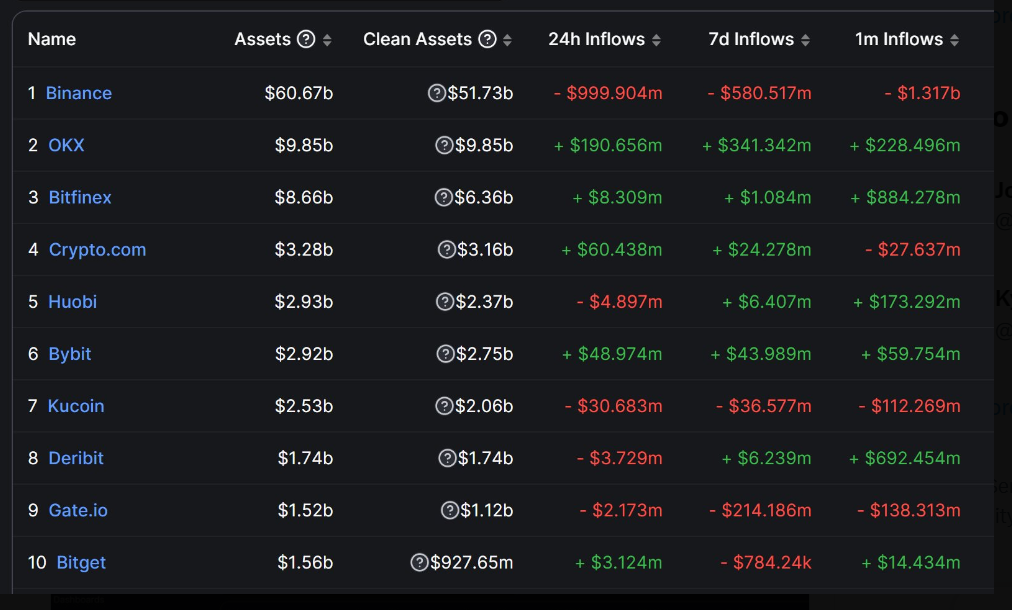

According According to data from cryptanalysis firm Nansen, Binance saw negative net flows of $778 million into the Ethereum blockchain, with $871 million inflows dominated by $1.6 billion flowing out of the exchange.

As of 9:15am UTC at the time of writing, in the 24 hours since the SEC charges, Ethereum-based tokens have seen negative net flows, with $14.8 million in assets flowing in and $50.5 million in assets leaving the exchange in the past. hour alone.

Binance’s reserve assets saw a net outflow of approximately $1.4 billion in the first hour after news of the SEC charges broke, representing 2.6% of its total reserve assets of $52 ,9 billion.

Binance’s outflow of funds across all protocols in the last 24 hours reached $999 million. Deteriorating trust in Binance, on the other hand, has helped OKX become the next destination of choice for traders, as the exchange saw a significant inflow of over $190 million.

Compared to the March 2023 Commodity Futures Trading Commission (CFTC) demand, the recent net outflow is substantial but less than the December 2022 period. Additionally, this net flow is still less than the reserve from the bag. The cryptocurrency exchange still has a healthy stablecoin balance of over $8 billion.

This is a developing story; more information will be added as it becomes available.

NEWSLETTER

NEWSLETTER