The Arbitrum (ARB) price has fallen nearly 20% a week after setting its all-time high at $1.60 on March 23. However, it seems that the Ethereum layer 2 token will resume its bullish trend in the coming weeks.

Polygon Price Fractal

Signs for a bullish Arbitrum token date back to the market debut of rival Ethereum L2 Polygon.

MATIC began trading on Binance on April 26, 2019 at $0.0026 per token. MATIC/USD rallied nearly 300% to hit $0.0105 the same day before wiping out 70% of those gains in a market correction on May 9, 2019.

It subsequently regained its bullish momentum, rallying nearly 1,350% to $0.045 on May 21, 2019.

The price trajectory reflects a recurring phenomenon involving the launch of digital tokens with apparently strong fundamental backing, according to Mac independent market analyst.

For example, Solana (SOL), a Layer 1 blockchain, rallied 50,000% before going through a similar phase of pumping, correcting, and sideways consolidation after its April 2020 IPO debut.

Arbitrage price could reach $2 in April

From a fundamental perspective, Arbitrum has become a strong contender in the Ethereum L2 space in recent months, with several leading DeFi protocols including GMX, Uniswap, Sushi, and Aave among its users.

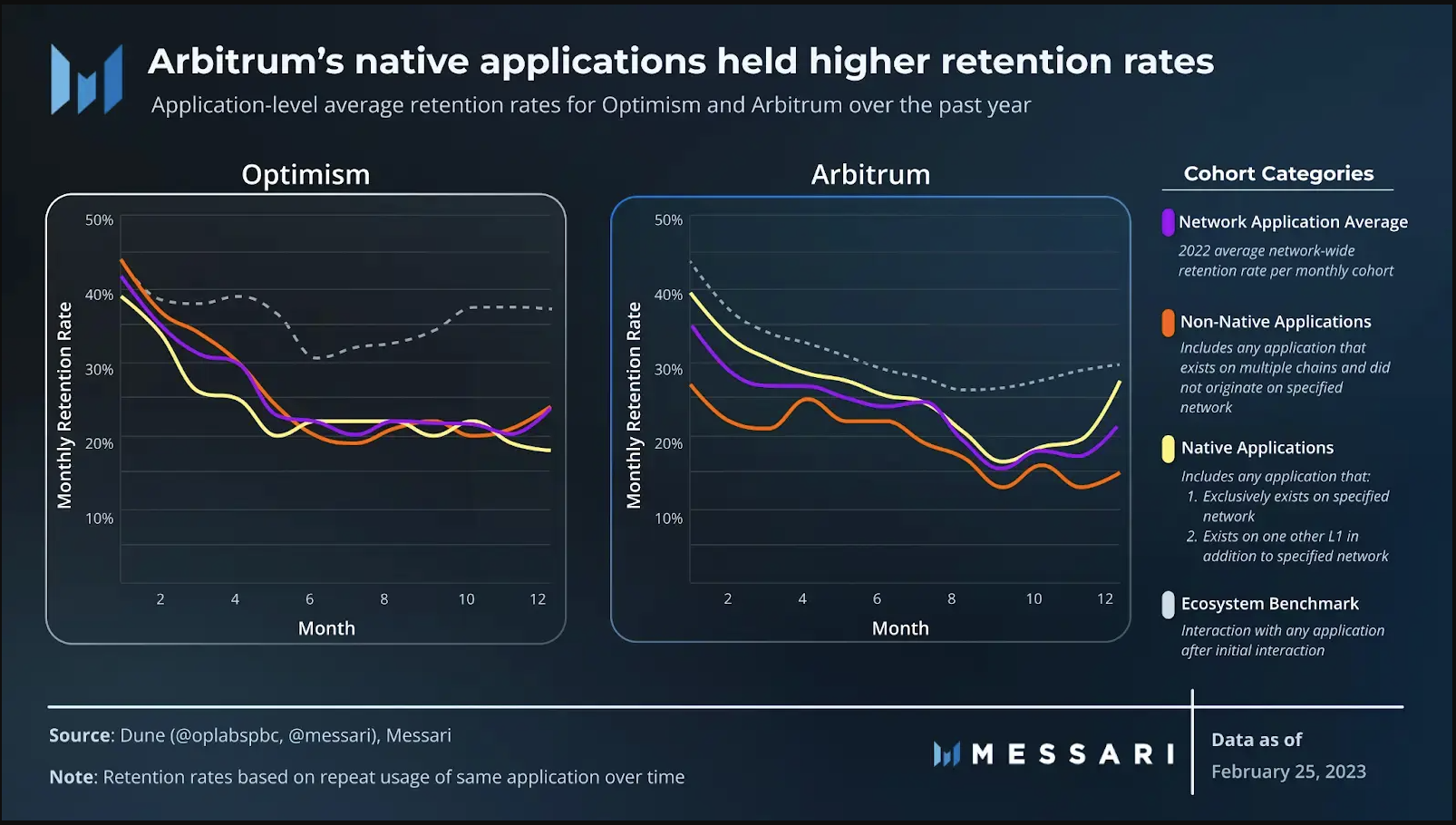

“GMX and Radiant on Arbitrum are two of the fastest growing protocols in terms of fundamentals and price appreciation this year.” noted Dustin Teander, a researcher at analytics firm Messari, adds: “

“Looking at user retention metrics, it’s clear that these protocols have gained superior market traction compared to imported protocols like Uniswap or Aave.”

As of March 29, the total value locked (TVL) in Arbitrum pools increased to $2.2bn from $981m three months ago, according to the data resource. Defi Flame.

Related: Arbitrum airdrop sells on listing, but traders remain bullish on ARB

Mac noted that Arbitrum’s strong fundamentals could limit ARB’s downside prospects and prompt traders to re-accumulate the token in the coming weeks.

That may lead to another price spike, targeting $2 by April 2023, as illustrated below.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

NEWSLETTER

NEWSLETTER