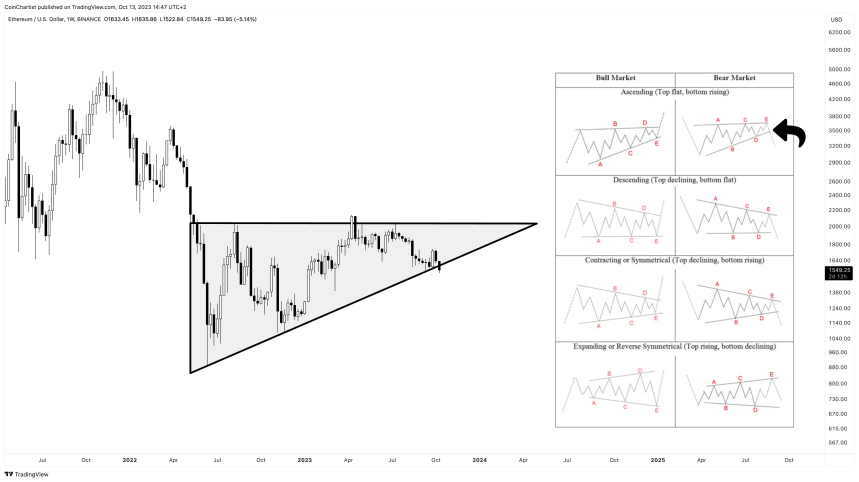

ethereum price is trading at around $1,550 after failing to break above $2,000 again throughout 2023 so far. Increasingly higher lows over the year and a horizontal resistance zone had formed an ascending triangle, a potentially bullish chart pattern.

However, this pattern may be failing. A broken pattern target could take the price per eth below $1,000.

Is the bullish chart pattern breaking down? | ETHUSD on TradingView.com

ethereum Ascending Triangle Begins to Break Down: $700 Target

ethereum hit its bear market low in June 2022, while bitcoin and other coins continued to decline through the end of the year. Despite early leadership in a bear market rally, eth underperformed btc in 2023. It now risks falling to a new low with a target well below $1,000 if a suspected bullish pattern breaks down instead of up.

ETHUSD has been trading what appears to be a textbook ascending triangle pattern from its 2022 local low. A series of higher and higher highs has created a decelerating ascending trend line. A horizontal resistance zone around $2,000 has kept the price action in check. Volume has been trending downward throughout the pattern. The price is approximately two-thirds from the apex of the triangle.

Ether even had positive news under its belt: the launch of the first ethereum Futures ETFs. However, it has failed to produce any significant upside and is now trying to pull back causing a breakout of the bullish pattern. If the pattern breaks down, you would have a target of around $700 per eth based on the measurement rule.

Or is the a bearish barrier triangle anyway? | ETHUSD on TradingView.com

Elliott Wave Explained: Golden Fibonacci Extension Targets $300 eth

Although the ascending triangle is considered a bullish chart pattern, it only has about a 63% chance of breaking, according to the Thomas Bulkowski’s Encyclopedia of Chart Patterns. The remaining 37% of the time it breaks. But technical analysis is a broad study. An ascending triangle for one trader could be a barrier triangle for another.

A barrier triangle is simply an ascending or descending triangle as defined by the Elliott Wave Principle. In the Elliott wave principle, triangles are especially revealing. They only appear before the final movement in a sequence. Because Elliott Wave labels waves with the trend from 1 to 5, the triangles are corrective and appear only at the place of wave 4, just before wave 5 which ends the sequence.

In a bear market, corrective structures are called ABC. The triangles themselves may appear during a B wave, which is once again ahead of the final move in the ABC count. Wave C targets are often found projecting the 1.618 Fibonacci ratio from wave A. This makes the broken pattern target around $300 per eth. Between the gauge rule and the Fibonacci extension target, ethereum could face prices below $1,000 in the future.

Could Ether fall sub-$1000? | ETHUSD on TradingView.com