The company behind the issuance of the USDT stablecoin, Tether Holdings, has announced that it will work with a third-party exchange to convert 750 million USDT from Tron to Ethereum ERC20 via a chain exchange.

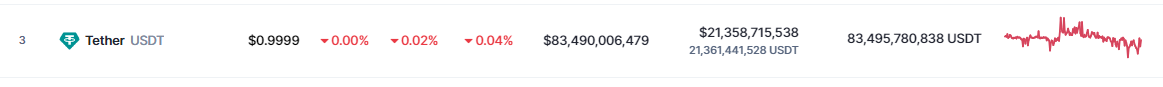

With a current market valuation of $83.37 billion, USDT is by far the most valuable stablecoin out there. Stablecoin usage has skyrocketed in recent years, and Tether has been working hard to diversify its reserves in response to the growing need for trust in the network.

To keep the coin’s liquidity stable, cryptocurrency exchange Binance said via Twitter on Monday that it will organize an exchange of 750 million Tether-Tron token pairs for Tether-Ether. Tether has ensured that the overall supply of USDT will not rise or fall as a result of this.

After 12:00 UTC today, #Binance will exchange 750 million USDT-TRX for USDT-ETH directly with the Tether team to ensure liquidity of the stablecoin across all chains for our users.

If you see any significant USDT movement from our wallets today, that is why.

The funds are SAFU.

—Binance (@binance) June 12, 2023

Tether crashes at the 1:1 USD anchor

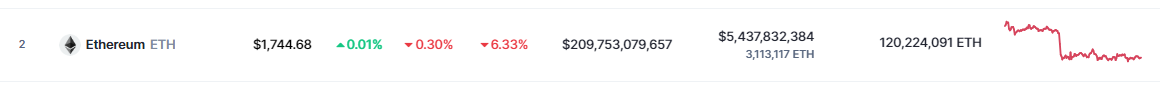

Tether, the most popular stablecoin, strives to maintain a one-to-one exchange rate with the US dollar (USD) at all times. This token swap will involve Tron, the ninth largest cryptocurrency by market cap at $6.3 billion, and Ether, the second largest cryptocurrency by market cap at $210 billion, after Bitcoin.

By exchanging bitcoins from one blockchain to another, or “chain swapping,” investors can gain access to all of the blockchains that support the digital money they hold. Your digital assets can be used on other blockchains that support them.

The move to rebalance the liquidity base of USDT on Ethereum by going from the region of surplus to the region of scarcity remains the most reasonable explanation for the various theories being put forward as to why USDT is shifting.

Meanwhile, the increased regulatory scrutiny of Binance has been detrimental to the exchange, prompting this strategic shift. Binance is now involved in litigation with the US Securities and Exchange Commission, highlighting the importance of taking preemptive action in light of the current regulatory environment.

ETH market cap currently at $210 billion. Chart: TradingView.com

Replenishment of Ethereum network inventory

Binance, its CEO Changpeng Zhao, and Binance.US were named in a lawsuit filed by the SEC last week. Binance has been accused of engaging in alleged deceptive activities, manipulating trade volumes, siphoning user funds, and keeping secret the identity of those who control the company in the United States.

Tether re-minted $1 billion worth of USDT on the Ethereum blockchain on Monday, prompting the exchange. Tether CTO Paolo Ardoino tweeted that the recent minting of $1 billion was part of the company’s effort to restock its storage on the Ethereum network.

In a related development, as of March, both the Tron Foundation and its creator, Justin Sun, were indicted for fraud by the SEC. As a result, Binance USA announced that it will delist the tron digital asset token from its exchange.

At the time of writing, Ether (ETH) was trading at $1,744, down 6.33% over the past seven days, according to data from the crypto market tracker. CoinMarkeCap Tether (USDT), on the other hand, is painted red and is trading at $0.99.

Source: CoinMarketCap

Featured image from The Cryptonomist

NEWSLETTER

NEWSLETTER