Ether (ETH) price faced resistance after reaching the $1,970 level on July 3. A number of factors limited the rally, including higher odds for more interest rate hikes in the coming months and a tighter cryptocurrency regulatory environment.

Fed macro headwinds

In addition to external factors, the Ethereum network has faced withdrawals from its smart contract applications, also putting the June rally in jeopardy.

Investors are now wondering if the tailwinds from Bitcoin (BTC) ETF applications have faded, opening room for a correction to the $1,700 level last seen on June 16.

Recent macroeconomic events can provide some indications, including the US gross domestic product growing 2% annualized in the first quarter, the German Consumer Price Index rising 6.8% in June compared to the previous year and global service purchasing managers from China Caixin. index (PMI) that reports the expansion of activity.

Therefore, strong economic indicators have raised investor expectations for further tightening measures by the US Federal Reserve.

Fed Chairman Jerome Powell’s suggestion of two more interest rate hikes in 2023, along with the rising cost of capital and higher yields on fixed-income investments, have dampened interest in cryptocurrencies.

On the regulatory front, the most pressing news and events included:

TVL approaches 3-year lows as grid demand falls

The Ethereum network is likely to face its own challenges, particularly after co-founder Vitalik Buterin stated on June 29 that he does not stake all of his Ether due to the complexities associated with multi-signature wallets.

Total Value Locked (TVL), which measures deposits locked in Ethereum smart contracts, hit its lowest level since August 2020. The indicator declined 3.1% to 13.7 million ETH in the previous 30 days. to July 4, according to DefiLlama.

Lower TVL means that investors are either losing interest in using network smart contracts or have moved to Layer 2 alternatives in search of lower transaction fees. Either way, the potential demand for the Ethereum network is negatively affected, so it is interpreted as bearish.

ETH Price Gains Driven by Leveraged Longs

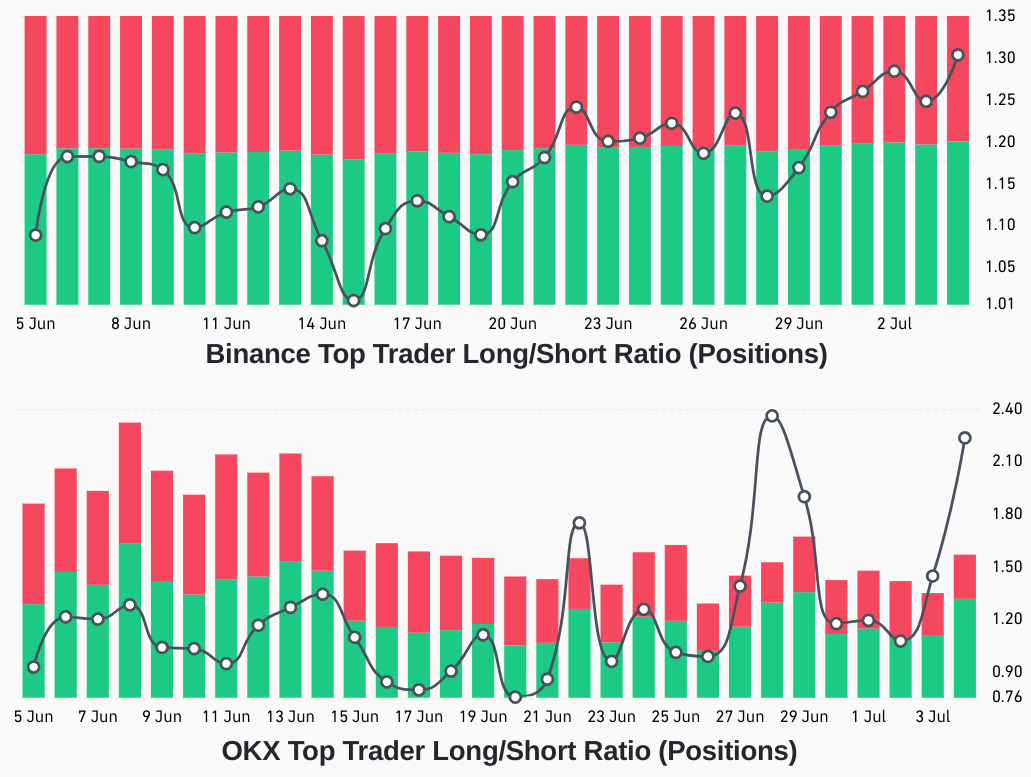

Analyzing the positions of professional traders in ETH derivatives is crucial to determine the probability of the Ether price breaking out of the $1970 resistance level.

There are occasional methodological discrepancies between different exchanges, so readers should monitor changes rather than absolute numbers.

Despite Ether trading within a tight range of $1815 to $1975 since June 22, professional traders have increased their leveraged long positions in futures, as indicated by the long to short ratio.

On the Binance cryptocurrency exchange, the long-to-short ratio rose sharply, from 1.14 on June 20 to 1.30 on July 4. Similarly, on OKX, the long to short ratio also rose from 0.76 on June 20 to a high of 2.25 on July 4. July 4, favoring leveraged longs.

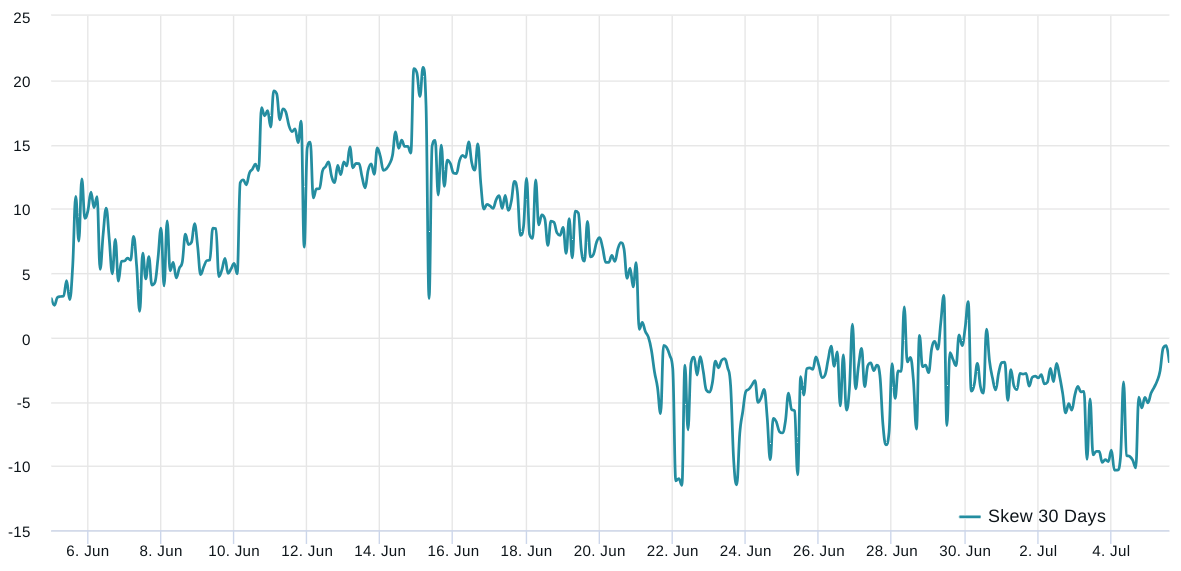

To exclude externalities that might have affected only Ether futures, the ETH options markets should be analyzed. The 25% delta bias indicator compares similar call and put options and will turn positive when fear prevails because the protective put premium is higher than call options.

The bias indicator will move above 8% if traders fear an Ether price drop. On the other hand, general enthusiasm reflects a negative bias of 8%.

As shown above, the delta bias flirted with subdued optimism between July 3-4, but was unable to sustain that level. Currently, the negative 2% metric shows balanced demand for put and call options.

Related: The Supreme Court Could Stop the SEC’s War on Crypto

ETH at $1,700 may be distant, but so is $2,000

Given these four reasons, namely higher long-to-short leverage ratio, decreasing TVL, potential interest rate hikes, and tighter crypto regulation, ETH bears are in a better position to contain the positive price impact coming from the Bitcoin ETF saga.

Although these factors may not be enough to drive the ETH price down to $1,700, they do present significant hurdles for ETH bulls. Notably, the previous attempt to break $2,000 on April 13 lasted less than a week. Therefore, in the short term, the bears have a better chance of successfully defending the $1970 resistance.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts and opinions expressed herein are those of the author alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

NEWSLETTER

NEWSLETTER