Ethereum has been the dominant smart contract and decentralized application (Dapp) network since its inception. An analysis based on the price of Ether (ETH) and its market capitalization shows indisputable evidence that the blockchain has been gaining market share over time.

As shown above, Ether’s dominance in terms of market capitalization has grown over the past two years, from an average of 18% in July 2021 to 20% today. Excluding Bitcoin (BTC) from the analysis, Ether’s market share currently stands at 40.6%, while the next competitor, BNB, has a share of 7.2%.

This shows the disparity between the leading Dapp-focused network and incumbents, which is also evident when looking at the total value locked (TVL) in each network’s smart contracts. Ethereum is the all-time leader with $24.6 billion in TVL, followed by Tron’s $5.4 billion and BNB Chain’s $3.3 billion.

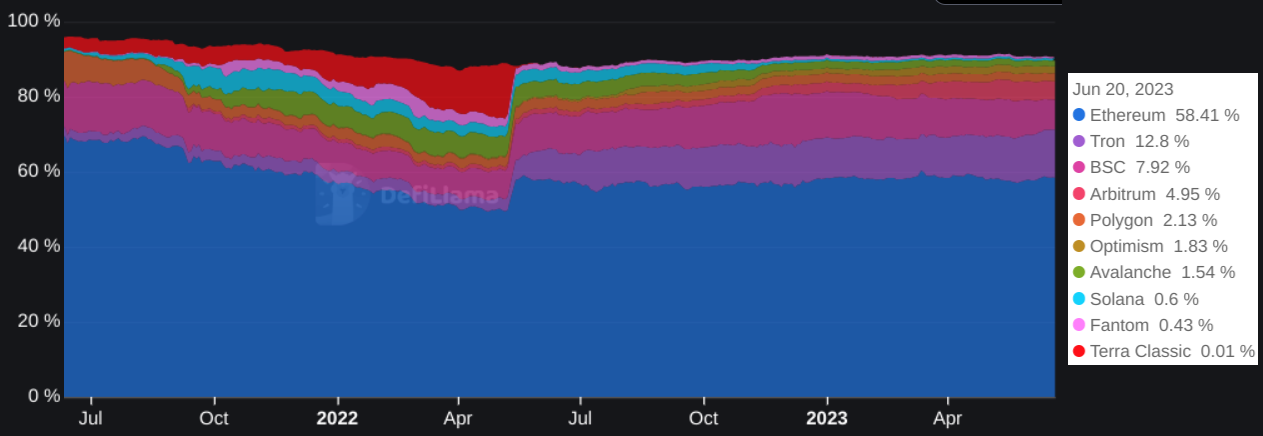

The graph above shows the fall of the TVL market share of the Ethereum network from 70.5% in June 2021 to 49.5% in May 2022. The move came as Terra and Avalanche gained a combined market share 20% on smart contract deposits. However, after the collapse of the Terra-Luna ecosystem in May 2022, culminating in developers halting network activity, Ethereum quickly regained a 58% market share.

Despite the appearance of Dapps on the BNB and Tron blockchains, Ethereum’s leadership has not been challenged for the past 12 months. This data shows the irrelevance of the total number of unique active wallets interacting with smart contracts (UAWs) per chain.

For example, according According to DappRadar, WAX has 363,600 active users, followed by BNB Chain’s 30-day 517,300 UAW. These numbers are much higher than the 66,300 unique active addresses on the Ethereum network, but reflect a much lower transaction fee, opening up room for manipulation.

Decentralization is important and Ethereum stands out among its competitors

Ethereum is the ecosystem with the largest number of active developers, exceeding 1,870, more than the next three competitors combined: Polkadot (752), Cosmos (511) and Solana (383).

Currently, the Ethereum network has more than 700,000 validators, and 99% of the balances locked in participation participate in the process. The threshold limit of 32 ETH per validator undoubtedly inflates this number, but Lido, the largest known staking pool, control S 32% share, with Coinbase in second place at 9.6%.

Consequently, it is safe to say that Ethereum is much less centralized in terms of development and validation compared to Tron, BNB Chain, and Solana.

Other reasons why Ether’s dominance has been increasing, even as Bitcoin hit 50% market share on June 19, are derivatives activity and Ethereum’s dominance of the NFT market.

Derivatives markets are essential for institutional investors

Ether futures contracts are essential for institutional trading practices such as hedging and leveraged trading. Ether cash-settled futures were added to the Chicago Mercantile Exchange in February 2021. To date, no other cryptocurrency aside from Bitcoin has made it to the world’s largest derivatives exchange.

In futures markets, longs and shorts are balanced at all times, but having a larger number of active contracts (open interest) allows for participation by institutional investors who require a minimum market size. The aggregate open interest of Ether futures is $5.4 billion, while competitors BNB have $380 million and Solana only $178 million.

Ethereum remains the market leader in NFTs

Non-fungible tokens (NFTs) are a perfect example of how cheaper and faster transactions don’t always translate to higher adoption. There is nothing stopping NFT projects from switching between blockchains, either for new listings or existing collections. In fact, y00ts and DeGods moved to Polygon in early 2023.

Despite facing gas fees that often exceed $10, Ethereum remains the absolute leader in the number of buyers and total sales. According to CryptoSlam!, the leading network reached $380 million in sales in the last 30 days, while Solana, Polygon and BNB Chain had a combined total of $93 million.

Ultimately, the data favors Ethereum over competing smart contract-focused blockchains. The positive trend in Ether’s dominance could fade over time if the promised upgrade to enable parallel processing (sharding) does not come to fruition, but for now, Ether’s 20% market cap share remains unchallenged.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts and opinions expressed herein are those of the author alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.