The Lido DAO (LDO) price rallied to its three-week high of $2.21 on May 16, up 40% from the local low of $1.57 set four days ago.

This impressive double-digit rally appeared alongside other top-tier crypto assets including Bitcoin (BTC) and Ether (ETH). However, LDO has far outperformed the broader crypto market (TOTAL), which is up just 4.5% since May 12.

But what are the reasons why Lido DAO is outperforming the rest of the cryptocurrency market right now? Let’s take a closer look at the three most important factors that are likely to increase the price of LDO.

The return of Ethereum depositors after Shapella

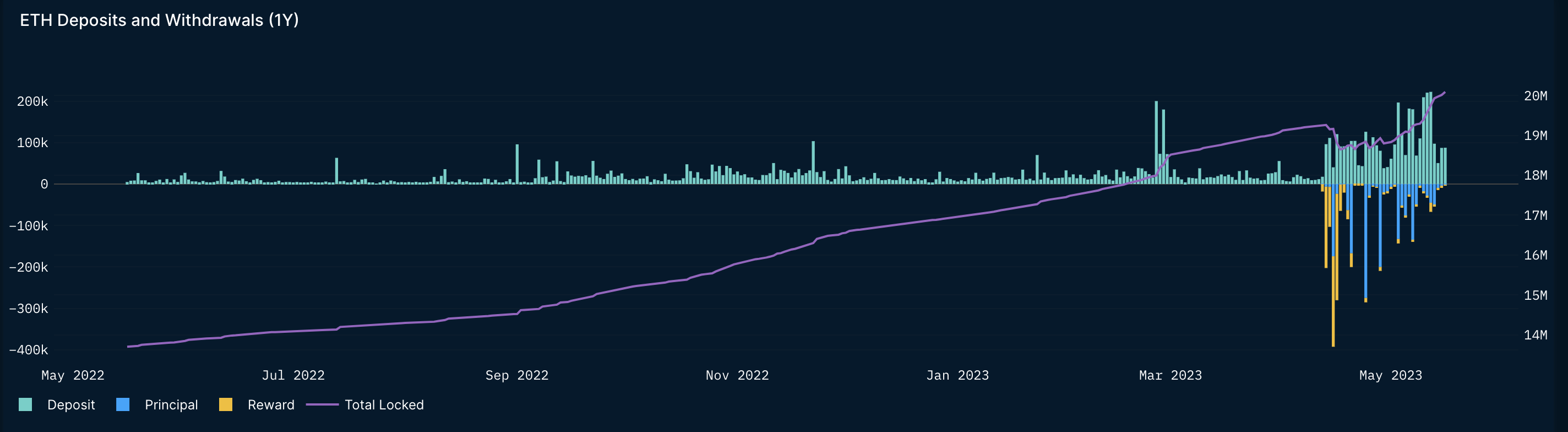

The LDO price recovery coincides with positive net inflows into Ethereum’s proof-of-stake (PoS) contract in recent days.

Lido DAO is primarily an Ethereum liquid staking platform. It allows users to pool their funds to become Ethereum validators, thus bypassing the network’s requirement to deposit at least 32 ETH.

In April, Ethereum underwent a network upgrade called Shapella, which supports withdrawals of its staking contract rewards. As a result, his PoS contract witnessed days where the amount of ETH withdrawals exceeded deposits.

For example, the net ETH staked with his PoS contract was 19.27 million ETH on April 11, one day before the Shapella update. The number fell to 90,704 a week later, followed by a steady recovery, according to data tracked by Nansen.

As of May 16, the Ethereum PoS contract had over 20 million ETH, underscoring the growing demand for liquid staking service providers like Lido DAO. The price of its LDO governance token likely benefited from the narrative.

For example, Lido DAO’s closest competitor RocketPool (RPL) has also soared 15% to around $50 when measured from its May 12 low.

Lido V2 mainnet launch

It should be noted that Lido DAO did not support full ETH withdrawals. Instead, it issued staked Ethereum (stETH), theoretically pegged to ETH for 1:1, to users that could be freely traded for other crypto assets on exchanges.

But that was until recently.

On May 15, Lido DAO released the mainnet version of “Lido V2”, which allows Ethereum participants to burn their stETH and exit the protocol at a 1:1 ratio. Since the update, the LDO price is up 20%, or half of its 40% bounce so far.

Related: Celsius moves $781 million into stETH just as Lido withdrawals open

The Lido DAO whales have also supported the bullish movement of LDO in the days leading up to the release of Lido V2. And, according to the Lookonchain data resource. This may suggest that the “buy the rumour” scenario may have contributed to the LDO price rally.

Due to the release of Lido V2, we noticed the accumulation of 3 whales $LDO in the last week.

– 0x9EA7 withdrew 724,822 $LDO($1.52 million) from #Binance at $2.01.

– 0x4E4e withdrew 655,641 $LDO($1.38M) of #Binance at $1.83.

– 0x9eda bought 570,883 $LDO with 974K $USDC to $1.71 on May 12. pic.twitter.com/S0cNUxpLw0

— Lookonchain (@lookonchain) May 16, 2023

LDO Price Bullish Wedge Bounce

From a technical standpoint, the LDO 40% bounce started near the lower trend line of a prevailing falling wedge setup. Traditional analysts view a falling wedge as a bullish reversal pattern.

The LDO/USD pair has rallied in a similar fashion in recent history, with each bounce taking its price to the upper trend line of the wedge. Now, with the price hovering around the upper trend line again, LDO could enter a breakout stage or pull back to retest the lower trend line.

The LDO breakout scenario will see the price rally to $3.35 by June 2023, around 50% higher than current price levels. This target appears after adding the maximum height of the wedge to the potential breakout point near $2.70.

Conversely, the pullback scenario could drive the LDO price to near $1.56 by June 2023, down 30% from current price levels. This level has served as support and resistance in the past.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

NEWSLETTER

NEWSLETTER